Lemonade is set to

The acquisition price puts Metromile lower than when the company

Daniel Schreiber, the chief executive officer at Lemonade, spoke during an investor call on Nov. 9, about how the deal will benefit Lemonade.

“It would take us years to build this kind of data,” Schreiber said. “We’re injecting all the Metromile mojo into Lemonade Car, which will lead to a product offering that stands alone in the market. Together we’ll have all the people and tools in place to deliver the markets most seamless and customer-centric car insurance product. That, at any rate, is the plan.”

Metromile has had some trouble with operating losses in the last few months. During the height of the COVID-19 pandemic, the company saw decreases related to its premiums as people were driving less and its model operates on a pay-per-mile system. However, the company has also seen losses attributed to the cost of car repairs, as have all of the traditional auto insurers.

Industry experts agree that this acquisition could benefit both companies though.

Mark E. Watson III, founder of Aquila Capital Partners said: "The two companies can benefit from each other’s strengths while utilizing additional shared resources, infrastructure, and product offerings to propel the company forward. It probably makes sense for these two companies to partner up. As companies which both went public with immature business models, they will be better positioned for success as a combined entity."

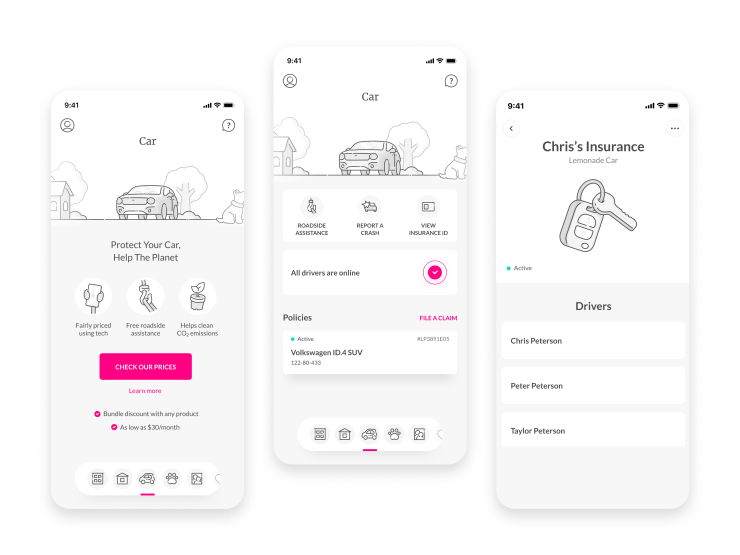

The move from a Lemonade perspective is partially related to how Metromile prices premiums--based on a continuous stream of data and not proxies, as more traditional auto insurers use. Lemonade Car won’t operate using proxies but telematics.

What the product will look like once the companies combine is still in the works. But Nick Frank, a partner at Simon-Kucher & Partners, said there is a clear fit.

“Lemonade has been trying to put out an auto product for a while, so it seems like a smart thing for them, from my perspective to buy a strong knowledge base in Metromile, as that company has always invested in a smart digital stack for their insurance and with the trend toward UBI, it was a smart choice,” Frank said. “This couldn’t have been a better choice in terms of culture and investment. It’s two like-minded companies--it’s a perfect marriage made.”

Yael Wissner-Levy, vice president of communications at Lemonade, said that Lemonade believes its ability to incorporate Metromile's tech and culture gives it an advantage.

“Ninety-six percent of incumbent policies use no telematics data, while the 4% that do, tend to turn it off after two weeks and to underweight its signals,” Wissner-Levy said. “Innovators, legacy-free and built from scratch in the 21st century, are uniquely positioned to lead the industry’s graduation from pricing based on proxies to pricing based on continuous data streams. Metromile’s ten year head start at harnessing AI and big data for car insurance gives them an unsurpassed ability to predict losses per mile driven. The transaction should enable Lemonade to bypass the riskiest phase of the Lemonade Car growth trajectory and to leapfrog to a leadership position in pricing and underwriting.”

Metromile reports several areas of focus including, creating more ways to bundle and save for homeowners and renters alike, investing in connected car technology to align with advances in auto safety and autonomous driving, taking the next big steps to reshape insurance pricing based on the individual, and moving away from unfair proxies, the blog post states. Metromile suggested in its blog post that joining forces with Lemonade will create more opportunities for growth and returns.

“As shareholders of the newly combined company, we will benefit from the advantages realized by bringing together Lemonade’s one million subscribers, growth expertise and Metromile’s distinctive competencies in auto insurance. data science, and claims automation. With a single brand, single platform, and unified team, we will be able to achieve faster scale, far more efficiently, realizing that value creation as Lemonade shareholders,” the blog post reads.

Metromile has been working to create a bundled insurance offering for its customers. Its acquisition will likely make that possible as Lemonade already has home, renters, life and pet insurance products available under a single brand.

Dan Preston, Metromile’s CEO, will take on a senior vice president role at Lemonade. Additionally, other leadership from Metromile will similarly have roles at Lemonade.

Stephanie Dalwin, an advisor at Aite-Novarica, said that this deal indicates the heat of the insurtech market will continue.

“We’re in the insurtech boom,” Dalwin said. “I think a lot of people thought insurtech investments would slow down during the pandemic and it did but it rebounded. It makes sense we will be seeing acquisitions like this. I don’t know how much market share they’ll take, but the type of consumer they're targeting is digitally savvy and underserved.”