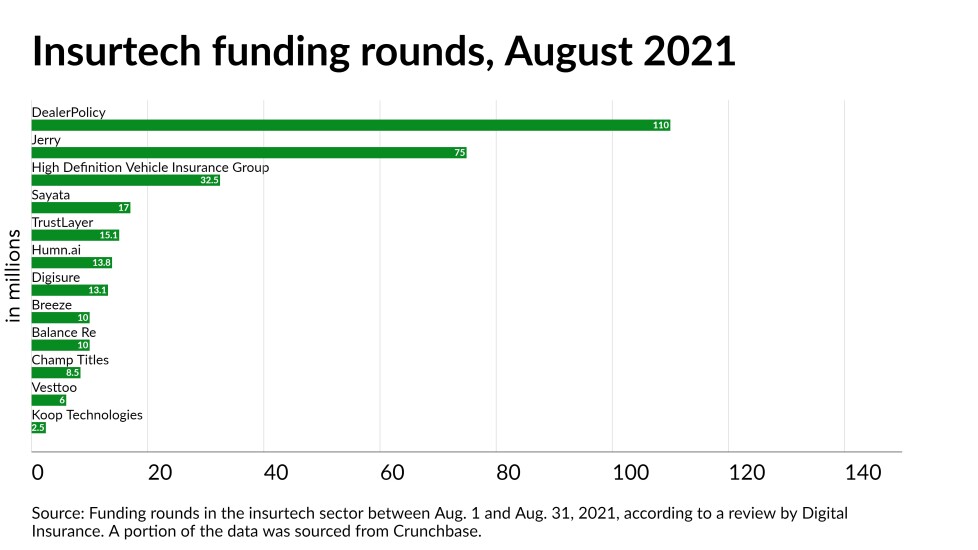

There were about 12 funding rounds in the insurtech sector between Aug. 1 and Aug. 31, 2021, according to a review by Digital Insurance. What follows is a selection of the funding rounds. A portion of the data was sourced from Crunchbase. For our previous edition, which covered the month of July,

Spotlight on top insurtech funding, August 2021

August 31, 2021 7:15 AM