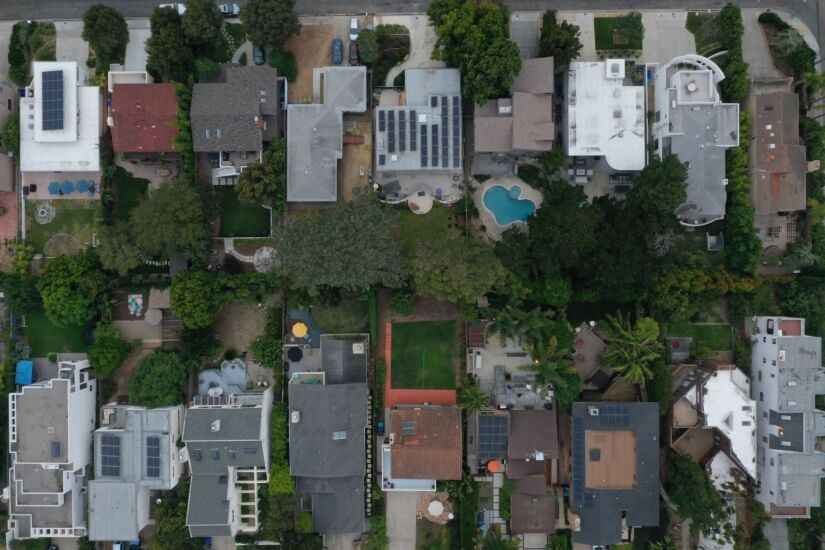

In today’s booming housing market, insurers are looking for ways to easily maintain and reach new customers and leverage new technology in the process.

Insurers such as Nationwide are expanding their partnerships with digital technology providers, while technology firms like DIY smart home technology company Notion are delivering services that are helping insurers with policyholder acquisition, price differentiation and client retention.

Read our roundup for more on the impact of digital technology in homeowners insurance.