-

Insurance commissioner Ricardo Lara, responding on social media, said tariffs and ICE raids are making rebuilding more difficult. Advocates also point to federal disaster relief that has been held back.

January 28 -

Nearly 40,000 acres were burned in the Eaton and Palisades wildfires last January, killing at least 31 people and destroying 16,000 structures.

January 28 -

Digital Insurance contacted insurance professionals to comment on the climate crisis and natural disasters.

January 19 -

Since the 1990s, American homes have been systematically underinsured in the event that they are completely destroyed.

January 16 -

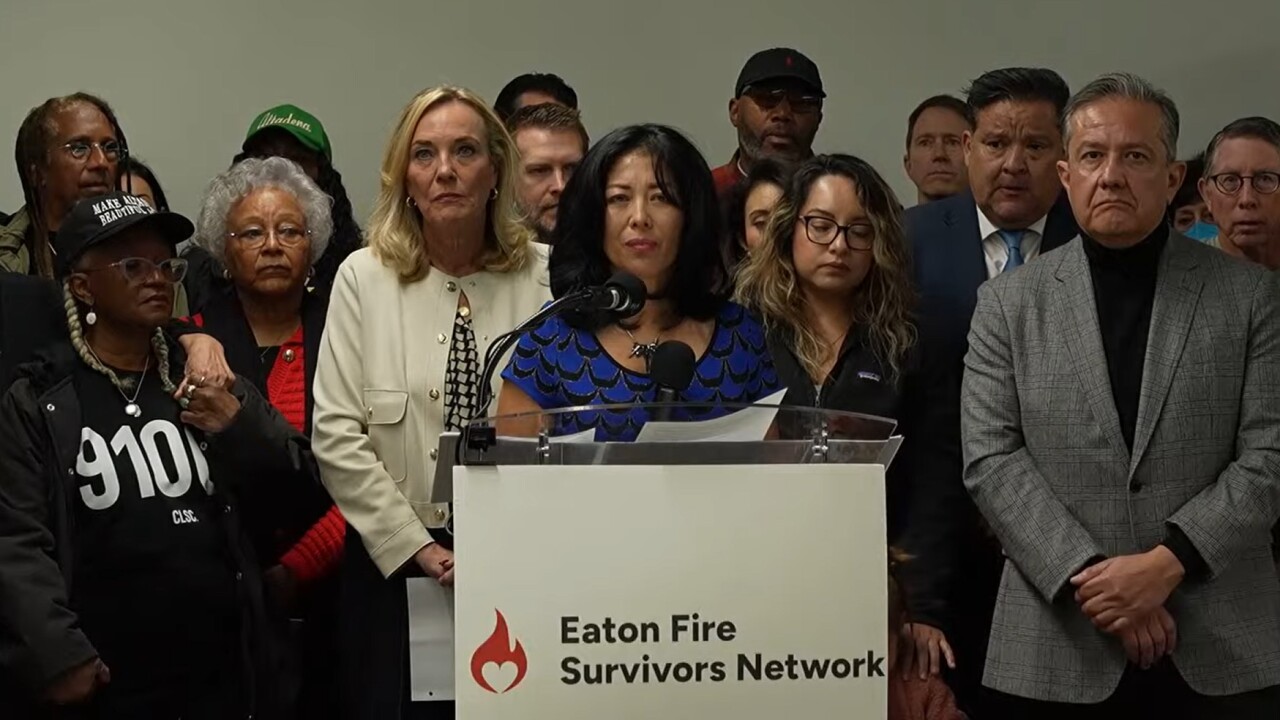

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

Edison International Chief Executive Officer Pedro Pizarro said it is likely that the company's utility equipment could be found to be associated with the start of the deadly Eaton Fire.

October 29 -

Hedge funds speculating on wildfire insurance claims in California were just dealt a legal blow.

October 6 -

California governor's executive order tasks insurance regulator and other state agencies to make recommendations on mitigating wildfires, insurance affordability and availability, expediting insurance claims and more.

October 1 -

New law, SB 429, California Wildfire Public Catastrophe Model Act, depends on the state's university system and its resources to check insurers' and regulators' risk modeling.

September 23 -

Five ways technologies and revised processes are helping insurance organizations better predict and protect.

September 16 Xceedance

Xceedance -

California sellers of older homes in high-risk areas must disclose to potential buyers not only a dwelling's susceptibility to fire but what they've done to address those vulnerabilities.

September 8 -

Digital Insurance stories related to insurance regulation.

August 27 -

More than six months after the LA catastrophe, officials have yet to complete regulations as wildfires burn across the state this week

August 12 -

California's insurance regulator and a consumer advocacy group continue battles over the funding of the state's home insurer of last resort, and other issues.

August 1 -

Damage claims from the Eaton wildfire could wipe out the $21 billion fund created to protect utilities and their customers when an investor-owned utility's equipment is deemed responsible.

July 25 -

An academic paper presented at the Brookings Institute's annual conference found that future wildfire risks are already having economically significant impacts on financial markets, municipal borrowing costs and vulnerable communities.

July 23 -

The state forecasts eroding coastlines will endanger $18 billion of existing homes and commercial buildings in the coming decades.

July 3 -

After California's own insurer of last resort was held liable for smoke claims, and a probe of State Farm was launched, a new task force is ordered to set standards for smoke damage claims.

July 2 -

The chance at a piece of strong returns has encouraged investment banks, hedge funds and debt investors to vie for contracts to fund the litigation, according to people involved in transactions.

June 30 -

The state's insurer of last resort is facing an investigation by the California Department of Insurance as well as lawsuits from policyholders.

June 26