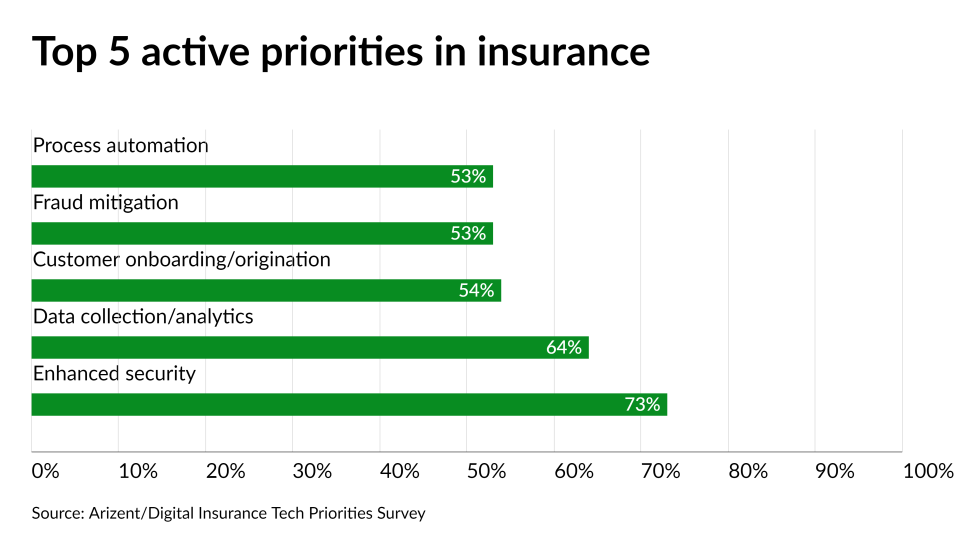

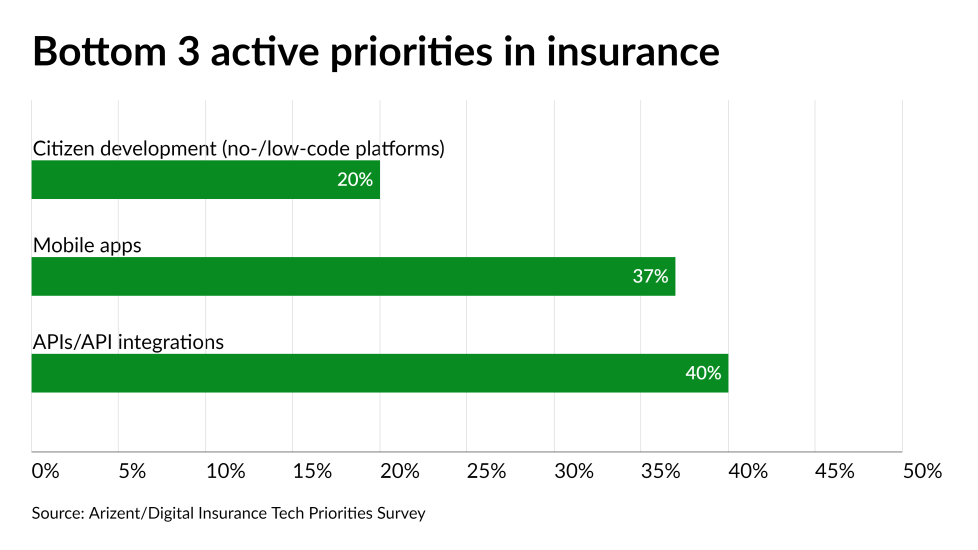

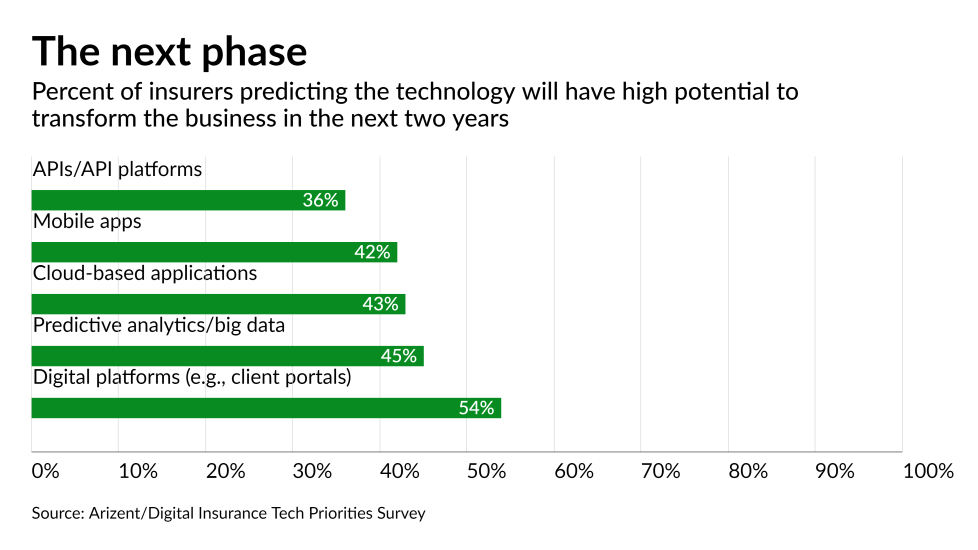

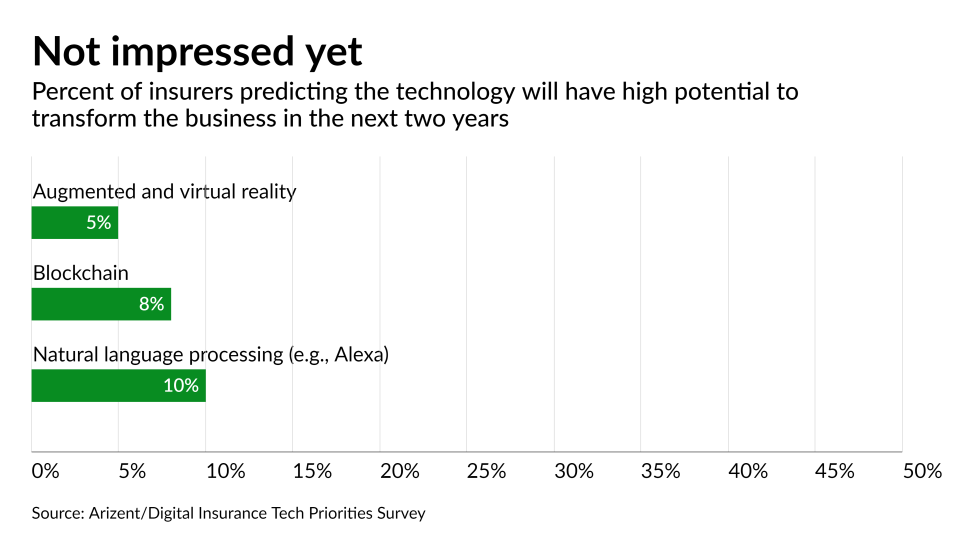

At the end of 2022, Digital Insurance parent company Arizent surveyed tech decision-makers across insurance, banking, mortgages and wealth management. The resulting 2023 Tech Priorities survey is

How do insurers' digital priorities stack up against banks?

February 28, 2023 6:58 AM