While billing is an area that tends to get attention only when something goes wrong, it is a critical part of insurers’ agent service and customer-service strategies. Billing presents an opportunity to fulfill a brand promise of convenience and trust. It is the primary opportunity that insurers have to interact with their best customers, and errors can be costly. Most insurers are starting to see billing for what it is: a key customer service function (rather than a purely financial function). Many insurers find that legacy billing technology limits efficiency for internal operations, effectiveness of customer service, the speed to market for new or modified billing features, and can be an obstacle in delivering capability to agents and policyholders.

A modern, configurable billing system with strong rules, tools, and workflow capabilities can address these issues and provide:

- Improved time to market for new products with creative billing options

- Improved customer service levels

- Improved customer satisfaction

- Improved agent satisfaction

- Increased operational efficiency

- Improved consistency in process

- More personalized customer experience

- Improved cash management

- Better identification and management of delinquencies

- Clear audit trail of activities

- Faster ability to train new employees

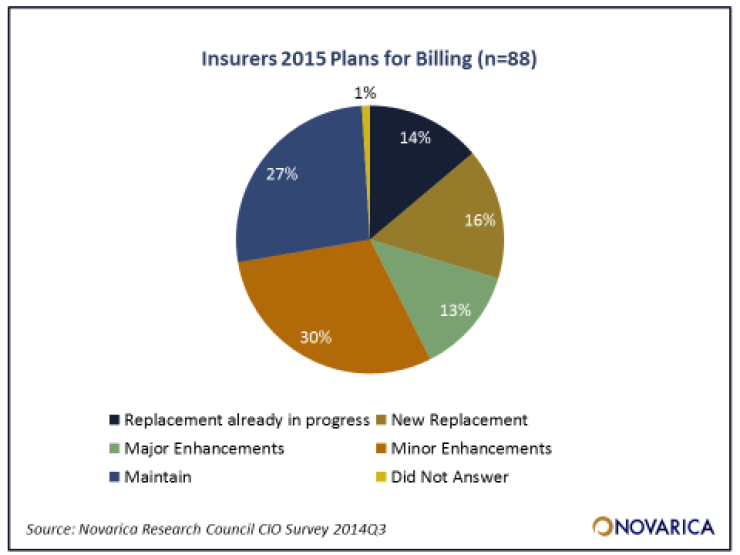

In Novarica’s most recent study on budgets and projects for insurer CIOs, more than 40% of companies were planning to engage in replacements or major enhancements to their billing systems.

In a world of growing business expectations, carriers must see billing as a way to meet, if not exceed, their customers’ assumptions. With this in mind, Novarica has just released two new reports on billing to help get insurers up to speed on the latest technologies and trends.

Novarica Market Navigator: US Property/Casualty Billing is 83 pages long and includes similar detailed profiles of solutions from Accenture, CSC, Decision Research Corp, EIS Group, Guidewire, Insuresoft, Insurity, Majesco, MphasiS-Wyde, OneShield, SAP, SpeedBuilder Systems, and StoneRiver. The report is available to Novarica clients and for purchase online at:

Business and Technology Trends: Billing provides an overview of business and technology issues, data about the marketplace and 16 examples of recent technology investments in billing issues. The report is available to Novarica clients and for purchase online at:

The impact of investing in new billing solutions will be significant as insurers look to digitally transform themselves in the years ahead. For more information about the latest billing trends and solutions, register my upcoming

This blog entry has been republished with permission.

Readers are encouraged to respond using the “Add Your Comments” box below.

The opinions posted in this blog do not necessarily reflect those of Insurance Networking News or SourceMedia.