In the century between the Spanish Flu and COVID-19, actuarial science, modeling and technology have come a long way, taking advantage of modern innovations. These include the massive scale of cloud computing, distributed databases which can handle previously unthinkable data volumes as well as business intelligence tools and automation software to provide governance and also accessibility and turning the significant output of these risk models into meaningful data and information to inform decision making and manage risks in near real time. By deploying this technology, today’s insurers can face the challenges, crises and extreme events of the next 100 years with greater confidence.

The risk models insurers had previously relied on need to be adapted for today’s challenge. There’s a lot more information and complexity: data on contact tracing information, the R rate, the different measures that countries around the world have taken, effective treatments and first-generation vaccines. Actuaries will need to not only model the impact of the novel coronavirus and its various mutations over the next five years at least, but also make sure that their models and solvency plans are effective enough to handle another pandemic.

In light of the of the events of the last year, insurers need to first carry out a top-to-bottom review of the resilience of their risk modeling practices, operations and application of modern risk technology. Let's discuss the questions insurers should be asking themselves, and offer a five-step plan for modernizing their insurance risk technology strategy.

Are your solvency models strong enough?

During the crisis actuaries have been running models and analysis based on different paths of the pandemic and how it could affect mortality, the economy, persistency of business, claims for business interruption, disrupted travel, health and so on. This was mainly for internal risk management; for solvency modelling, it’s critical that insurers look at both external regulatory models and the internal models they use to manage their business. How well have solvency models held up under COVID-19? If they didn’t cope well with falling asset values and higher numbers of claims, then it is time to revisit them. Even if they did, it’s still time to revisit them!

Where pandemics were modelled they were generally very simple models: for example, a flat excess probability of an insurers life dying. This simplistic modelling needs to be revisited. Could excess deaths be spread out over a number of years? Are different age groups more at risk? And ultimately, should there be a stronger correlation between mortality and the economic fallout of a pandemic? Insurers need to avoid trying to overfit models of the future to the current pandemic.

Are your terms and conditions clear?

Even if an insurer has accurately modeled a pandemic, its level of reserving may not have been sufficient. Quite simply, the company’s terms and conditions may not have been clear enough and we’ve seen several legal challenges around business interruption claims. This was certainly a “blind spot” for some insurers.

In the future, insurers should consider adding reverse stress testing to identify potential points of failure and hidden vulnerabilities. It’s evident that many firms weren’t doing this at the start of 2020 and may have learned a hard lesson.

How risk models can adapt to “extreme events”

Among all uncertainties and complexities of COVID-19 and beyond, the actuarial challenge remains as clear as ever. On the one hand, insurers must manage risks and protect policyholders for the right price. And on the other, they must make sure that they hold enough capital to pay claims, even during a pandemic.

When it comes to capital management, you need to know that your reserves can withstand the worst-case scenarios: extreme, “black swan” events that would otherwise cause insolvency.

By definition, however, the COVID-19 outbreak is actually a “white swan” event: not the first of its kind and therefore predictable and actually likely to occur at some point.

Five steps to building stronger risk models for the modern age

1. Review the resilience of your solvency platform and framework

Regulation has traditionally led insurers’ robust approach to solvency, with for example Solvency II driving stronger governance and control of modeling results.

You must also ask yourself serious questions about the changing nature of the workplace in the pandemic. Will what started off as “emergency” lockdown measures become a more permanent shift and keep many staff working from home or remotely more often? How will your risk platform and governance around it hold up with employees being remote?

2. Assess stress testing

How did any pandemic modeling you carried out compare to actual COVID-19 results and would it have protected you in previous pandemics? Or should the stresses be higher and more explicitly targeted? Was the cumulative effect of asset falls, interest rate falls and additional claims modelled?

In terms of solvency, it’s important to gauge how well your stochastic and stress tests on models actually protected your company.

3. Rethink mortality assumptions

Some basic assumptions should also be made in the stresses about the pattern of mortality either worsening due to increased deaths from COVID or the impact of long COVID or improving because of improved public health, hygiene and resistance to future viruses or flus.

4. Deliver timely information

Tying back to your solvency platform and framework, actuaries need to be able to answer senior managers’ most fundamental questions, fast.

To consistently provide a rapid response in these kind of circumstances, you need a risk platform that is well governed, scalable and accessible from anywhere in the cloud, with the flexibility to model changes and get the answers quickly.

5. Push ahead to meet new solvency requirements

“Solvency Modernization” is now a reality for insurers around the world, with many countries echoing the spirit and format of Solvency II as well as the upcoming Insurance Capital Standards (ICS). It is likely all solvency regimes will be reviewed in the light of COVID-19. So far, insurers’ risk models have stood up well to the impacts of COVID-19, while allowing for a range of possible scenarios as the pandemic continues to unfold.

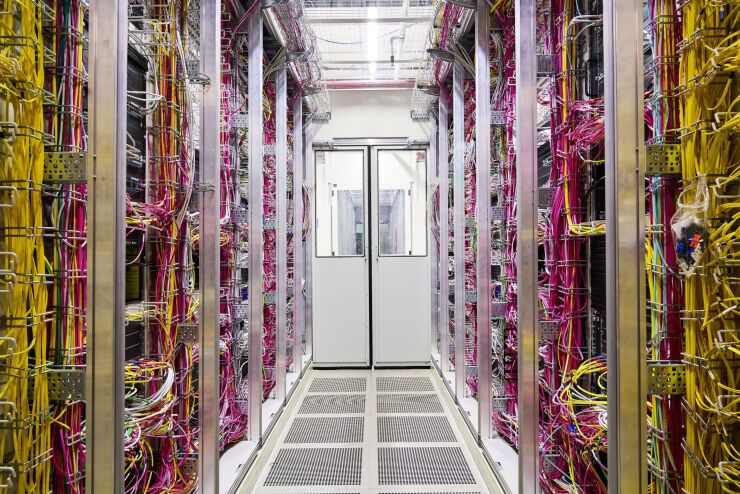

In the century between the Spanish Flu and COVID-19, actuarial science, modeling and technology have come a long way. By renewing their approaches and taking advantage of modern innovations such as the massive scale of cloud computing, meaning thousands of compute cores are available on demand to do the complex calculations risk models demand. Distributed databases which can handle previously unthinkable data volumes as well as business intelligence tools and automation software to provide governance and also accessibility and turning the significant output of these risk models into meaningful data and information to inform decision making and manage risks in near real time. By deploying this technology, today’s insurers can face the challenges, crises and extreme events of the next 100 years with greater confidence.