-

Insurtechs are everywhere, covering every sector and raising money at record-setting clips. But the legacy insurance businesses, from carriers to agencies, have already been here and have the deep pockets to remain. So naturally the story has become about competition for market share.

January 24 Breeze

Breeze -

Digital Insurance spoke with Brett Jurgens, the CEO of Notion, a DIY smart home monitoring company, which is owned by Comcast, about how Notion works with insurers and what benefits smart home monitoring has for policyholders.

January 24 -

Amplify, a digital life insurance platform, is focused on helping customers build wealth through permanent life insurance.

January 18 -

In other news: Overhaul and Movingdots collaborate; Zurich Resilience Solutions adds DEI service; Vertafore names chief technology officer.

January 13 -

The first implementation will be of Tractable's AI Subro product for subrogation.

January 7 -

The three winning teams will split $200,000 in prizes. Eligible insurtechs include those that had less than $250,000 in revenue last year.

January 6 -

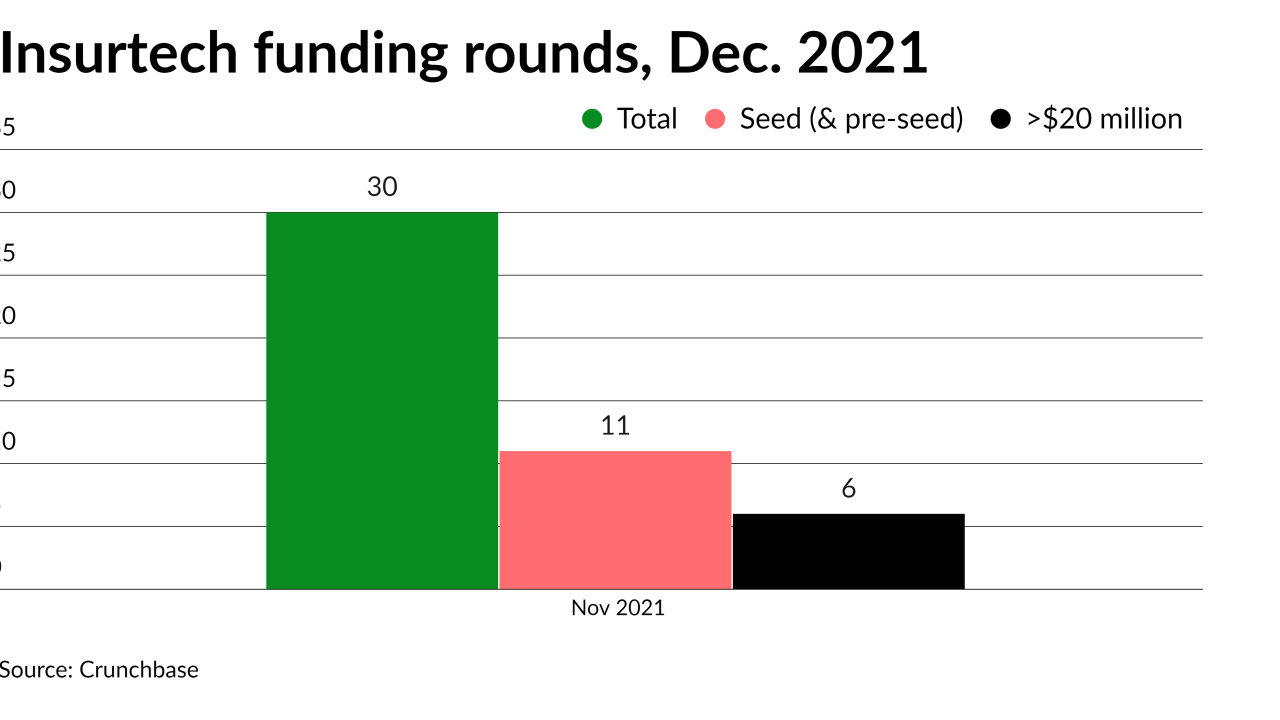

More seed and pre-seed rounds in the final month of the year.

January 3 -

A review of Digital Insurance's Meet the Insurtech department.

December 27 -

In case you missed it, insurtech -- technology developed to improve and transform the insurance industry -- is having a bit of a moment. Forrester recently reported record-breaking funding for insurtechs, closing Q3 at $15 billion - more funding than in 2019 and 2020 combined - with more deals anticipated by the end-of-year.

December 22 Tractable

Tractable -

During, “The View from Venture Capital,” at the Digital Insurance DIGIN conference, Dec. 10, three experts involved in venture capital firms discussed what they look for when funding a company and what’s ahead for the industry.

December 15 -

In 2021, the insurance industry reckoned with the broad impact of the COVID-19 pandemic. Appropriately, 2022 will need to be the year that agencies and carriers pivot from reacting and surviving to implement new strategies for success.

December 10 CoTé

CoTé -

There’s no denying that working with startups entails risk. Plenty of newer insurtechs have technology that’s too underdeveloped, a value proposition that’s too undefined or leadership that’s too inexperienced to overcome the gauntlet of obstacles that stands between startups and success.

December 8 HONK

HONK -

Wyshbox is the marketing name for Wysh Life and Health Insurance, which provides term life insurance for consumers with digital customized plans.

December 7 -

In other news: Chubb teams up with Betterfly in Latin America; Franklin Mutual partners with vipHomeLink; Aon announces last-mile insurance with CarrierHQ.

December 6 -

Chubb Ltd. is joining with insurance-tech startup Betterfly for offerings in Mexico, Colombia, Ecuador, Chile and Argentina as the companies seek to tap into under-served Latin American markets.

December 2 -

As the wave of SPAC mergers crested in the past two years, startups that chose this path found it difficult to keep up with more established companies and investor expectations. The insurtech companies that went this route are not exempt from experiencing that strain.

December 2 -

There were an equal amount of rounds of more than $20 million and seed or pre-seed rounds.

December 1 -

In this segment of the series, the authors examine the role M&A will play in the industry’s adoption of insurtech—and more generally, the need for established carriers to adapt to the increasingly innovative and service-based product and service offerings new entrants bring to bear.

November 23 SSA & Co.

SSA & Co. -

Today’s clients are looking for financial guidance and product recommendations that account for their entire financial lives. Unfortunately, because of legacy technology in place, most insurance advisors can’t credibly weigh in on the whole picture.

November 19 Advisor360°

Advisor360° -