Enact reported fourth quarter net income of $144 million, compared with $194 million in the third quarter and $154 million one year prior.

For the full year, it made $704 million, an increase over the $547 million profits reported for 2021.

In the fourth quarter, its NIW of $15 billion was 1% higher than the prior quarter but down by 29% from the $21 billion produced for the same period in 2022.

But the most recent period included a one-time deal where it provided insurance on seasoned loans. Without that transaction, NIW would have declined 4% from the third quarter and 32% from the fourth quarter of 2021, Enact said.

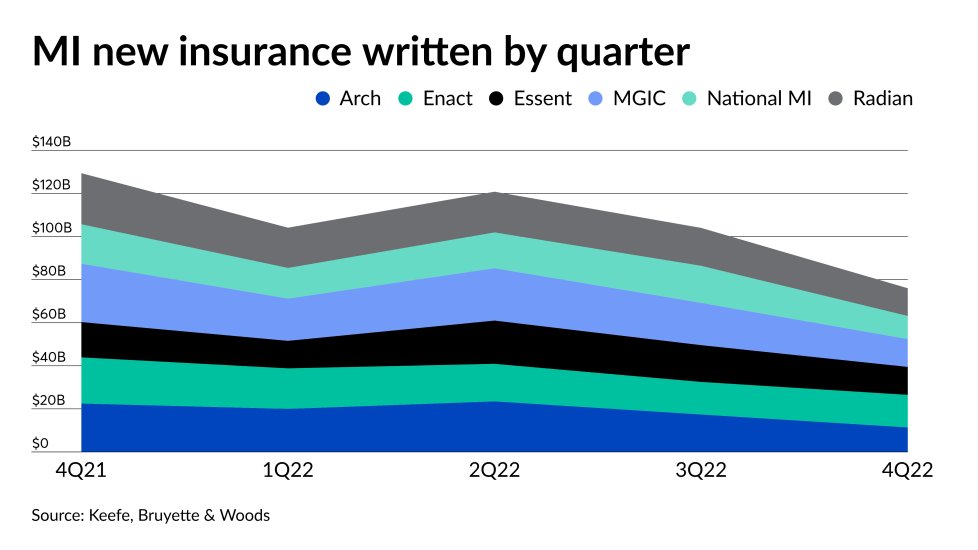

For the full year, though, Enact slipped to the No. 4 spot among the six companies at $66.5 billion. In 2021, it ranked third with $97 billion written.

Former parent Genworth Financial still owns 81.4% of Enact's stock. Both companies believe that financial strength conditions established by Fannie Mae and Freddie Mac

at the time Enact went public had been met by year-end. If the government-sponsored enterprises confirm this, Enact would no longer be subject to tougher capital requirements than its competitors.

"We don't think it would necessarily change the approach to capital/risk management, although we see it being generally supportive of valuation, particularly if macro conditions were to weaken," wrote Eric Hagen, an analyst with BTIG.

Meanwhile, Genworth right now is unlikely to conduct a secondary public offering of Enact stock, said George. Enact paid $206 million in dividends last year to Genworth and George expects a similar amount for 2023 and next year.

"This level of dividends more than covers Genworth's $60 million of annual interest expense and is allowing the company to opportunistically buy back stock and further reduce debt," George said. "Longer term, we believe Genworth wants to do a tax-free spin out of Enact to its shareholders, and we note that in order for a spin of Enact to be tax-free, Genworth cannot reduce its ownership stake in Enact below 80%."