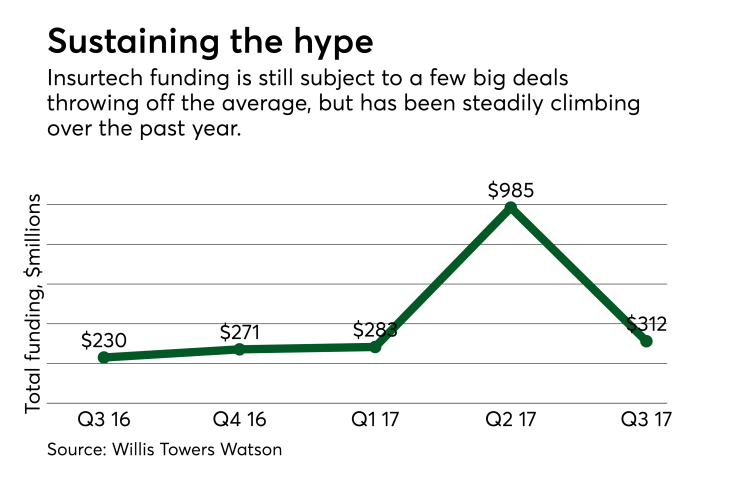

Investment in insurtech startups by carriers and venture capitalists continued an uneven ascent in the third quarter of this year, with 48 deals totaling $312 million outpacing the same period last year by about a third.

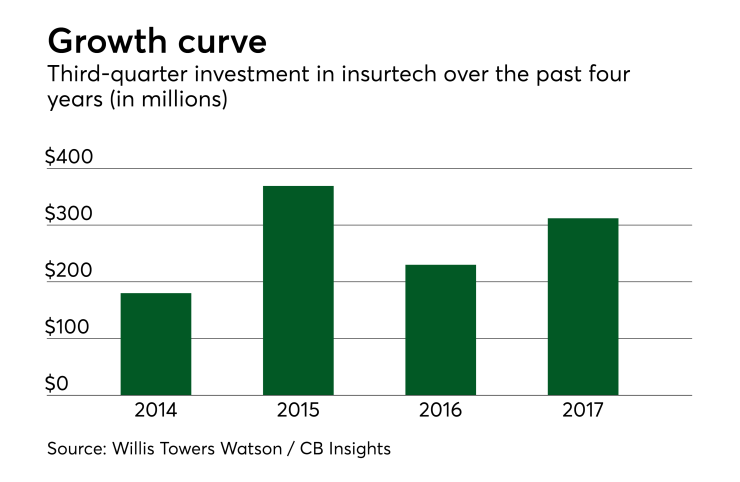

That's according to the quarterly Insuretech Briefing report, released today by Willis Towers Watson and CB Insights. Though Q3 2017 represents a precipitous drop in terms of funding from the nearly $1 billion invested in Q2 -- the second-most lucrative quarter for insurtechs -- the almost 50 deals completed in the quarter are the third-most by that measure. In the third quarter of 2016, 38 total deals yielded $230 million in funding.

Study data goes back to 2012, and the relatively new industry has had periods of intense activity followed by comparatively calm ones. Three quarters -- Q2 2015, Q1 2016 and Q2 2017 -- have reported funding volume between $783 million and $1.85 billion. However, funding in the calm periods has been on a steady climb over the past year.

Of the total deals, 28 included direct investment by insurance companies and/or their investment arms, with some making multiple deals:

4 deals

Ping An

3 deals

AXA

Allianz

2 deals

MassMutual

Hannover Re

China Life

Aviva

CMFG

Driving the year-over-year increase, as well as buoying the insurtech funding trend, were significant investments in these health insurtechs, according to the report:

- Shuidihuzhu, a China-based insurance platform that aims to solve the problem of high medical fees faced by patients diagnosed with a critical illness

- Stride Health, a health insurance recommendation engine

- Lumity, an insurance consulting platform that helps employers make better health benefits decisions

- Gravie, a digital health benefits administration platform