Many industry reports say carriers are investing in underwriting. In fact, according to results from an Accenture survey, 57 percent of insurers plan to improve the effectiveness of underwriting during the next three years through process automation. The next top priorities are increased use of predictive models for pricing and risk evaluation (51 percent), and increased use of external data to evaluate risks (51 percent). According to Accenture, these two will become even bigger market differentiators as some carriers invest significantly to take the next leap forward.

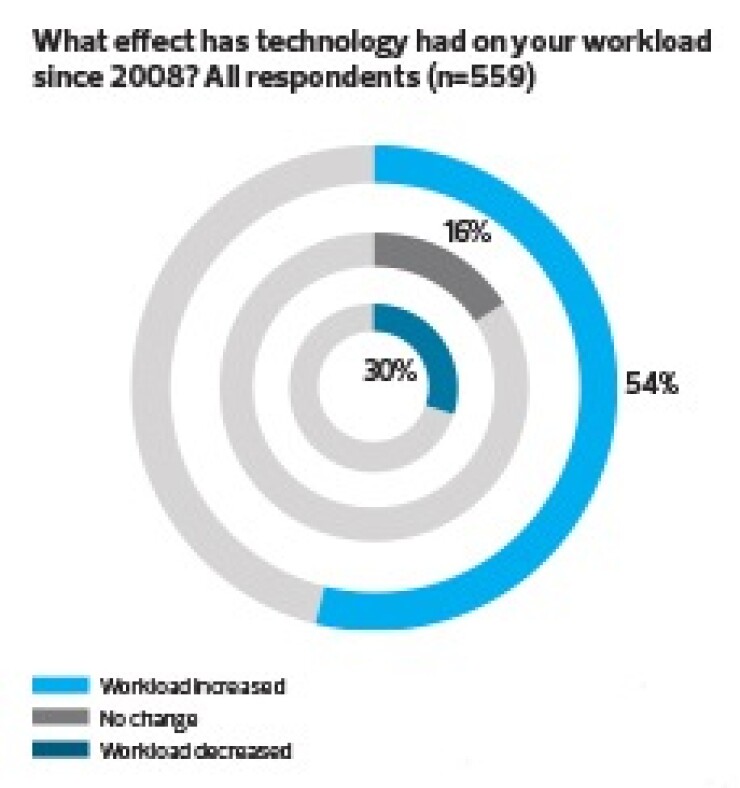

But will all of these changes benefit underwriters? Half of the 559 North American commercial lines, specialty lines and reinsurance underwriters participating in Accenture’s “North American Commercial Insurance Underwriting Survey 2013” believe new technologies implemented have not met effectiveness expectations. This percentage is buoyed by frontline underwriters using the technology first-hand, which means that management may not have a full grasp of effectiveness; also, more than half feel their workload has increased because of technology. Reasons cited for the lack of efficiency gained from technology were lack of data integration, lack of process integration and insufficient training.