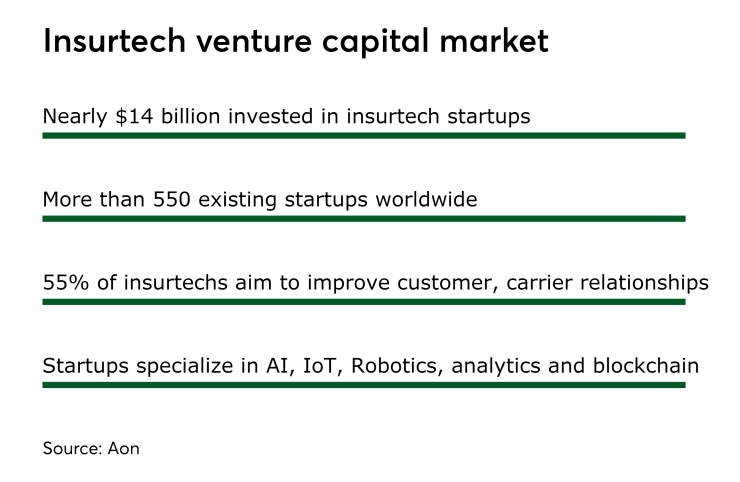

Insurtechs with expertise in robotics, artificial intelligence, IoT, blockchain and advanced analytics are encouraging insurance companies to rethink product development through collaboration. That’s according to a new study from professional services firm Aon.

The

“The insurance industry has been relatively slow to embrace digital technology compared with other industries. That reticence has opened a window of opportunity for entrepreneurs to deploy digital technology to improve the customer experience through a host of startup companies,” Aon says. “This has allowed the startups to not only provide more effective solutions, but also to continuously improve them through the collection and analysis of data.”

Aon also finds the on-demand economy presents both opportunity and turmoil for the insurance sector as customer assets, such as homes and cars, are increasingly used on both a commercial and personal basis through services like Airbnb and Uber.

Similar problems arise over the uncertainty of how to insure driverless cars. Aon estimates U.S. premiums could decrease by 40% from 2015 levels by 2050—the year autonomous vehicles are expected to be fully adopted. One predicted benefit from self-driving cars is the reduction of accident frequency. However, the study warns accident severity could increase. Transfer of liability could also shift from drivers to car manufacturers and software providers.

“A major premise behind autonomous vehicles is the hope that that they will prevent the 94% of current accidents involving human error,” Aon says. “This would have a substantial disruptive impact on the current regulatory, legal and insurance industry approach.”