Tokio Marine North America, Inc. (TMNA Group) has undertaken a Big Data analytics program to gain insight into customer behavior and drive better decision making.

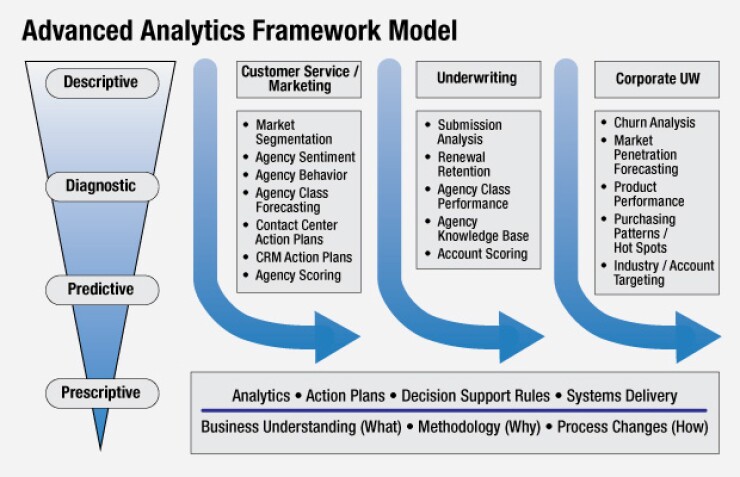

The program, launched in 2014, is collecting data from tens of thousands of agencies into a rich customer knowledge base and using predictive analytics to identify new growth opportunities as well as services areas in need of improvement. During 2016, the property, casualty and marine insurer plans to move from predictive to prescriptive analytics and begin providing customer service, call center and field agents with specific recommendations when working with customers.

Many older data analytics solutions use what’s known as descriptive analytics, which basically summarize developments and their implications after the fact. Predictive analytics is more sophisticated and uses a variety of techniques such as modeling and data mining, to examine recent and historical data to make predictions about the future.

Until recently, insurance companies have limited their use of predictive analytics to actuarial and underwriting applications focused on pricing and rating, but more insurers are beginning to apply these tools to front-end, customer-facing processes, explains Brent Cavan, manager of predictive analytics at Tokio Marine North America Services (TMNAS), the IT services arm of the TMNA Group. “From our perspective, predictive analytics is relatively nascent. Until the last year or two, the industry hadn’t really invested in it, and there is still a significant amount of data that is underutilized.”

The tide is turning, Cavan says, partly because analytics technology has become much more flexible and easier to use. Instead of requiring intensive coding that only IT pros and data scientists can perform, new analytics tools feature drag-and-drop data mining user interfaces, and some even automate algorithm selection. This makes it possible for business users to make direct use of analytics programs themselves.

“The barrier to entry is much lower, in my opinion,” says Cavan, and this is inducing insurers to invest more in analytics projects.

BUSINESS USER CHAMPIONS

It was business users—and more specifically a customer services department from one of TMNA Group’s companies—who championed the TMNA Group’s current analytics initiative. Not too long after, underwriting from another group company also began sponsoring the program. After surveying the market, IT began prototyping capabilities. Since then, TMNAS IT has developed analytics systems for market segment analytics (based on agency sentiment surveys, premium performance, account size, credit rating and sales activity data); rules-based automation; agency and account performance, and scoring models for customer service. The latter are used to analyze how agencies perform and to help underwriters assess account performance, claims velocity and loss type dominance.

The analytics applications leverage mostly structured, transactional data, but Cavan and his colleagues are working to utilize unstructured survey data as well. Next quarter they plan to add data from sales call logs and claims notes into the mix.

Supporting all these initiatives are a variety of commercial, off-the-shelf products. The TMNA Group is using IBM’s SPSS for statistical and text analysis, IBM’s Cognos for data visualization and IBM’s Watson Analytics (NLP) for end-user queries. The company is also evaluating SAP Predictive Analytics for statistical analysis, SAP Hana for in-memory computing and SAP Lumira for data visualization, according to Cavan.

Easy-to-use reporting and data visualization tools are the key to any successful Big Data analytics program, Cavan maintains. “Analytics are driven off of real-time data and that’s great,” he says. “But It is also important to expose the data in a way that it can be used over and over again, in different ways.”

The TMNAS team is also prototyping and designing new prescriptive analytics applications. For example, they are working on rules-based action plans that agents can access in the field using iPads, Surface tablets and other mobile devices.

Cavan accepts that the onus is on IT to help business users move quickly and tap into the latest analytics applications. “IT has historically been viewed as a black box for business users, who ask for something and then wait for a long time for it to be delivered,” he acknowledges.

Analytics projects can get stalled, Cavan allows, because IT departments attach them to formally structured data warehouse and data mart projects that take a long time to complete. But this is at odds with users who just want clean data they can use. “I would argue that you do not have to wait for that Big Data warehouse project to finish,” he says. “You can do a lot of good work using ETL tools, OLTP systems and staging tables, and this all can run in parallel to the data warehouse project, and you can have some analytics tool for the business users in a handful of months.”

Cavan will share TMNA Group’s experiences with its Big Data analytics initiative at the Insurance Analytics Symposium, planned for Oct. 5th and 6th in Boston. Joining Cavan on stage will be Matthew Josefowicz, president and CEO of the insurance industry consultancy Novarica. Last month, the TMNA Group received a Novarica Research Council Impact Award for its new analytics systems.