Consumers are changing the ways they interact with insurers and buy insurance. And, according to an Accenture survey of more than 6,000 insurance customers in 11 countries, many are open to providing more access to their personal data if it means more personalized products or better value for their coverage.

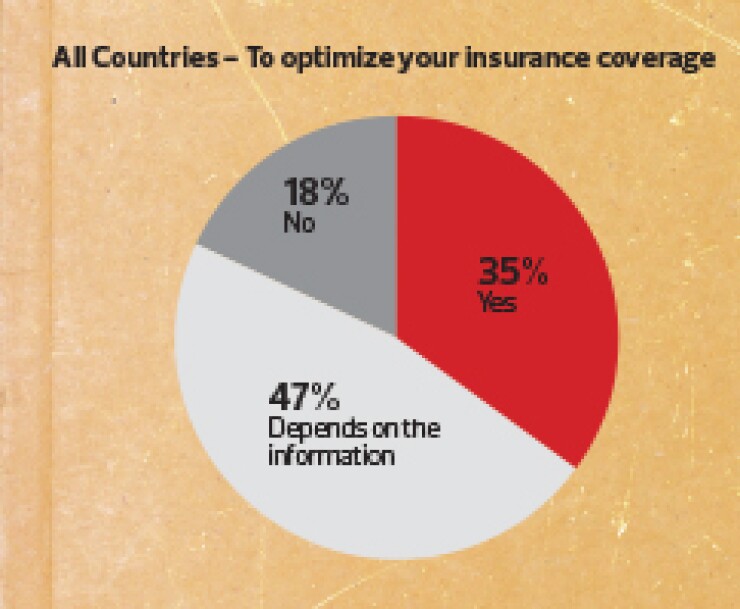

More than one-third (35 percent) of insurance customers said they are open to providing access to their usage or behavior information, such as car-usage or lifestyle information. Almost half (47 percent) said it would depend on the information requested, and 18 percent were not comfortable doing so.

"Personalization clearly emerges as a key driver in retaining existing customers and attracting new ones," said Michael Lyman, global managing director for management consulting within Accenture's insurance industry practice. "While Internet access using personal computers or laptops was the first step in enabling customers to use digital channels, the real game changer has been the growth in mobile. The mobile channel offers insurers the opportunity to take customer experience to the next level, enabling them to become partners of their customers' everyday life by tailoring offers and interactions to the physical context, as location-based services can be highly relevant in insurance. For example, travel insurance - suggested offers can be sent to customers' mobile phones when landing in an airport abroad, or a claim can be submitted from an accident scene with supporting photos."