Although global investments in insurtech increased to $1.7 billion in 2016 – doubling over the past two years – traditional insurers still lag behind their banking peers for collaborating with such startups to mutually beneficial ends.

That’s according to new research from Accenture, titled “The Rise of InsurTechs.” The brief paints a picture that suggests insurers are starting to increase their investments in insuretech startups. Nevertheless, report authors say insurers have yet to heed the lessons learned by their brethren in other financial services sectors – like banking – and advance their appetite for collaborating with insurtechs to drive an innovation culture based on “try and see” rather than the conservative “learn and do.”

The research combines proprietary analysis by Accenture on the activities of 200 insurers and 80 retail bankers with analysis of CB Insights data on 450 insurtech deals over the past three years.

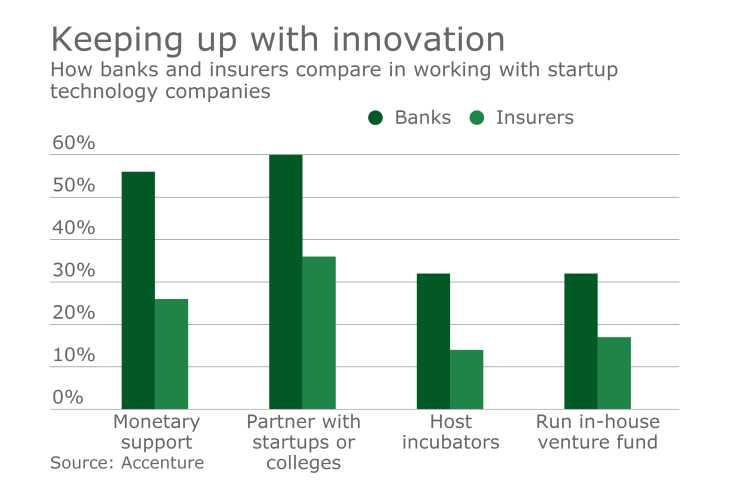

According to the report, bankers significantly outpace insurers for every comparative metric related to digital start up support. For 2016 this includes:

- Banks were about twice as likely to supply monetary or non-monetary (e.g. coaching) support, 56% for banks to 26% for insurers.

- Only 38% of insurers partner with startups or universities on digital initiatives compared with 60% of banks.

- Less than half as many insurers (14%) host incubators for digital startups as banks (32%)

- Just 17% of insurers support an in-house venture capital fund, or similar instrument, while banks do so at a rate of 32%.

Insurers appear to be particularly at risk of getting left behind on collaborations in the areas of analytics, artificial intelligence (AI) and the internet of things (IoT), where Accenture reports a rapid acceleration in startup investments over the past 12 months. The trio of technologies collectively accounted for 56 percent of total number of insurtech deals in 2016 and about 70 percent of the total value invested.

However, funding for these three technologies mainly came from outside the traditional insurance and reinsurance space in 2016, with only 14 percent of total investments featuring an insurer or its venture arm. Still, insurers may be catching up as their contributions amounted to only five percent of totals in 2014.

On the insurtech side, notable report findings include a bias by startups toward non-life personal lines solutions. Specifically:

- 63% of 2016 insurtech deals went to startups focusing on non-life sectors, with 30% of startups targeting multi-line sectors and just seven percent on life.

- Insurtechs may be slowly shifting in favor of multi-line and life, as two years ago multi-line deals represented 26% and five percent of deals, respectively.

- On personal vs. commercial front, 78% of deals related to personal lines, leaving only 22% of insurtechs focusing on commercial.

- The personal lines preference actually accelerated over two years ago, when 60% of startups focused on commercial and 40% on commercial.

- Despite the personal lines acceleration, Accenture reports insurtech startups often begin with a personal focus and transition their technology to commercial as well.

Overall, the report concludes that young startups and mature insurers can “bring out the best in one another” by each learning to leverage the other. “InsurTechs need to understand what they’re solving for, and how to integrate themselves into an industry that wants to change but doesn’t know how,” say authors in the report.

On the flip side, “InsurTech is not a silver bullet,” the authors say. “Insurers need to embrace innovation as part of business as usual. Simply participating in third-party incubators or investing in a few startups will not be enough.”