The percentage of insurers planning to increase IT spending increased to 56 percent in 2013 from 40 percent in 2010, and 5 percent of insurers plan to increase IT budgets by more than 10 percent, according to “2013 Insurance Ecosystem: Insurer Technology Spending, Drivers, and Projects,” a white paper from Strategy Meets Action.

P&C insurers are spending in an effort to position themselves for growth, stay competitive and better manage profitability, SMA said. To accomplish those goals, they are modernizing core systems, automating underwriting and conjoining those efforts with investments in portals, business intelligence tools, analytics, big data and mobile.

Life and annuity insurers are concentrating on new business sales, rethinking products, distribution and value propositions, and SMA said technology could play a role in developing and managing attractive products, identifying market opportunities and supporting a variety of distribution channels. L&A insurers also are continuing to focus heavily on financial management and investments.

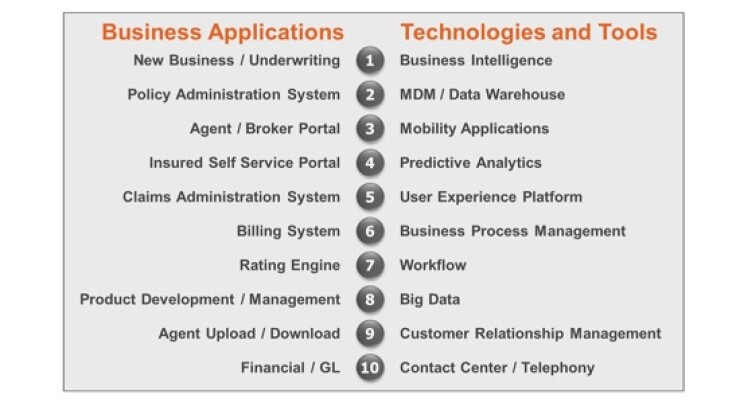

“The big theme for IT budgets and plans is the continuing emphasis on core systems, with a significant shift to more focus on front- and middle-office applications that will help insurers drive differentiation and advantage,” SMA said. “Top projects encompass new business/underwriting, policy administration, business intelligence, data management and mobile.”

A large majority of insurers are optimistic this year, SMA said, as 51 percent are positioning for growth, unchanged from last year; and 20 percent for transformation, up from 17 percent last year. The number describing themselves as sustaining declined to 24 percent from 28 percent last year.

The top five business drivers of IT investment for 2013, according to SMA, are business growth in current lines/markets/geographies (45 percent); cost containment/expense reduction (41 percent); business optimization (41 percent); competitive pressures (34 percent); and business growth through new lines/markets/geographies (30 percent). SMA said this is the first year that competitive pressures were a top five driver.

IT budgets increased an average of 2 percent; 56 percent said they plan to increase IT spending; 34 percent will remain flat and 5 percent of insurers are expecting to increase their budgets by 10 percent or more. On the downside, 10 percent of insurers will reduce their budgets by 10 percent or more. Over three years, 70 percent plan to increase their IT budgets, SMA said.

“New business/underwriting is the number one area for increased IT investment for 2013. This emphasis on investment in the middle office stands out. Insurers are increasing investments in new business and underwriting applications that work in concert with the front and back office,” SMA said. “These investments will support growth objectives, help them optimize the efficiency of the business, and improve customer service.”

“Priorities among business applications indicate that insurers are continuing to invest in areas that work in coordination with core systems,” SMA said. “For example, instead of planning separate projects for policy administration replacement, CCM, and business intelligence, these insurers are unlocking the value of their IT investments by planning for all of these projects in an integrated fashion. Through this joint effort, insurers are able to maximize the value of architecture investments they have already made. They are, in fact, rethinking and planning in a ‘smarter’ way.”

Insurers also predominantly are enhancing current systems, and 39 percent of those surveyed said enhancing new business/underwriting systems were the priority; 35 percent named policy administration systems as the priority, SMA said.

Top enhancement projects include business intelligence, data management/warehousing and predictive analytics; 31 percent are planning mobile projects. Many insurers are moving designing custom apps for strategic purposes, having moved beyond bring your own device (BYOD) policies and enabling mobile capabilities on their web sites; 33 percent have deployed mobile apps and 13 percent are deploying their second or third wave of mobile apps. Underwriting and agent portals are most likely to be replaced.