If USAA's pilot app works as intended, it's going to get a lot easier for its customers to shop for a car.

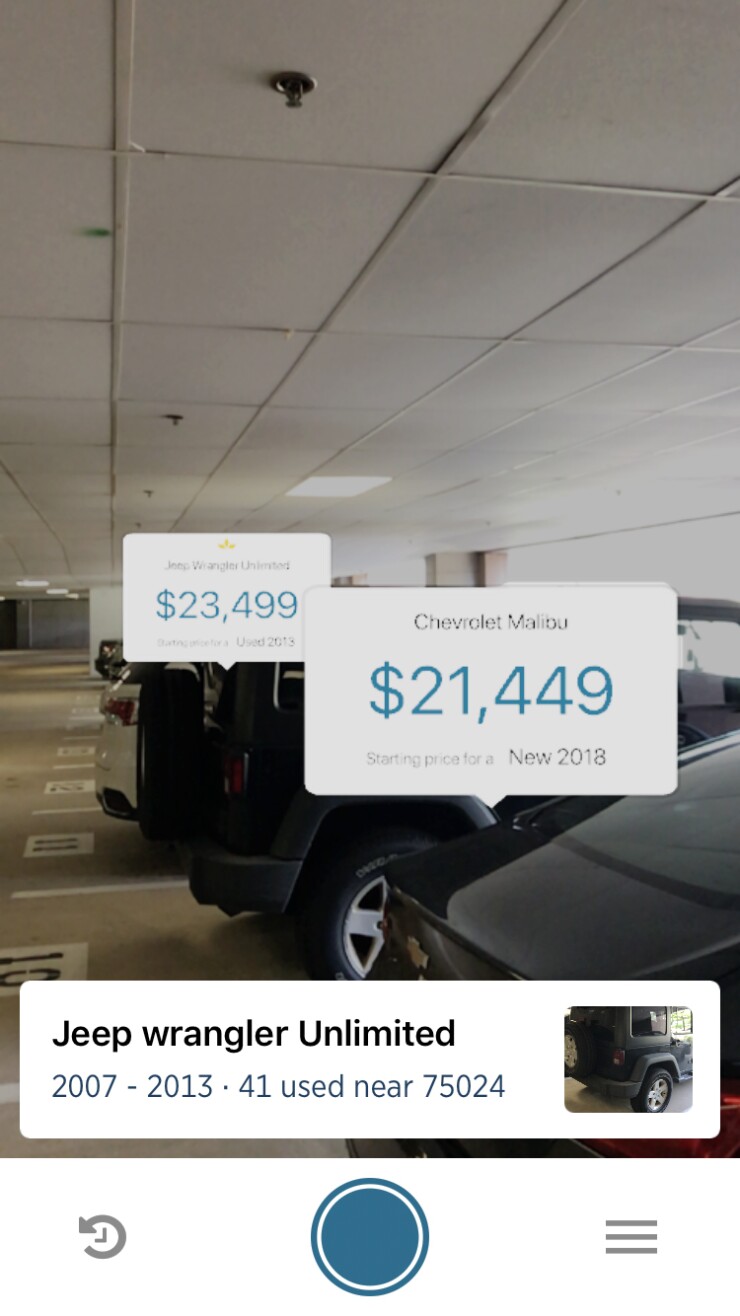

By using the app, which will go live Monday for close to a thousand members and employees, customers can point their phone at a vehicle and get an augmented reality overlay that provides all its critical info: the make, model and year of the car, as well as its price range and quotes for insurance and a loan to purchase it.

The app is designed to save customers time and embed USAA into the car-buying process.

“People’s attention spans are so short right now," said Patrick Kelly, assistant vice president of digital product development at USAA. "Giving them all the information at the right moment to make a decision takes a lot of workload out of the process.”

Evolution of car-buying apps

If the app sounds a little familiar, it should.

Capital One announced in March it was working on

USAA itself also launched a car-buying app in 2010 called Auto Circle.

