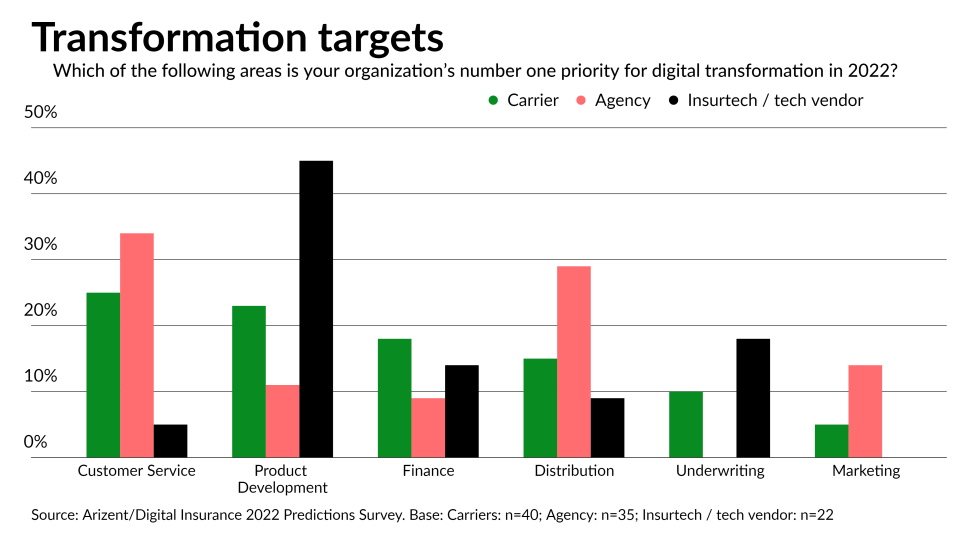

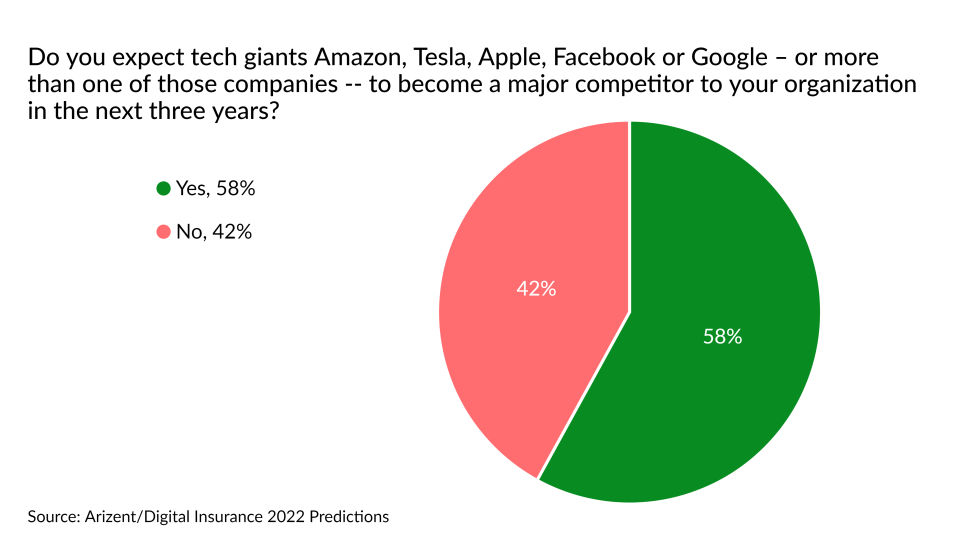

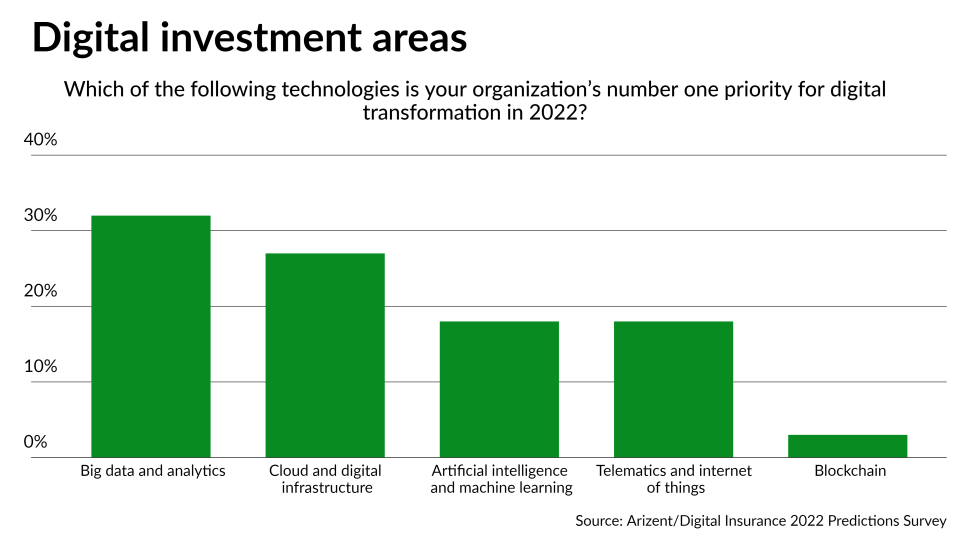

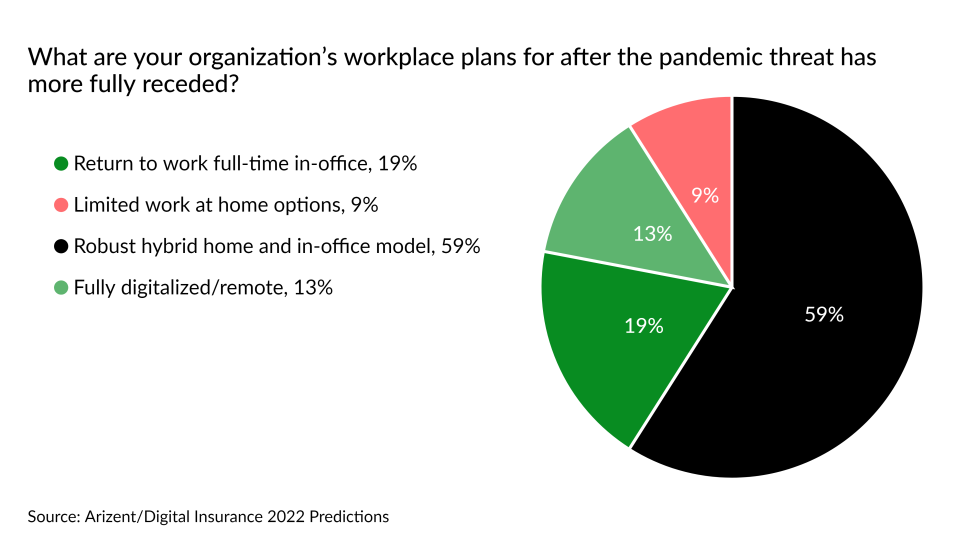

How will the insurance industry transition out of COVID-19 crisis mode? Is such a thing even possible? Digital Insurance fielded a survey in October 2021 to find out where stakeholders across the sector see their businesses entering 2022. A total of 97 insurers, agents, brokers, and insurtech firm representatives responded. Following is a selection of our findings.

Digital Insurance survey: 2022 predictions

January 18, 2022 6:47 AM