A recent report from

The fluctuation in life sales reinforces the importance of a sound multichannel distribution strategy. Life carriers in the U.S. need to understand consumer behavior in order to help agents close new business. Another important element of channel strategy is the growth in direct-to-consumer sales for simple term and packaged life and disability packages.

My upcoming research “The U.S. Life Insurance Buyer’s Journey” (published later in December), co-written with Peter Wannemacher, discusses the ever-changing behavior of life insurance researchers and buyers.

The report highlights data from two major Forrester surveys: 1) North American Technographics Benchmark Survey, 2009 (U.S., Canada) which surveyed 48,412 adults in the U.S., and 2) North American Technographics Investments And Insurance Online Survey, Q3 2009 (U.S.) which surveyed 4,814 online adults in the U.S. on how consumers researched, applied and purchased life insurance in the past year.

U.S. Life Insurance Shoppers Research Online, Buy Offline

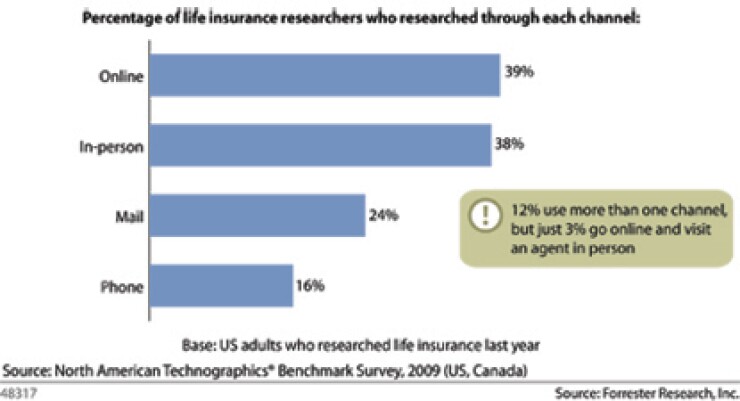

More than 125 million U.S. adults—or 49%—own life insurance, and roughly 25 million bought a new policy last year. But the way they buy life insurance is changing as more customers begin their journey online while still preferring in-person channels for applications: over the past five years, the percentage of life insurance researchers who research online has grown from 22% in 2005 to 39% today, yet nearly 90% of life insurance applications are still made offline.

It is critical that insurance eBusiness and channel strategy executives recognize the multichannel shopping behavior that now exists in the U.S. life insurance market. And it is critical to integrate systems for your Web site, call center and agent systems to turn around and stabilize this fluctuating market.

Do you agree or disagree?

Chad Mitchell is a senior analyst with Forrester Research. He covers mobile and social media strategies in insurance, acquisition, cross-sell and retention marketing strategies, comparative raters, online guided selling tools, emerging Web and call center technologies for sales and service, agent portals for marketing and underwriting, and the best practices of leading multichannel firms. Additionally, he advises leading insurers on best practices for public and secure insurance Web sites—analyzing functionality for quoting, policy administration and claims.