Denver-based workers' compensation-insurance carrier Pinnacol Assurance’s new subsidiary, Cake, is betting on digital to help stay sustainable in a changing sector.

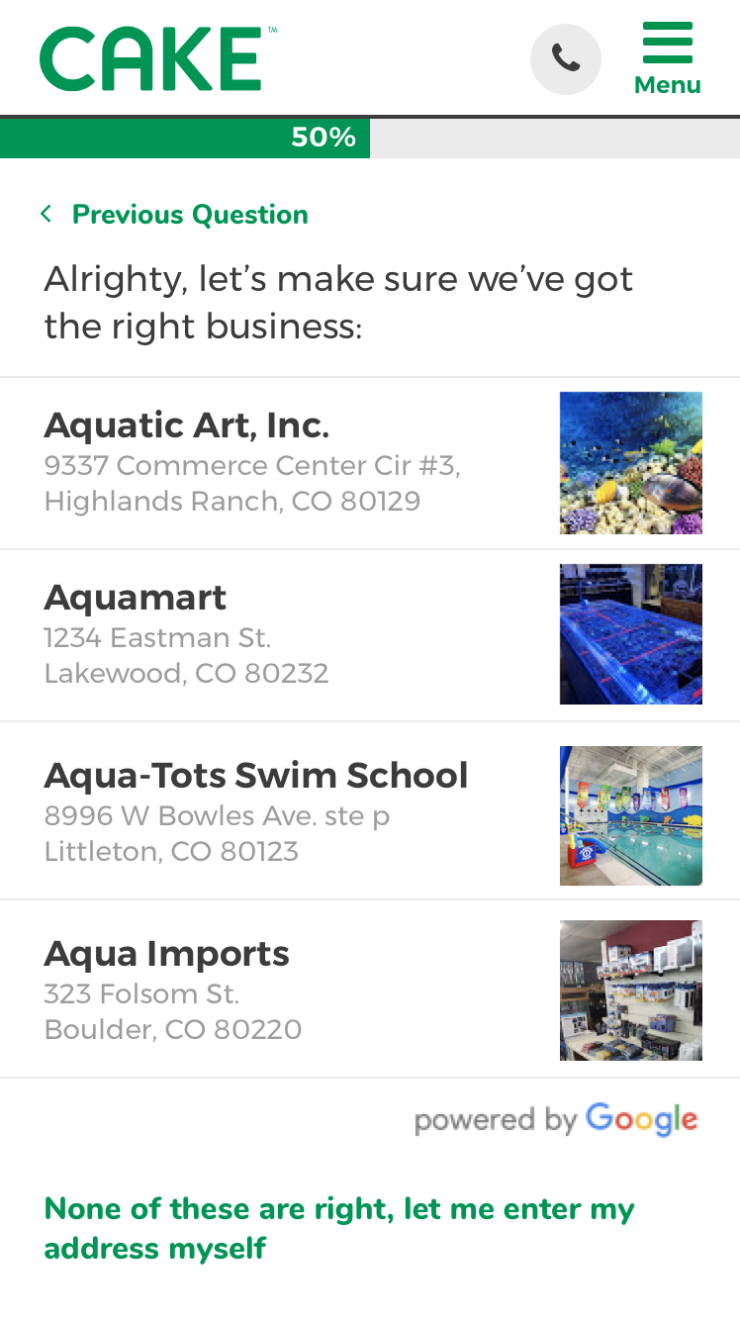

Within its first six months, Cake signed up nearly 700 businesses and generated over a million dollars in new revenue for Pinnacol. In fewer than five minutes, Colorado’s smallest businesses not only receive workers’ comp coverage, but they do it on their smartphones by answering only about a dozen questions – using plain English to boot.

Today, Cake is on track to achieve between five and $10 million in new premium revenues by year-end from its target market of small businesses with $10,000 or less in annual workers’ comp premiums. What’s more, the firm’s Net Promoter Score hovers around 74, well above the industry average of 33 according to the latest

Disrupting the market, not agents

Prior to Cake, Pinnacol served about 58 percent of all Colorado employers. Although constrained by legislative charter to selling within the state, Pinnacol faced the same industry threats but previous ideas for driving growth driving growth over the past decade were unsuccessful.

Then came a strategic planning retreat in March 2016. “There, we conceived the fundamental Cake approach,” recalls Phil Kalin, President and CEO of Pinnacol. “Subsequently, our then-CIO, Rob Norris, engaged me in multiple follow-up conversation. His energy was critical to shaping Cake’s business plan, making him a natural choice to lead the unit.”

