Every day, property and casualty (P&C) insurers make thousands of decisions relating to wildfire exposure, coastal risk and flood-prone zones. What's often overlooked is the common foundation these decisions rely on: publicly funded data and disaster programs provided by the National Oceanic and Atmospheric Administration (NOAA) and the Federal Emergency Management Agency (FEMA).

That foundation is cracking.

Recent budget cuts targeting NOAA and FEMA

"We've always known FEMA and NOAA were behind the scenes," said one national carrier executive, "but if you yank out the infrastructure behind flood maps, storm tracking, and post-disaster grants, the whole system begins to wobble."

That wobble has already begun.

A data drought with long-term consequences

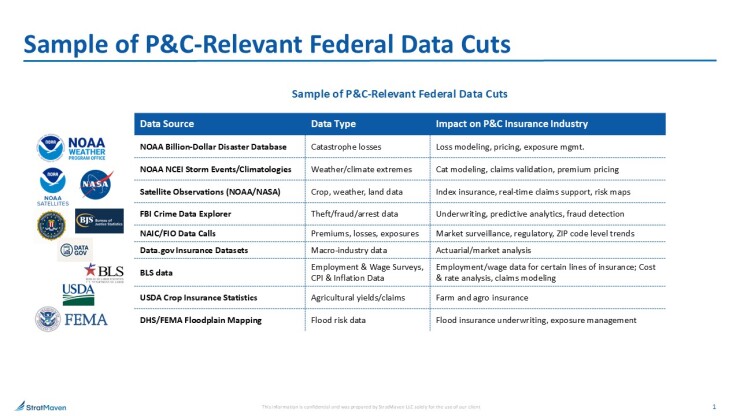

NOAA's climate projections and FEMA's flood maps serve as critical inputs into everything from flood zone determinations to catastrophe modeling. Yet many private data vendors positioned as alternatives rely heavily on these same federal sources as their foundational inputs. This creates a cascading vulnerability when federal data streams are compromised.

With

As a catastrophe modeler at a coastal risk MGA explains, "When our tools stop ingesting NOAA projections, we start flying blind. The risks don't go away. We just stop seeing them clearly."

The cuts create lasting gaps in historical data that will hinder underwriters for decades. Even if federal data is restored, these blind spots will persist. Losing NOAA's billion-dollar disaster data not only impacts insurers but also stifles the national dialogue on climate risk. Without transparent, centralized reporting on climate-driven events, it becomes harder to inform the public or influence policy. Shutting down the data means shutting down the debate and the solutions.

Market instability ahead

The shift to private data sourcing will alter industry dynamics. Smaller carriers may be priced out of essential risk insights, while larger insurers with deeper pockets can invest in proprietary datasets. This could accelerate market consolidation or drive insurers to specialize in niche risks where they can develop unique analytical advantages.

Further, the P&C insurance industry relies on two core assumptions: government disaster aid and community rebuilding. Without these, loss ratios become unpredictable. Insurers are already under pressure to raise rates or increase non-renewals, as seen in California and Florida.

Innovation is emerging…but it has limits

Private market innovation is on the rise. Parametric insurance, which pays out based on triggering events rather than assessed damage, is gaining traction, especially among municipalities. Fremont, California was the first U.S. city to secure city-wide flood insurance coverage this way, and the Mississippi River Cities & Towns Initiative is partnering with Munich Re on a parametric pool using USGS river gauge data. Still, these solutions aren't full replacements.

AI-driven risk scoring is expanding, but depends on reliable foundational data. "These tools are only as good as the data they're fed," noted one MGA executive." If federal datasets become unreliable or scarce, private models will falter too."

A blueprint for resilience

Forward-looking communities offer practical examples of how to weather a diminished federal role. Babcock Ranch, Florida – with hurricane-resilient infrastructure and a solar-first microgrid – suffered minimal damage during Hurricane Milton. State-funded programs like Florida's My Safe Florida Home and Alabama's Strengthen Alabama Homes have shown solid ROI. Homes built to FORTIFIED standards have reduced average losses by 55-74%, according to the Insurance Institute for Business & Home Safety.

These localized efforts show that resilience investments pay off. But only the federal government can provide the scale, neutrality and continuity that underpin the system.

A call to action

To navigate this turning point, insurers must:

- Conduct comprehensive vendor due diligence to understand the federal data dependencies in third-party models and services

- Diversify data sources while recognizing that true independence from federal inputs may be impossible

- Advocate for program restoration through industry associations and direct legislative engagement

- Invest in proprietary risk intelligence capabilities that can differentiate market positioning

- Collaborate on industry-wide data solutions to share costs and maintain market stability

- Enhance mitigation incentives to reduce exposures where risk visibility is diminished

Insurers that move quickly – those that rethink data pipelines, policy structures and resilience strategies – will be best positioned. "The first phase of uninhabitability," warned climate scientist Michael Mann, "is uninsurability." For the P&C sector, erosion of the federal data infrastructure is a wake-up call louder than any hurricane siren.