Though auto insurance customers have flocked to the internet to buy the product, their adoption of digital tools for claims is lacking.

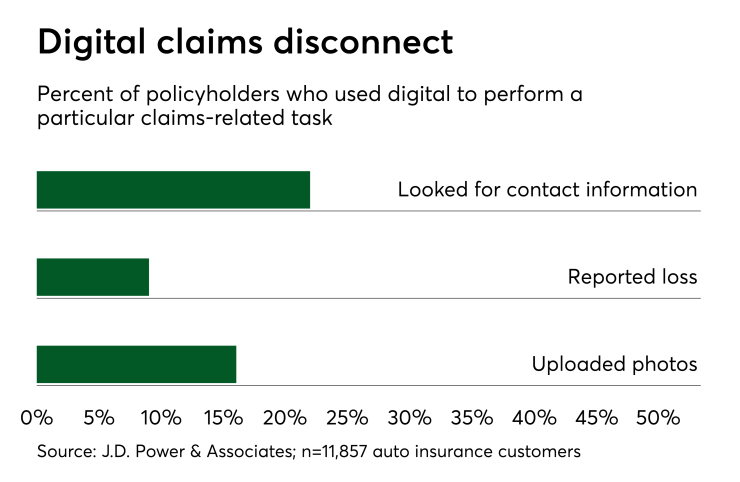

That's according to the J.D. Power 2017 U.S. Auto Claims Satisfaction Study. While just under a quarter of auto policyholders begin their interaction with an insurer online, only 9% of them opt to report a claim via web or mobile app, the market-research firm found. Even among younger "Generation Y" customers, only 12% use digital first notice of loss capabilities at the time of claim.

"We found was that a lot of people were looking for information online, like who to contact and how to begin the claims process, rather than actually reporting the claim," says David Pieffer, P&C insurance practice lead at J.D. Power. "Folks want to feel comfortable that things are being handled, and you can't necessarily get that from a digital approach to filing your claim."

In fact, satisfaction levels with claims filed online were lower than claims filed with a person, J.D. Power found. That's putting insurers in a quandary. Key indicators like miles driven and repair costs are on the rise, along with medical costs in case of an injury. That means claims frequency is going up along with expenses, and carriers want to use technology more often than expensive service agents as a result. But customers aren't responding to the offerings in the market.

"Insurers have to be careful about is trying to automate the front end because customers really need that connection up front," Pieffer says. "One of the things we look at is, 'Did you feel at ease,' and people, when they talk to someone, feel a lot more at ease."

One place consumers are responding digitally is in post-reporting claims management. J.D. Power found. The use of digital tools to upload damage photos and check claims status is higher than first notice of loss. That gives insurers some indication of where they can find the most success automating claims processes to keep costs low, Pieffer says.

"insurers should really be looking at is ways of connecting back to a customer on a regular basis to allow them to know things are progressing in their claim. whether it's the Dominos example of 'pizza being made, pizza in oven, pizza on its way' or something else," he explains. "The digital process would work well as long as they have specific ways to follow up with the customer."