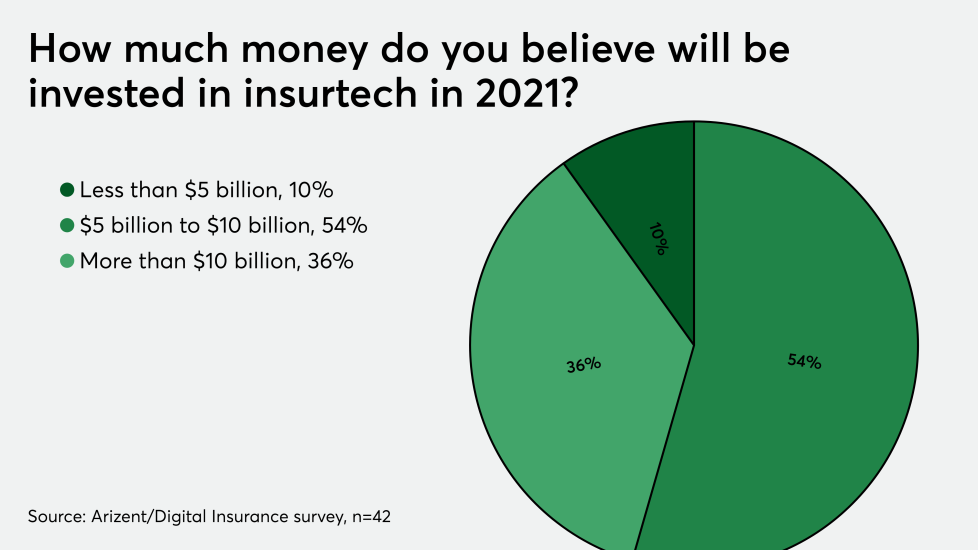

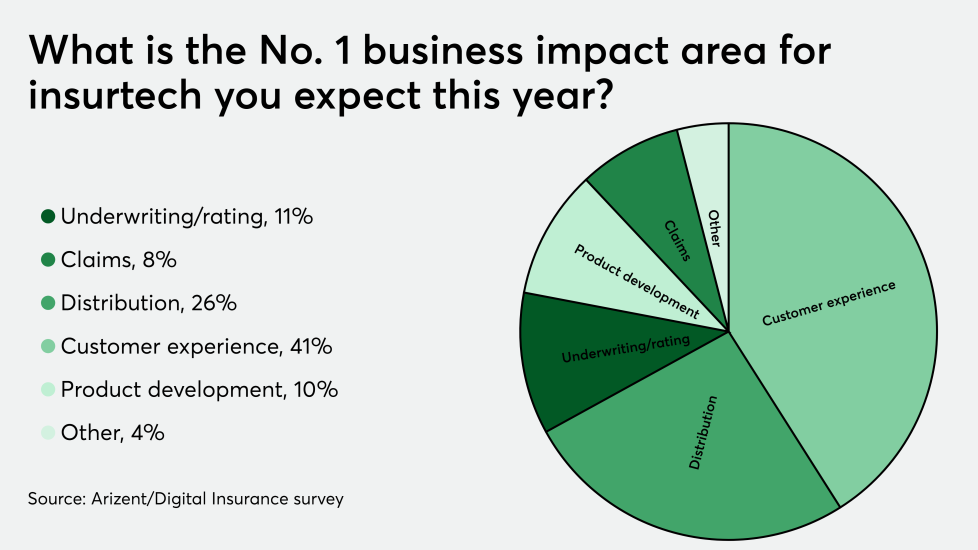

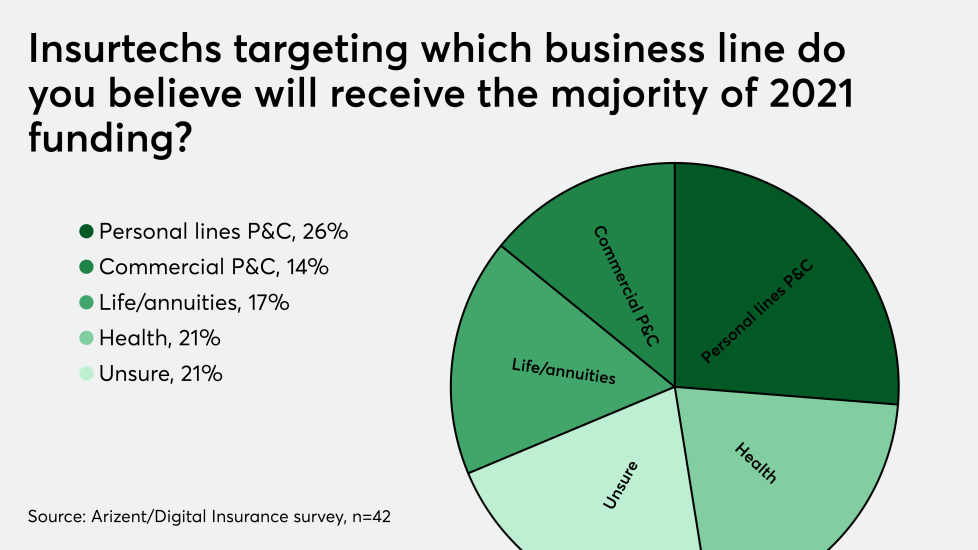

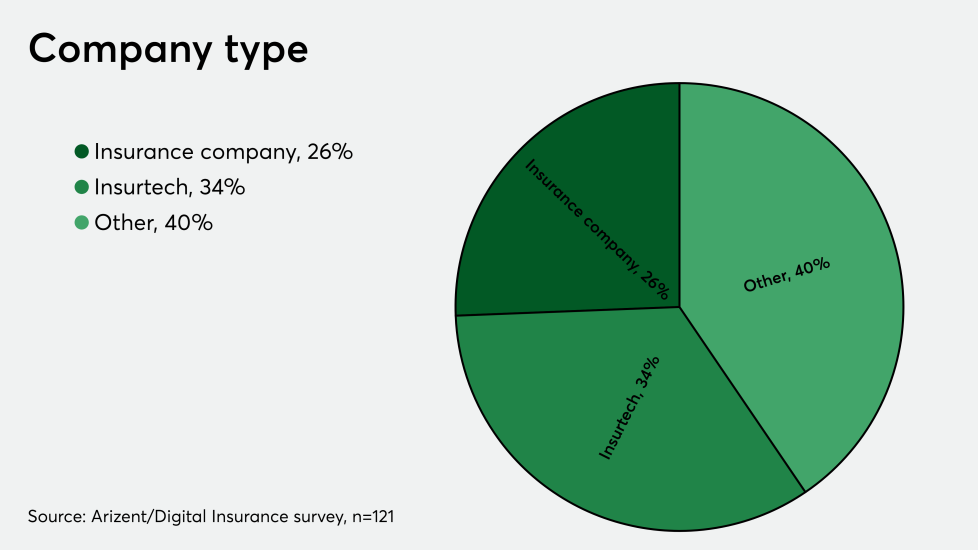

Insurtech funding growth is predicted to continue in a big way in 2021, despite the lingering impacts of the COVID-19 pandemic, according to Digital Insurance research. Our survey of 121 leaders at insurers, insurtechs, and other parties finds an industry excited to apply the accelerated consumer digitalization due to social-distancing mandates and other mitigation efforts to the insurance industry. This is our first release of findings from the survey, and serves as an overview to the major themes. We'll be releasing more results in different content over the following weeks.

Following record year, insurtech funding expected to keep growing: Digital Insurance research

February 11, 2021 2:18 PM