-

California assembly insurance committee chair and the state's insurance commissioner propose measure to improve claims handling, coverage options and transparency for wildfire survivors.

February 3 -

Insurance commissioner Ricardo Lara, responding on social media, said tariffs and ICE raids are making rebuilding more difficult. Advocates also point to federal disaster relief that has been held back.

January 28 -

Legislation cites non-renewals based on "inaccurate, outdated or misleading images."

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Representatives of both insurers and policyholders point out issues with market forces and challenges to addressing coverage costs.

January 19 -

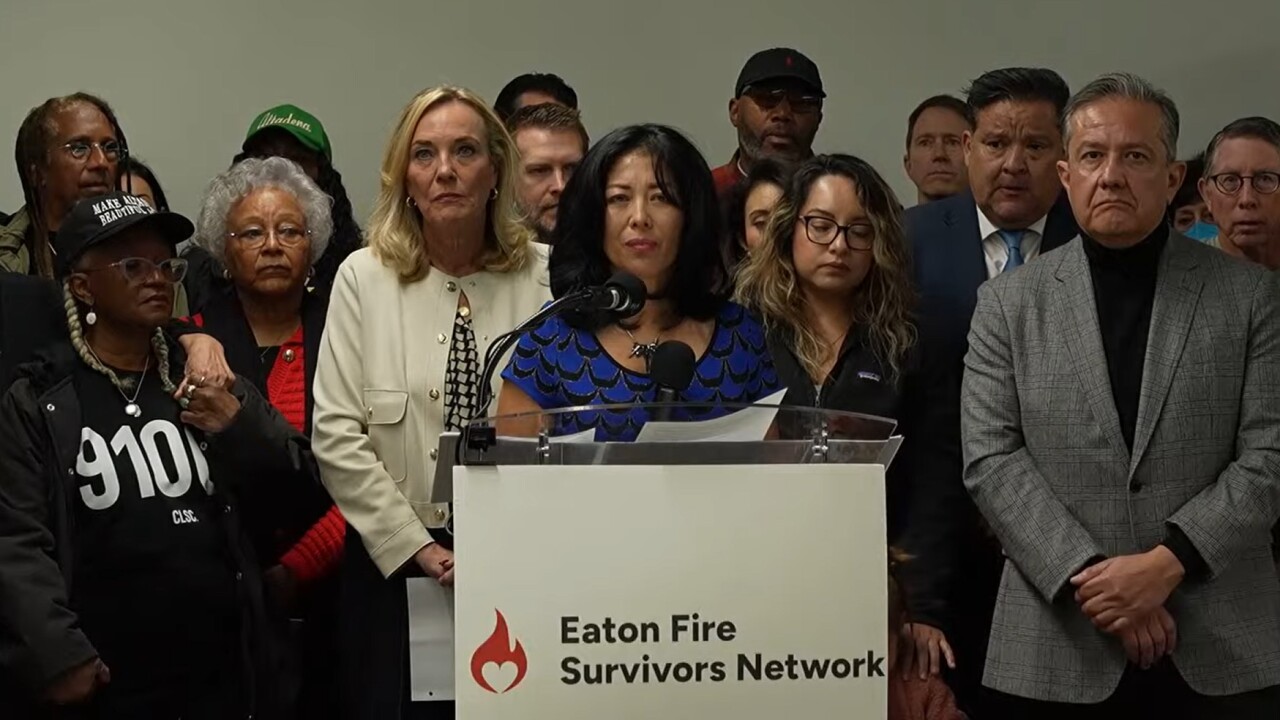

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

The changing climate is increasing insurance rates for residents and cities and lowering property values in areas that face more frequent and intense disasters.

December 11 -

Representatives of the insurance industry called the proposal too speculative and prescriptive, while consumer and environmental advocates say it doesn't go far enough.

November 17 -

Municipal bond insurance volume grew 17.7% year-over-year in the first three quarters of 2025, according to LSEG, outpacing the municipal market as a whole.

November 4 -

Edison International Chief Executive Officer Pedro Pizarro said it is likely that the company's utility equipment could be found to be associated with the start of the deadly Eaton Fire.

October 29 -

Several insurance and wildfire-related bills were signed into law October 10, including authorization for bonds to finance California's insurer of last resort.

October 14 -

Hedge funds speculating on wildfire insurance claims in California were just dealt a legal blow.

October 6 -

California governor's executive order tasks insurance regulator and other state agencies to make recommendations on mitigating wildfires, insurance affordability and availability, expediting insurance claims and more.

October 1 -

California insurance commissioner Ricardo Lara proposes stricter standards for Consumer Watchdog's compensation in representing home insurance policyholders against insurers' rate increase proposals.

September 29 -

AB 226, still subject to governor's approval, allows likely $1 billion of borrowing to cope with strains on the state's insurer of last resort.

September 24 -

New law, SB 429, California Wildfire Public Catastrophe Model Act, depends on the state's university system and its resources to check insurers' and regulators' risk modeling.

September 23 -

The home insurer's objections to an in-person public hearing with regulators are dismissed by a California administrative judge, along with efforts to separate and postpone wildfire claim handling complaints from the rate hearings.

September 3 -

California Sen. Dave Cortese proposed the bill as the state grapples with a shortage of affordable housing.

August 15 -

California's insurer of last resort faces regulatory orders and court fights over its funding and claims handling. The following articles track developments concerning the FAIR Plan in recent months.

August 13