Predictive analytics "is still regarded as an innovation" in life and health insurance, according to a survey by life and health reinsurer Gen Re.

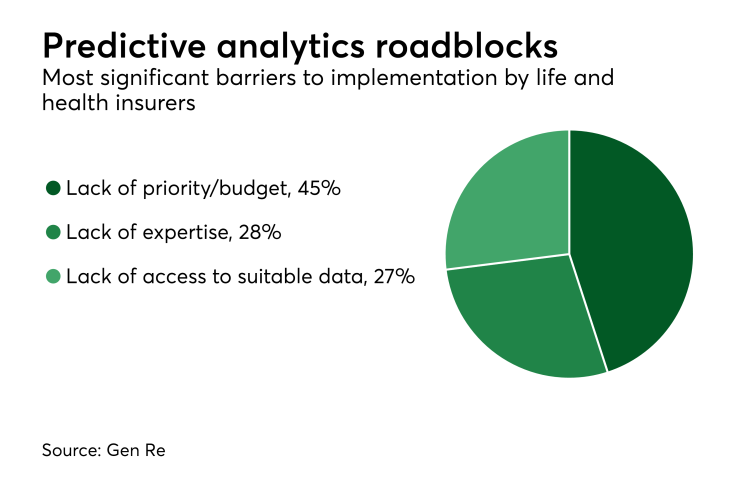

For the purposes of its study, Gen Re defined predictive analytics as “statistically rigorous techniques (beyond conventional actuarial experience analysis) that are applied to data to model or predict future outcomes.” The company surveyed 136 fellow insurers in those lines of business and found that only about one in five (22%) currently use predictive analytics, with 46% having no plans to implement the technology over the next two years. The most popular business applications were sales and marketing, with 40% each, followed by underwriting, for 30%.

“The use of predictive analytics is still catching on in the insurance industry as it is regarded as an innovation,” said Guizhou Hu, chief of decision analytics at Gen Re and

Geographically, life and health insurers in Taiwan, the U.S. and the Middle East were most likely to use predictive analytics, while Europe and Latin American insurers were least likely.