Regulation and compliance

Regulation and compliance

-

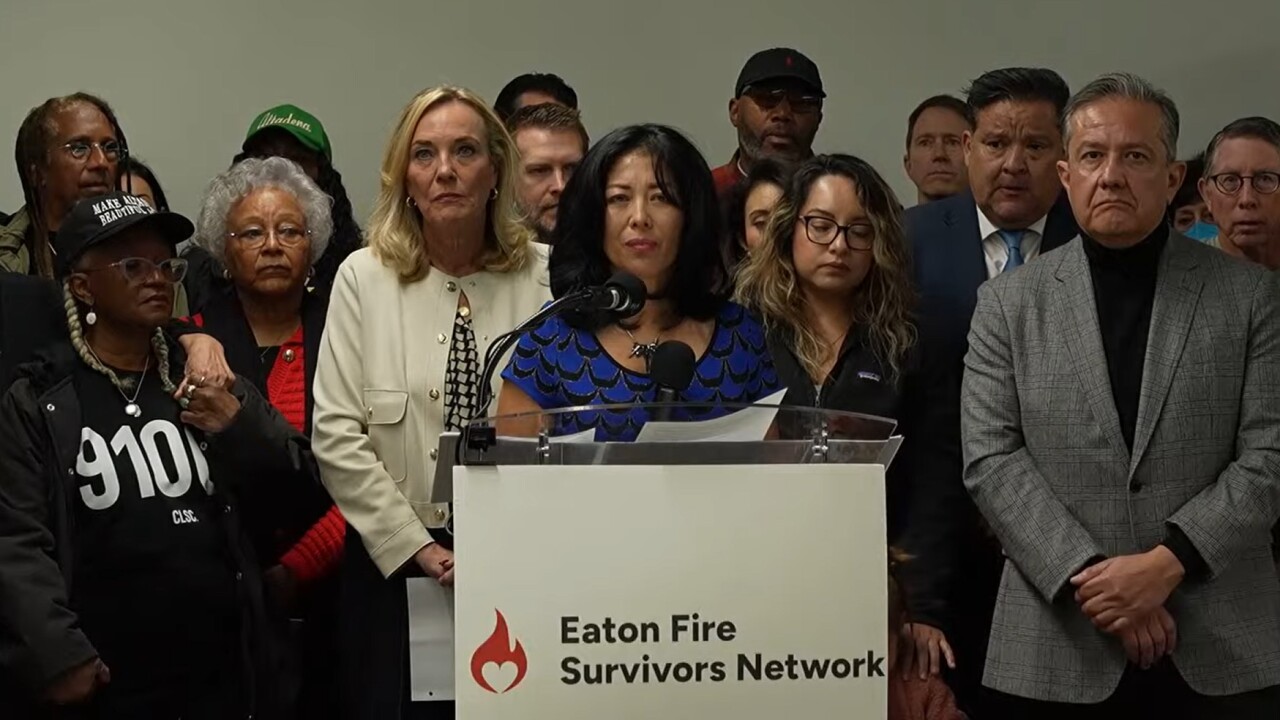

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

As Washington revisits the tax-favored status of health benefits, a longtime policy expert explains why replacing group plans could cost far more.

January 6 -

Changing communication methods like the use of emojis present a growing compliance risk in regulated industries where interactions are subject to scrutiny.

January 4 -

Increases ranging from 0.9% to 8.8% are necessary to maintain the insurer's past level of operating profit, according to its filings with state regulators.

December 29 -

Digital Insurance spoke with Nancy Clark, assistant vice president of regulatory strategy at Verisk, and a leader of the firm's Regulatory Data Exchange (RDeX) tool, about what the service offers to insurance carriers and regulators.

December 23 -

Members of the association of state insurance regulators began another revision of its proposed AI Systems Evaluation Tool, a proposal attracting skepticism from insurers and the insurtech companies who serve them.

December 21 -

Speaker Mike Johnson will block a push by moderate House Republicans for a vote on renewing expiring Obamacare subsidies.

December 17 -

Organization of state regulators, criticized for lack of disclosure of its previous collected data, promises to gather new information on losses, claims payments, policy premiums and mitigation discounts.

December 14 -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10 -

The Office of Insurance Regulation and three advocacy groups paint conflicting pictures of insurance affordability, coverage availability and claims handling.

November 30 -

Representatives of the insurance industry called the proposal too speculative and prescriptive, while consumer and environmental advocates say it doesn't go far enough.

November 17 -

The insurer's 32-page regulatory filing for the increase, implemented in July, claims a 19 cent loss for every dollar in home insurance premiums collected – based on a catastrophe loss estimate given without further details or documentation.

November 11 -

Congressmen introduced the Retroactive Renewal and Reauthorization Act to the House Monday, with hopes to backdate the reauthorization of the insurance program.

November 11 -

Hampered by a lack of institutional authority, the Illinois Department of Insurance goes to court to compel State Farm to provide property insurance market data. The insurer says it has already given the regulator data to justify its recent rate increase.

October 20 -

Several insurance and wildfire-related bills were signed into law October 10, including authorization for bonds to finance California's insurer of last resort.

October 14 -

Reed Smith insurance plaintiff attorney Hugh Lumpkin points to 90% of Citizens Property Insurance arbitrations denying claims, with insurer funding judges' salaries.

October 12 -

The federal flood insurance program, which lapsed just before the government shutdown, mostly covered severe repetitive flood risk that the industry cannot cover.

October 9 -

California governor's executive order tasks insurance regulator and other state agencies to make recommendations on mitigating wildfires, insurance affordability and availability, expediting insurance claims and more.

October 1 -

California insurance commissioner Ricardo Lara proposes stricter standards for Consumer Watchdog's compensation in representing home insurance policyholders against insurers' rate increase proposals.

September 29