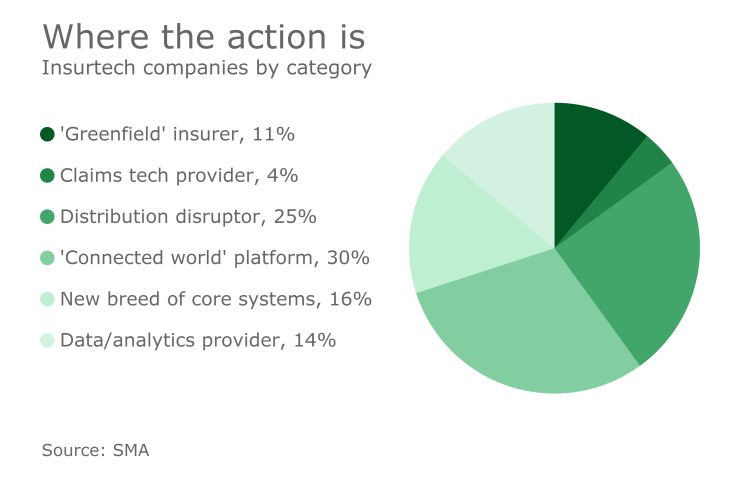

About one-quarter of insurtech companies are focused on insurance distribution, according to an analysis of nearly 800 companies by Strategy Meets Action.

The analyst firm codified its findings in a research report, “2017 Insurtech Landscape: Aligning to Business Opportunities," authored by partner Mark Breading. He says that it’s no surprise that a large cohort of insurers are focused on distribution.

“If there is an area of the business that can be disrupted more than others it is distribution,” Breading says. “The insurtechs see a more digital way to interact with customers. It’s not that hard to set yourself up as a digital agency, so they can rethink customer experience while they still have insurers on the back end taking the risk.”

SMA split insurtechs up into six categories. In addition to the distribution disruptors discussed above, companies were identified as:

- Greenfield insurers, which are actual startup insurance companies taking on risk;

- Claims ecosystems, which are companies targeting field technology for claims pros;

- New breed solution providers, or firms creating new core administration, underwriting or rating platforms that reflect a digital world;

- Digital data/analytics, insurance-specific data aggregation, big data, and analytics platforms;

- Connected world, which encompasses several smaller categories of companies that target other industries besides insurance with Internet of Things-based solutions.

An attempt to help insurers understand how to work with different kinds of companies is “actually what kicked a lot of this [research] off,” Breading says.

“There are differences between companies. There are some that are completely aligned with insurance, that’s all they do – something like a digital broker, or a software company focused totally on the insurance industry,” Breading says. “But for a lot of these new startups offering solutions, insurance is just a component of what they’re doing.”

Breading predicts that as insurtech gains prominence and carriers become more comfortable with digital interaction and innovation, that most of the “greenfield insurers” will be spinoffs of existing insurers rather than venture capital-funded startups. He also believes that rather than displacing existing software vendors, insurtechs will become part of a larger ecosystem with historical providers to the industry.

“We see less of insurance being disrupted with the new players taking over for the old players, but the best of both worlds,” says Breading.