Like many insurers, the catch for disrupting Pinnacol’s marketplace was maintaining positive relations with its 600-strong independent agents. The solution: be sure they get a slice of pastry, too.

Led by Norris, Pinnacol’s strategy essentially made Cake an MGA, responsible for quote/bind/issue and policy administration, with Pinnacol providing remaining customer lifecycle needs. In addition, Pinnacol would leverage Cake to innovate in other ways.

This included becoming a test bed for improving Pinnacol’s other functions, such as streamlining claims and developing similar digital tools for agents, while also serving as an agency lead-generator by funneling businesses with complex requirements to Pinnacol agents.

“We worked closely with agents from the beginning to demonstrate how Cake would address a market segment they often chose not to focus on, or struggled to serve cost effectively,” says Norris, now Cake’s CEO. “We also explained why applying Cake’s technologies to Pinnacol would benefit agencies over time.”

In November 2017 Pinnacol’s board made a $10 million commitment on the promise of launching Cake in 12 months, paving the way to kick off Cake development in January 2017.

Winning ingredients: Stealth, Cloud, API’s

To avoid bogging down in legacy mindsets or kindling downsizing fears among Pinnacol’s more than 600 existing employees, Cake operated as a skunkworks project located in a leading-edge mobile-first worksite approximately seven miles away from the company HQ.

“We’re far enough away to ensure we focused without distraction, but close enough to take advantage of Pinnacol’s expertise and resources,” Norris says.

This included using about 20 Pinnacol employees, divided between IT and business roles, to develop Cake. For the most part, developers were dedicated to the initiative and others served part-time. Additionally, Cake retained Deloitte Digital, which provided a total of 30 individuals who worked on the effort at various points.

The worksite itself exhibits the casual, open, collaborative, mobility-centric environment embraced by other innovators such as

“For example, our developers, product team and data scientists literally sit right next to Cake’s client care team, enabling them to hear real-time customer interactions,” he continues. “This can lead to epiphanies for platform enhancements to avoid similar calls.”

What you won’t find at Cake is IT infrastructure. “Not even an internal cloud,” Norris says. “Every system we use -- development, productivity, production -- is on a public cloud platform.”

The Cake platform itself leverages a microservices architecture that’s fully cloud-based, enabling the platform to scale quickly. For development, the Cake team broke down applications into smaller, independently deployable components, which were then assembled into larger services, such as identity verification, electronic signatures, billing, and payments.

“We engineered Cake using a variety of development languages and frameworks,” says Norris. “This includes Python for data science needs, Ruby for back-end services, and the React framework for a mobile-first front-end.”

Cake hosts the architecture on multiple cloud platforms, including Amazon’s AWS and Google’s Google Cloud Platform. “Different Cake microservices have different platform needs and not all platforms work best in every scenario,” explains Norris. “Our strategy also enables experimenting with various clouds to determine which will best serve us over the long run.”

Salesforce + AI = PAS

Yet another departure from tradition was building Cake’s policy admin system from scratch utilizing Salesforce as the underlying platform. Because Salesforce handles CRM for Pinnacol, this provides a mechanism for efficiently moving growing customers to the parent company.

Plain English input capabilities where accomplished with a natural language classification engine, leveraging machine learning algorithms that Pinnacol began researching in 2015. “Initial engine training occurred by analyzing decades of existing Pinnacol data,” says Norris. “We also drew on third-party data sources, to gain a high degree of input accuracy, resulting in tighter classification accuracy than industry norms.”

“Since launch, we’ve constantly refined as we analyze customer interactions with Cake,” he adds.

But the Cake platform isn’t completely robotic. “A chat button is prominently available throughout the process for getting assistance,” Norris says. “When activated our client care team, comprised of licensed P&C producers, answers inquiries live."

Guiding it all has been customer feedback as well as agent involvement. “We asked employers across a range of business types to participate in digital research, and select those with the keenest interest as a representative group,” says Norris.

Moving forward, Pinnacol hopes to further monetize Cake by partnering with insurers outside Colorado to enable the platform to serve as an MGA on behalf of others. Another option is white labeling the technology to other insurers. “Our enabling statute disallows Pinnacol from underwriting insurance in other states, but the law expressly authorizes Pinnacol to sell related products and services,” Norris says.

Regardless, Pinnacol plans to continue evolving Cake to meet ongoing disruptions while also applying technology advances to Pinnacol’s systems.

“We’re watching a number of other start-ups, like