Insurance pilot programs are gradually moving into production, with more than half geared toward digital distribution and analytics projects, according to a new study by Novarica.

Its report, “The Novarica New Normal for P&C Insurers: 100 data, digital and core capabilities,” surveyed 61 CIOs from large and mid-size companies to develop a list of advanced capabilities insurers are working on deploying across their organizations. These technologies span distribution, underwriting, billing, claims, customer engagement, finance, marketing and product development, the analyst firm says.

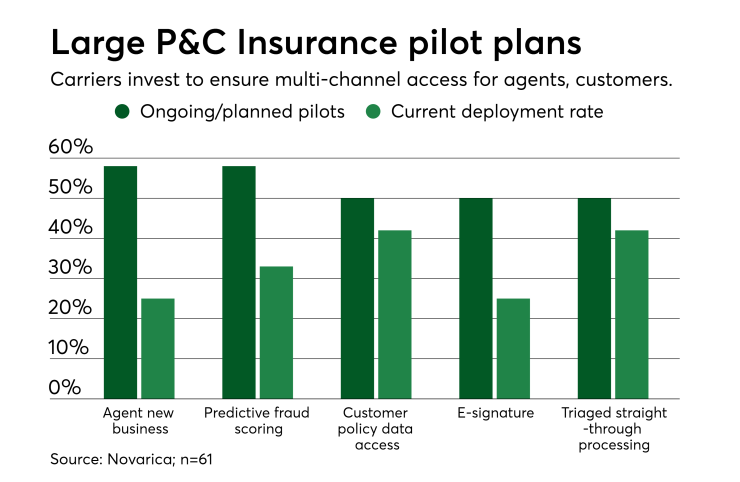

Novarica concludes that large P&C insurers’ pilot activity is predominantly focused on acquiring new business for agents using mobile channels, predictive fraud scoring and e-signature, accounting for more than half of planned or ongoing proofs on concepts. About one-third of mid-size carriers also reported current mobile agent and e-signature pilots.

“Large insurers continue to invest in digital capabilities to ensure mobile and multi-channel access, which was an area of focus for pilot programs in 2016,” the study’s authors wrote, adding that overall technology deployment levels for companies remain broadly similar to last year, with slightly more tools implemented in marketing, underwriting, and billing.

As it stands, 29% percent of pilots lunched in 2016 have moved into production among multi-year study participants; the majority of which have progressed to yield “some” or “mature" capabilities, according to CIO respondents.

However, pilots for core functions have notably lagged behind both digital and data in 2017. So too have the conversions of previous core pilots to operating capabilities.

“[This] perhaps reflects the greater complexity of modifying or replacing core capabilities,” the study explains.

On the plus side, insurance proof of concepts for triaged straight-through processing in claims represent the highest deployment rates among initiatives large insurers want to implement today, tied with customer access to policy data via mobile. Other key core initiatives for insurers include consolidating bills across multiple product lines and automated budgeting.

Matthew Josefowicz, president of Novarica, and senior associate Harry Huberty co-authored the report.