-

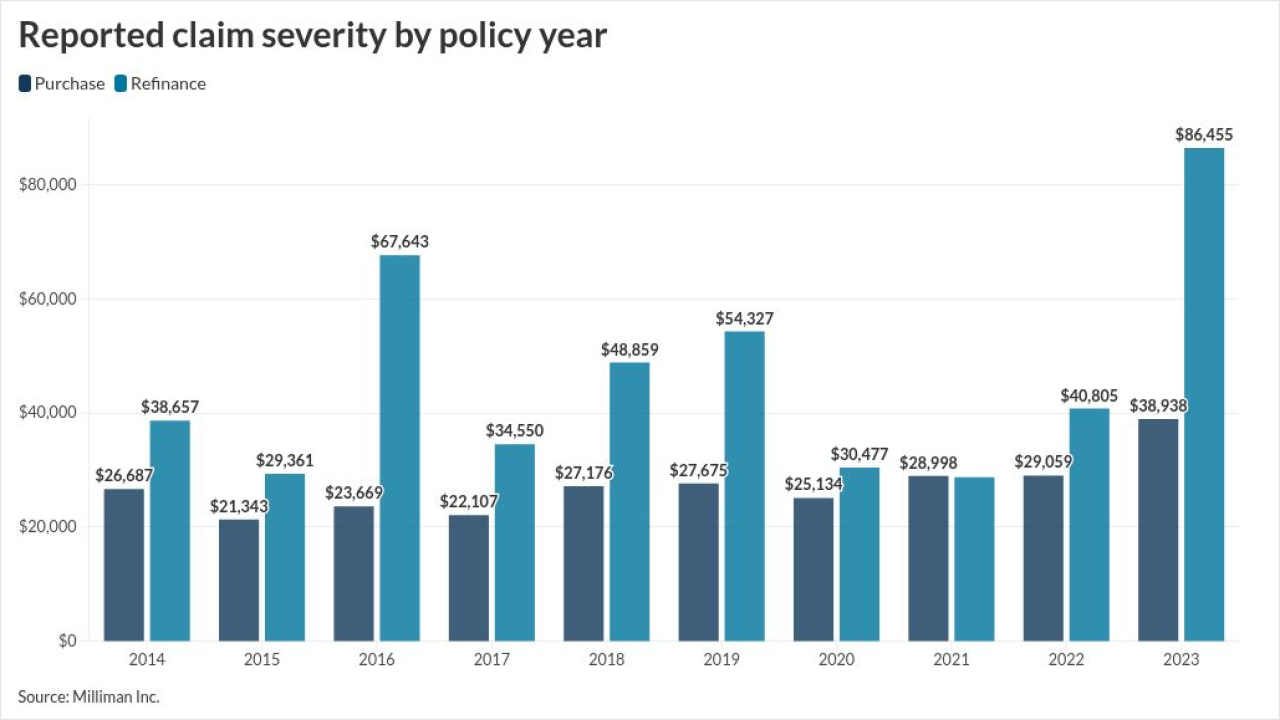

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

Kin, a direct-to-consumer insurance provider, has started a mortgage broker in Florida which also takes loan applications through a call center or online.

October 21 -

The title industry sustained improvement first seen last year, with second-quarter premium totals up on both a quarterly and annual basis, ALTA said.

September 24 -

Premiums for property insurance have risen over 69% since 2019, far outpacing other components of the monthly mortgage payment, ICE Mortgage Technology found.

September 8 -

The U.S. Mortgage Insurers put out a blog promising its members would be ready to accept submissions for coverage which were scored using VantageScore.

August 28 -

Numbers on use and performance point to potential for nonpublic insurers to take on a greater role but also suggest there are limits to it, Fitch Ratings found.

July 25 -

April was a mixed bag for title companies, executives said on earnings calls, but some are expecting a stronger market the rest of the year.

May 12 -

Lumber retains protections for now, but construction stocks still fell, and while the initial market reaction lowered rates, there could later be a reversal.

April 3 -

Publicly traded lenders, including UWM, Rocket Mortgage and Guild Mortgage, saw personnel expenses increase significantly throughout last year.

April 2 -

The postponement would pertain to Federal Housing Administration-insured single- and multifamily loans and other final determination dates that have not passed.

March 7 -

The increase in refinance originations in the fourth quarter trickled down to the title insurers, which reported year-over-year gains in new orders.

February 26 -

As homeowners insurance becomes expensive and hard to find, mortgage loan officers should work closely with insurance agents, said Travis Hodges of Viu by Hub.

February 21 -

The private mortgage insurers reported just 5% less business versus the third quarter and 33% more new insurance written over the fourth quarter 2023.

February 18 -

The consortium of businesses intends to work with state regulators to protect consumers as interest from secondary market investors also grows.

February 14 -

The nation's largest homeowners insurance providers imposed rate hikes in double-digit percentages last year, led by Farmers' 53.5% increase in Maryland.

January 27 -

Premium volume increased by 5.3% year-over-year, while operating income was up, but industry expenses also rose in the third quarter, the American Land Title Association said.

December 18 -

Continued reductions by the Federal Reserve in short-term interest rates should benefit mortgage volume, and thus title insurance activity, Fitch Ratings said.

December 9 -

In the aftermath of the election, a bipartisan group of House members are the latest to ask the FHFA to put the owner's title insurance waiver pilot on hold.

November 19 -

Private mortgage insurers are having a strong year so far, although most had flat business in the third quarter, industry results show.

November 11