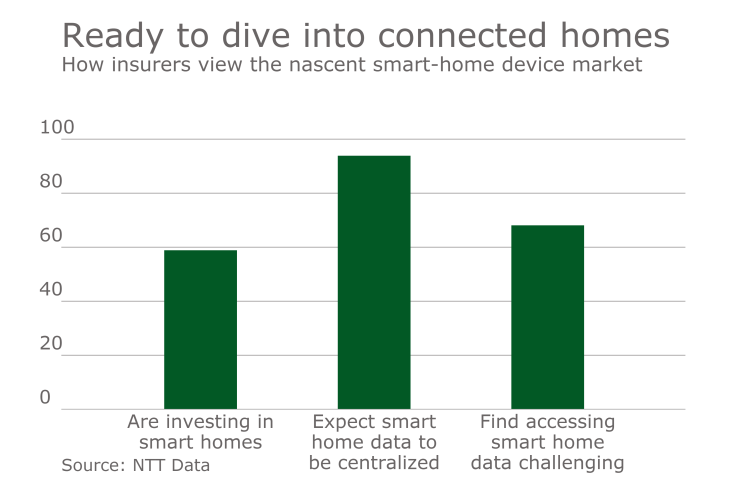

Insurance companies are big believers in the potential for smart home devices to boost the homeowners insurance line of business with better customer interactions. That’s according to a new survey from NTT Data of 100 insurance carriers, which found that 59% “have made strong progress with leveraging smart home technology to improve products.”

But at the same time, insurers report frustration with the data requirements around smart home devices. Two-thirds reported an Inability to gain access to data from smart homes, while a further 62% said that using the analytics from that data in the carrier underwriting process is challenging.

Nevertheless, the “IoT Disruption and Opportunity in the U.S. Insurance Industry” report reported the top five drivers for insurance investment in smart homes:

- Improving the relationship with customers

- Creating additional value-added services

- Attracting potential customers

- Improving their ability to personalize offerings

- Improving their brand

“Fortifying customer relationships is one of the best ways to engender loyalty and reduce churn,” the report says. “Turning these possibilities into realities will require insurers to think creatively and focus on creating new value-added services as a way to expand customer relationships, create strong loyalty and generate new revenue streams.”

Data deal

Insurers want to use the Internet of Things, and smart homes specifically, to refine their products, but data strategy is challenging, NTT Data found. About two-thirds said that the inability to gain access to the IoT data is the biggest barrier to implementing products.

“The data itself represents a new level of complexity and carriers must prepare for managing not only big data but fast data and the inclusion of real-time and edge analytics,” the report says. “The faster and more effectively carriers can get these data issues under control, the more likely it is they’ll be able to use data to their advantage — in service delivery and underwriting/pricing — and successfully address the impact of insurtech firms and other disruptors.”

Most carriers – 94% – expect that smart home data will be aggregated by one or more firms. That means that insurance companies are likely to be in business with the tech companies large and small that have access to the data and can help carriers create value from it.

“Carriers must leverage partnerships to manage the parts of the ecosystem they cannot control, especially data access,” NTT Data says. “Turning potential disruptors into allies and finding cost-sharing arrangements may prove highly beneficial for all.”

Customer insight

The customer side of the survey also yielded several interesting insights for insurers. Only a quarter of respondents said they believed that “their insurance company could provide more personalized products and value-added advisory services for their homeowner’s policy,” and almost all of them – 92% -- said they didn’t want more interactions with their home insurer. Most of the concern had to do with sharing the data with insurers. However, that just increases the opportunity for smart homes to change that dynamic, NTT posits.

“We believe homeowners insurance carriers must seize the IoT opportunity to transform their largely transactional relationships with customers to more personalized and advisory-based relationships,” the report says. “Over time, customers will make the transition from viewing interactions as purely transactional (submitting a claim) to appreciating them as a valued source for improving the quality and security of their lives.”