Despite the proven value of vehicle telemetry in supporting usage-based insurance (UBI) offerings for car owners, the insurance industry is taking a wait-and-see attitude towards the broader internet of Things (IoT).

That attitude means that it may be years before most insurers gain the ability to capture, analyze and integrate IoT into their pricing, underwriting and claims operations. The question is whether this extended timeline is appropriate and prudent—or, given the pace of change in today’s increasingly digital marketplace, whether it will leave insurers vulnerable to disruption by more nimble and IoT-savvy competitors.

See also:

Large insurers may be leaving themselves particularly vulnerable to this disruption. According to a research report released this week by insurance research and advisory firm Celent, few if any large insurers (characterized in the report as those with annual premium revenues of more than $1 billion) foresee themselves as gaining the ability to execute analytics and modeling with IoT data within the next three years. In fact, a full 60 percent of large insurers responding to the Celent survey are unsure of when they might eventually gain such capability for their non-auto lines of business. And another 20 percent are not certain such capability should be roadmapped at all.

This is in marked contrast to midsize insurers ($500 million to $1 billion in premium revenue). Of these respondents, 20 percent said they already had such capability today for non-auto LOBs and another 20 percent said they were on track to have it within a year.

The numbers are a bit brighter on the auto side, primarily due to the industry’s embrace of UBI offerings. There 17 percent of large insurers are projects IoT capabilities within the year—while 25 percent of midsize insurers claim to have such capabilities today.

Where’s the Data?

Of course, the main obstacle to insurance industry IoT initiatives is the current lack of data from networked sensors. As report author Donald Light, director of Celent’s Americas Property and Casualty Practice, points out, it’s not as if customers all have their homes wired to provide insurance companies with telemetry about ambient moisture levels, security system status or whether the batteries in their smoke detectors have run out.

But that doesn’t mean insurance companies have no choice but to wait passively for such telemetry to become available. “Insurance companies surveying the IoT landscape may want to consider whether there is an advantage to becoming a First Mover’ by actually putting sensors into the field themselves—somewhat similarly to what Progressive has been doing in the auto UBI market,” he says. “Or, barring that, they may also want to make sure they have what it takes to be a Fast Follower.’”

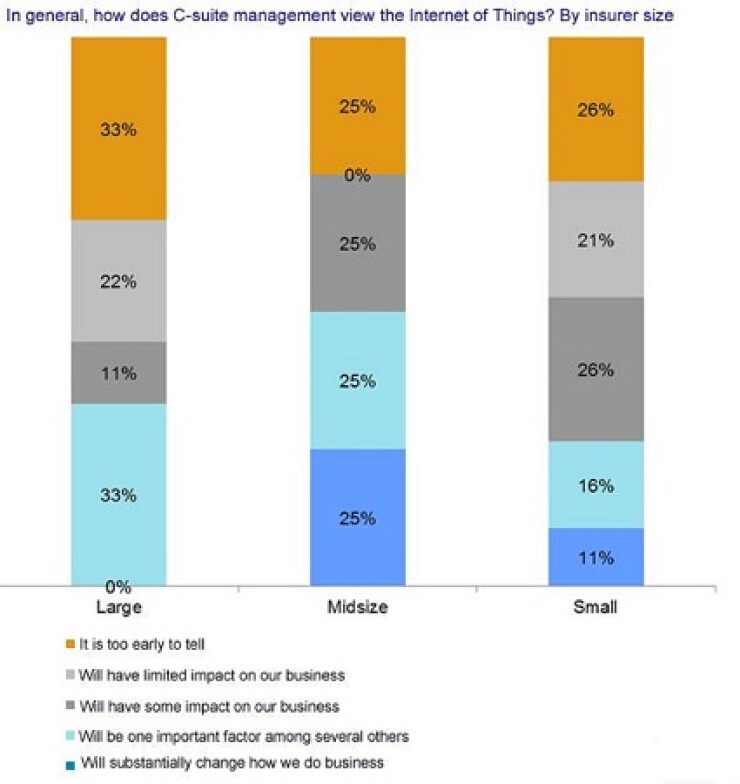

Either decision, however, would likely require C-level advocacy, which is hard to come by based on the report’s findings. None of the C-level executives from large insurers surveyed by Celent believe that IoT “will substantially change how we do business.” And only one-third see it as a potentially important factor.

That doesn’t bode well in a world where people are already walking around wearing fitness bands, where at least one company is already leveraging IoT data to eliminate on-site claims inspections for crop damage, and specialized facilities such as power plants are already wired for robust telemetry.

A complete copy of Celent’s report "