Takeaways:

- Autonomous vehicles will change liability in the event of an accident.

- Auto insurers are creating policies that separate human from mechanical liability.

- Autonomous vehicles should result in fewer accidents at some point.

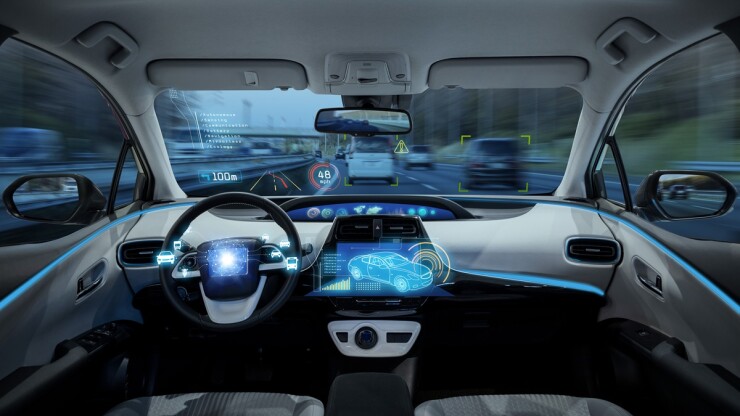

Manufacturers have been touting the benefits of autonomous cars for years, but fully autonomous cars are still not the primary mode of transportation…yet. There are fully autonomous taxis operated by Waymo in several U.S. cities that service customers through approximately 250,000 trips per week, as well as two companies, Baidu and Pony, that operate in China. However, progress on fully autonomous personal automobiles still lags behind earlier projections.

According to the National Highway Traffic Safety Administration, there are five levels to vehicles automation:

Level 1 – The driver is fully responsible for driving the vehicle, but systems may provide assistance such as warnings and alerts, or emergency safety interventions.

Level 2 – The driver is fully responsible for driving the vehicle, but the vehicle systems may provide acceleration, braking or steering assistance.

Level 3 – The driver is fully responsible for driving the vehicle, however, the vehicle systems may provide continuous acceleration, braking and steering assistance.

Level 4 – When the system is fully engaged, it is responsible for driving tasks and can operate within a limited area. A human driver is not required to operate the vehicle.

Level 5 – The system is fully autonomous and responsible for all driving tasks under all conditions and roads, and a human is not required to operate the vehicle.

How adoption changes risk

A new analysis by

As vehicles become more autonomous,

Some carriers are taking this differentiation into consideration and creating policies that

According to S&P Global Mobility, vehicles operating at Level 2 autonomy and higher are becoming more popular. In 2024, 1.3% of new vehicles sold included Level 2+ features and S&P Global Mobility forecasts that by 2035, there will be nearly 87 million Level 2 vehicles on U.S. roads, with 45 million Level 2+, 3.5 million with Level 3 and 1.7 million with Level 4 autonomy.

At this point, autonomy adoption is limited to specific geographic areas, with Robotaxis currently operating in select cities within California, Nevada, Arizona, Texas, and Georgia. The Mercedes Drive Pilot, currently the only commercial Level 3 system, is restricted to specific areas within California and Nevada.

The autonomous impact on risk

The increase in vehicle autonomy no long requires a human to be "in the loop," reducing the need for a human driver at all times. While traditional policies insured the driver, newer auto insurance policies must consider that a human may not be operating the vehicle at the time of an accident.

According to S&P Global Mobility, in some commercial sectors insurers are exploring new coverage options that treat a vehicle as a service-delivery platform. This expands coverage options and allows insurers to assign fault if the vehicle was operating autonomously at the time of an accident.

There is an expectation that automation will reduce the number of crashes and the resulting insurance claims. However, the AV components and sensors are more costly to repair if a vehicle is involved in an accident.

Robotaxis and other commercial autonomous vehicles are expected to have shorter life expectancies than other vehicles because of higher mileage and the need to upgrade or replace the technology more frequently.

The additional technology incorporated into autonomous vehicles will also affect the claims process, providing eyewitness accounts of an incident without humans. Existing electronic data recorders, cameras, sensors, time-stamped controls and software will provide data and analysis of accidents in new ways. Artificial intelligence is also expected to play a role in claims, but human oversight and reviews will still be required.

Autonomous vehicles will continue to evolve, and so will the auto insurance industry, but the changes provide a range of opportunities for carriers to expand their offerings to provide new and extended coverage options.