What’s new here is the augmented reality element, which according to Kelly greatly simplifies the car purchasing experience.

“If you were going to shop for a car on any car shopping website — CarMax, Autotrader — you would have to physically input all the information about the car yourself: new, used, what year, what make and model, what features,” Kelly said. “This takes all that data entry out of the picture. All you have to do is point it toward the car you like, we’ll take care of the lookup, and we will grab information about that car.”

The app contains computer vision software from Blippar that uses artificial intelligence to recognize the car shape and logo and pair that with a manufacturer’s database.

The software’s accuracy rate at identifying a make, model and year range is close to 100%, Kelly said. (It’s hard to know the exact year without looking at the inside of the car, he said; auto manufacturers usually keep a similar body style for four or five years before making a change.)

The app will list vehicles in the area for sale that match that make, model and description.

“When you select one of those cars exactly, then that exact content goes back into the engine to give you a more accurate quote,” Kelly said.

USAA hasn’t decided yet whether the car-buying app should be standalone or built into USAA’s mobile banking app. Currently it’s a separate app so it can easily be tested without affecting the banking app.

In the future, USAA will consider adding affordability widgets that will help the customer make a decision faster.

Brad Leimer, former head of innovation at Santander and co-founder of the consulting firm Unconventional Ventures, said he's used an app called TrueCar that combines car shopping and auto loans.

But adding insurance takes it a step further.

“It’s important to make things more convenient, because nobody wants to spend time in a dealership,” Leimer said. “You’re embedding convenience into an existing experience and enhancing that through the technology.”

It is the kind of effort banks need to make to stay relevant in the face of online lender and fintech competition, he said.

“We need to be changing the way we are looking at building experiences around typical consumer needs: buying a car, buying a home, and making it more convenient for the customer to make these large purchases and credit decisions with as much information as possible,” Leimer said. “The smartest institutions are experimenting with and looking at this idea of how augmented experiences, throwing data on top of reality, will help people. There are a lot of examples where this will become more pertinent in our day to day lives because it will be this ongoing companion that may be visual or audio.”

Leimer warned that banks shouldn’t watch on the sidelines as these apps get developed.

“There will be an inflection point when all these devices, all the sensors in our lives and the activity with 5G will catch up to the promise of a fuller ability to immerse these experiences into a digital application,” he said. “Then what do you do if you haven’t been looking at this all along? I’m not saying you have to build pilots for all this stuff if the use case isn’t there, but you need to be aware and engage with companies that are in these spaces in order to quickly be able to develop things as they come to market and take form.”

The build

One small team of developers at USAA, the people who built Auto Experience, created a prototype of the new app in about three weeks. They then spent two months refining and testing it for production. Kelly wouldn’t say what this cost or when any return might come.

“That’s part of what the pilot is for, to evaluate what the market would be,” Kelly said.

USAA hopes its app will help bring in new customers and appeal to the several hundred thousand members who buy a new car every year. The app is being piloted on USAA’s member innovation website, usaalabs.com. Members can log in and sign up to participate in the pilot to test the app and provide feedback. The company will then incorporate that feedback into the next phase of the app.

The pilot will conclude Nov. 1 and USAA will analyze the results.

The way USAA does product development lends itself to such short pilots.

“It used to be we would go out and do ethnographic research, a qualitative study and quantitative study then do a conjoint analysis to make sure all the features are right before we ever get to the point of launching a product,” Kelly said. “And we would make sure there was no risk.”

Technology now turns on such a short cycle that such a rigorous approach to product development doesn’t let a company keep up with the market, he said.

“We have to find a lighter weight, faster way to get out there and see if there’s even demand for these types of new interfaces,” Kelly said. “That whole market research phase is expensive and lengthy. I can let the pilot do the hypothesis testing for me instead of doing hypothesis testing in a lab. It’s much faster to market this way.”

Editor at Large Penny Crosman welcomes feedback at