Was it fun while it lasted, or is the real fun just beginning? That's the question on the insurance industry's mind as it enters 2023.

Few in the industry predict any sort of reduction in digital spending next year (though year over year increases may not be as high as they were in the past). But insurance digital transformation will look different next year than it has over the past few, respondents to a Digital Insurance/Arizent survey say. However, insurers are still focused on digitally transforming the sector, and working with insurtechs on delivering valuable solutions to customers.

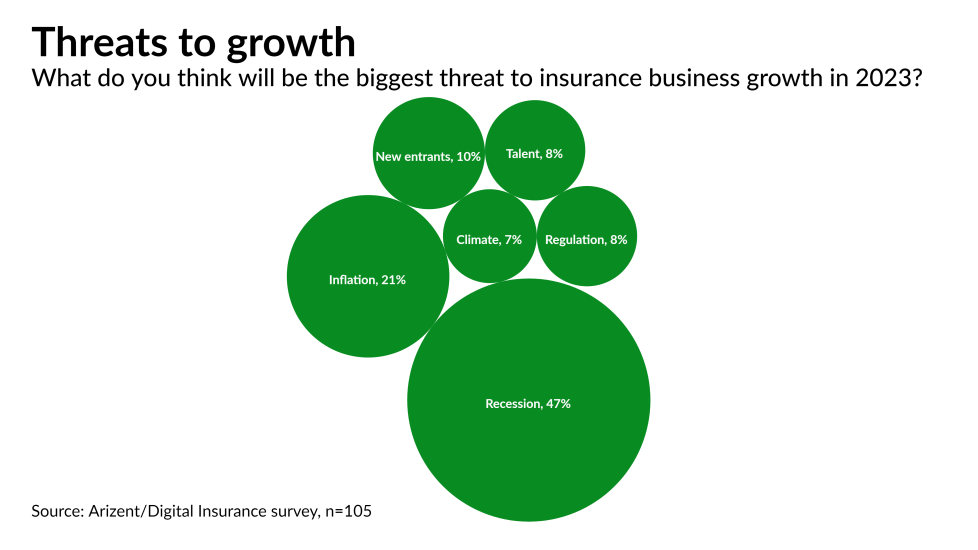

The full survey report will be out in January. But in this preview, you can find some of the more interesting data points. What do insurers fear more: recession or inflation? And are insurers likely to change their digital plans if conditions worsen? How much will insurtech investment fall? Read on to see, and keep an eye out for our full research brief after the New Year.