Currently, the number of households holding life insurance policies is at a 50-year low. That makes now an ideal time for life insurance carriers to transition to a more digital sales funnel for better growth opportunities.

That’s the conclusion of a recent report from Deloitte Insights, which surveyed more than 1,600 middle-market consumers about their life-insurance purchase preferences. The company defines these buyers as 25 to 54 years old, with a median household income of approximately $52,000. Consumers in this segment want the ability to research policies before buying -- and service them after purchase -- digitally, but agents are still in demand during the decision-making stage.

“Agent advice still provides a degree of clarity and fosters confidence in ways that independent research cannot,” according to the “Embracing digital disruption: Consumer buying preferences and life insurance in a digital age” report, which was written by Kevin Sharps, Chin Ma, Michele van Rensburg, and Nikias Stefanakis.

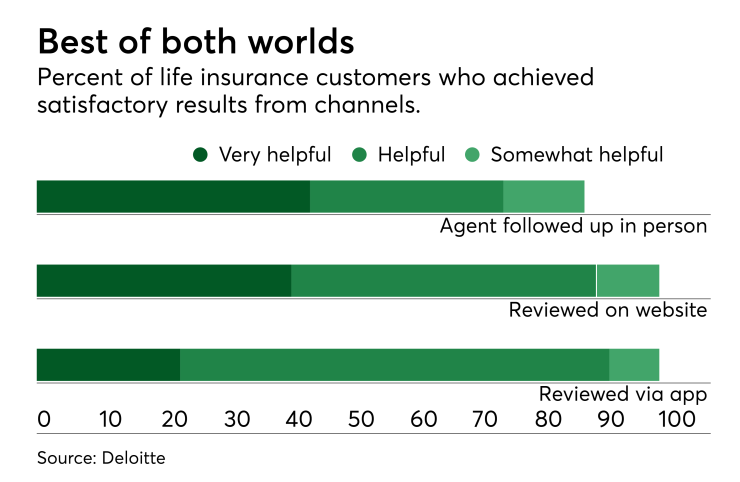

Ninety percent of buyers say they would use digital platforms during the research phase, and the same percentage would use them to self-manage their existing policies. But only about a quarter of buyers reported that they are willing to purchase life insurance digitally. “Going digital allows customers to have a better and longer relationship because it is designed for their strengthens,” says Sharps, who is the Global InsurTech lead of Life and Retirement Principal for Deloitte. "As an industry, we need to be more consumer friendly.”

At the same time, “the period of time in which an agent has the ability to influence purchasing decisions has been compressed,” Deloitte says. The company says there are four key themes for life insurers to keep in mind:

- Market for the now, rather than later. Sixty-two percent of consumers are seeking policies after having children, but did not know the importance of having life insurance for themselves prior. To keep consumers informed, carriers need to develop a targeted approach for marketing. Deloitte suggests offering prospects digital financial planning tools to engage them more often.

- Remember consumers’ budgets are tight. Day-to-day financial priorities are likely to overshadow a monthly life insurance plan payment. That makes it crucial to explain the value thoroughly.

- Make information available on the go. The time to explain information to digital savvy consumers is limited. Buyers are interested in information from agents, but at the decision time of the process and for a less amount of time. Digital platforms allow those consumers to be hands on at their desired time.

- Plug digital gaps. Consumers prefer to manager and research information themselves, yet not all carriers have met the consumers demand and merged their digital platforms.

"We know the industry has an issue with disruption, however this is a great time to be in the life insurance market and a great opportunity to look in to the concept of it," Sharps concludes