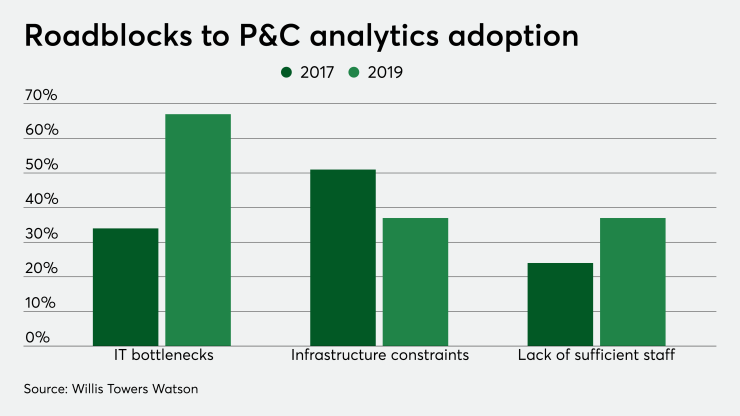

Insurers in North America are not as advanced in analytics as they would like to be due to lack of coordination, infrastructure, and sufficient staff.

That’s according to Willis Towers Watson’s “Advanced analytics: Are insurers living the dream?” survey of 122 executives at 99 P&C insurers.

About 45% of insurers shared they suffer from problems “with information bottlenecks where people and systems typically need to interact,” and there has also been a notable rise in the percentage of companies reporting issues with a “lack of sufficient staff to analyze data.”

“We see that many insurers continue to aspire to build up their advanced analytics reserves, notably in areas highlighted in previous editions — customer experience, claim management and telematics,” the report, which was written by Nathanlie Begin and Lisa Sukow, says.” But we also see that current reality and rate of progress don’t always match the vision, which means that intentions to apply advanced analytics in some other areas, notably in expense management and marketing, are largely taking a back seat.”

Some next-step options that Willis suggests are:

Maximize internal data utilization. “Many P&C insurers routinely collect customer data as part of an application or claim process, which can be of wider value to the business when suitable analytics are run on them. Companies shouldn’t overlook what is readily available.”

Explore what external data has to offer. “Internal data are certainly a potentially rich vein to explore, but consider supplementing it selectively with external data sets to improve results and achieve objectives.”

Align strategy and analytics. “Companies should identify what they believe is core to achieving a competitive edge and steer their efforts and resources accordingly. Avoid getting carried away with analytics for analytics’ sake.”

Match tools to the job at hand. “Tap into the technology that is constantly evolving to enable companies to leverage analytics capabilities in a controlled environment.”

Review staffing allocation. “Companies will get the most from data and advanced analytics with employees who can devote sufficient time to them and develop their skills in the process.”

Create a flexible road map. “Companies should plot a course for how they want to apply data and analytics but remain flexible enough to take advantage of market and technical developments as they arise. Insurers should think of the whole process of enhancing analytics capability as a journey, not a destination.”