-

Highlighting what technology tools insurers are using to better understand the risks associated with the climate crisis.

May 13 -

California Governor Gavin Newsom said he wants lawmakers to expedite the approval process for insurance companies seeking to hike rates, saying an overhaul of the state's market is taking too long.

May 13 -

Catastrophe bonds and other insurance-linked securities, which powered last year's highest-returning hedge fund strategy, are built on calculations that can underestimate a new breed of risk stemming from high-frequency events such as wildfires and thunderstorms, according to veteran investors.

May 13 -

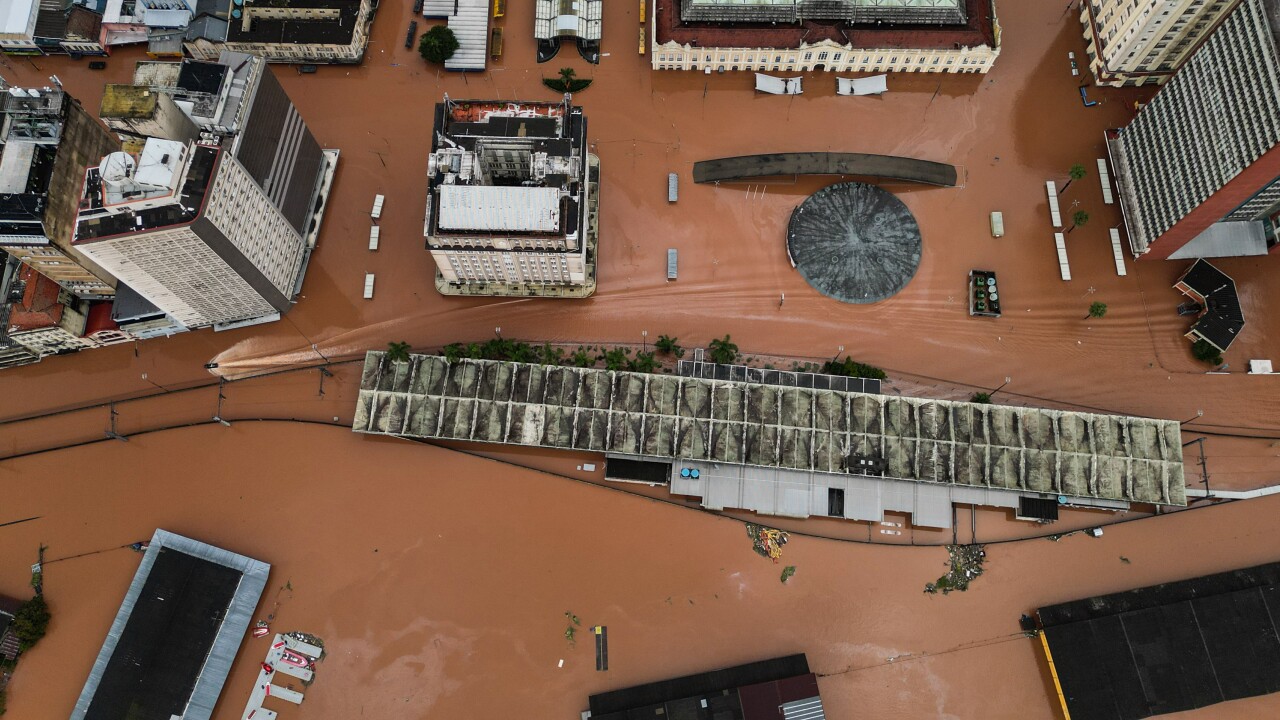

Heavy rains in Rio Grande do Sul, Brazil's southernmost state, left entire cities under water and shut down its main airport indefinitely.

May 9 -

Climate-related disasters rank as just one of the leading factors.

May 7 -

Ariel Re, Hiscox cyber consortium; Swiss Re Gen AI underwriting assistant; Liberty Mutual Reinsurance announced a partnership with Safehub and more insurtech news.

April 29 -

The Net Zero Insurance Alliance will instead be replaced by the Forum for Insurance Transition to Net Zero (FIT), convened and led by the United Nations Environment Programme, according to a statement on Thursday.

April 25 -

"Lax regulation and monitoring of property insurers makes Florida mortgage markets far more exposed to climate risk than people might think," said Parinitha Sastry, an author of a working paper by researchers at Harvard University, Columbia University and the Federal Reserve.

April 24 -

Greater exposure to climate risks is driving an increase in insurance premiums and decrease in insurance availability.

April 22 -

The two companies, units of Japan-based Tokio Marine Holdings Inc., said the decision will affect 12,556 policies with premiums of $11.3 million.

April 19 -

The one-year-old startup, which recently had a $500,000 funding round with Metaprop and others, helps identify properties that are better protected against natural perils.

April 14 -

There is a disconnect between today's insurance frameworks and the financing needed to invest in adaptation and mitigation measures.

April 11 ACTUAL

ACTUAL -

The average premium for homeowners insurance in the US is expected to hit $2,522 by the end of the year, driven largely by intensifying natural disasters, rising reinsurance costs and higher fees for home repair, according to Insurify, a Massachusetts-based insurance-comparison platform.

April 1 -

Defections by U.S. states from NAIC's call for property market data reporting could widen the gap in insurance protection, climate risk solutions expert says.

April 1 -

Insured losses from natural catastrophes have been on a slow and steady rise.

March 26 -

The move comes just nine months after State Farm announced plans to stop issuing new coverage in the most populous US state.

March 26 -

This will be the first spring outlook since 2021 where there are no communities at risk of significant flooding, according to climate forecasters.

March 26 -

Strong data and resilience are key to scaling the renewable energy sources needed to combat climate change.

March 25 kWh Analytics

kWh Analytics -

The jury is still out on whether the California insurance regulator's plan to let insurers use catastrophe modeling for rates will make wildfire loss coverage more widely available.

March 25 -

In partnership with the United Nations Capital Development Fund (UNCDF), Lloyd's will run parametric insurance training workshops in Papua New Guinea and Fiji.

March 25