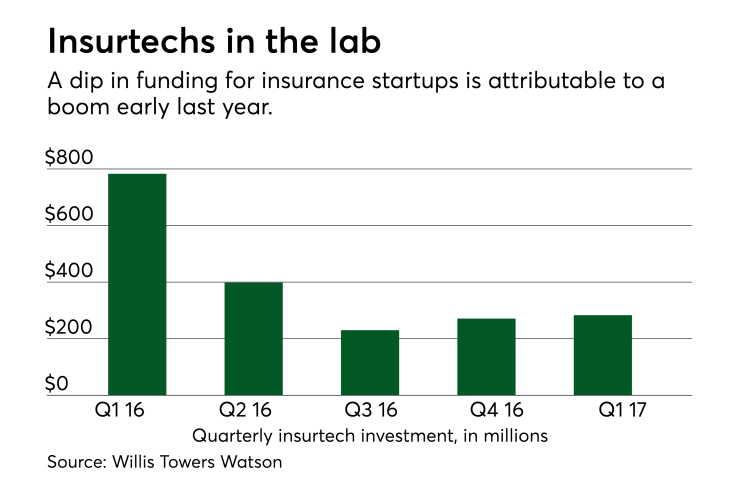

Insurtech investment is down year-over-year in the first quarter of 2017 as big investments from 2016 translate into launches.

That's according to the inaugural Quarterly Insurance Briefing from Willis Towers Watson Securities. A total of $283 million was invested in insurtechs in Q1 2017, compared to $783 million in Q1 2016. At the same time, the amount is higher than each of the past three quarters, indicating insurers are still interested in entering financial relationships with tech startups, but the industry is waiting for the first round of big innovations to translate into product launches.

"As we reach a phase of ‘peak hype’ for InsurTech, the industry now needs to focus its attention on sustainable technologies that can increase the insurance value proposition, so that early, perhaps inflated expectations, can be developed into productive applications and innovations that will survive and become profitable business drivers," Willis says in a statement.

New investments tend to be keyed on the small business insurance sector, Willis adds. That line of business is shifting toward digital fast, with up to 25% of it likely to be written online by 2020.

“As incumbents face pressure from entrepreneurial businesses targeting friction costs within the traditional insurance value chain and the continued influx of alternative capital into the (re)insurance sector, it is important for industry leaders to demonstrate an open mind, embrace innovation and invest in potential applications," says Rafal Walkiewicz, CEO, Willis Towers Watson Securities.