Telematics-powered usage-based insurance is entering its second decade of widespread availability in the U.S., and policyholders report positive impressions and experience with it.

That's according to a new survey of more than 1,000 consumers by Willis Towers Watson. Thirteen percent of respondents said they had tried usage-based insurance, and more than 80% of them described the experience as very or somewhat positive. Nine in 10 millenials reported a positive UBI experience.

The increasing number of connected cars on the road provides an opportunity to increase the number of UBI policies in force, says Willis Towers Watson. Fifty-five percent of consumers say they plan to purchase a vehicle with some sort of connected platform in the next two years.

And, connected car platforms were the preferred method by which consumers are willing to share driving data with insurers for UBI programs, beating out plug-in devices, aftermarket connected vehicle technology and smartphone apps.

“Drivers of all ages are embracing new driving technology, and many are willing to share their driving data in exchange for personalized insurance,” said Geoff Werner, global telematics product lead, Willis Towers Watson. “The key aspect of connected cars in relation to UBI is enabling policyholders to determine at the quote stage if a telematics policy will benefit them before they buy one, but this works only if consumers are willing to share recent driving data to receive a personalized quote.”

About two-thirds of respondents said that UBI is a fairer way to calculate insurance premiums than traditional risk factors. A further 30% were not sure, with only 7% disagreeing. But customers want more than just cheaper insurance from their UBI programs, Willis Towers Watson found: 93% said they enjoyed receiving value-added benefits and more than 80% appreciated seeing driving information and/or advice. Among value-added features consumers wanted from their UBI program, the leader was automated emergency calling at 45%, followed by theft tracking (38%) and breakdown notification (35%).

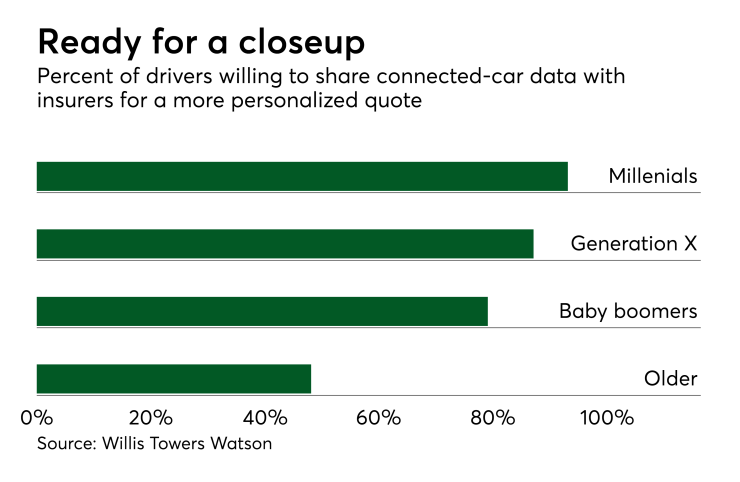

“The more consumers buy connected cars and related in-car technologies, the greater the UBI adoption will be,” said Katie DeGraaf, global telematics sales and delivery lead, Willis Towers Watson. “Many, particularly among the younger generations, are leaning in this direction, with exciting prospects for carriers that can find the right balance between cost, premium stability, rewards and range of benefits.”