Modern AI systems excel at recognizing patterns, yet they still struggle with a deeper task: understanding what users truly need. For insurers pursuing digital transformation, this challenge is particularly urgent. Data-driven automation may complete transactions, but it does not guarantee genuine insight into demand.

In our work, we found that demand cannot be treated as something passively revealed by user data.

The framework: Four elements, five principles

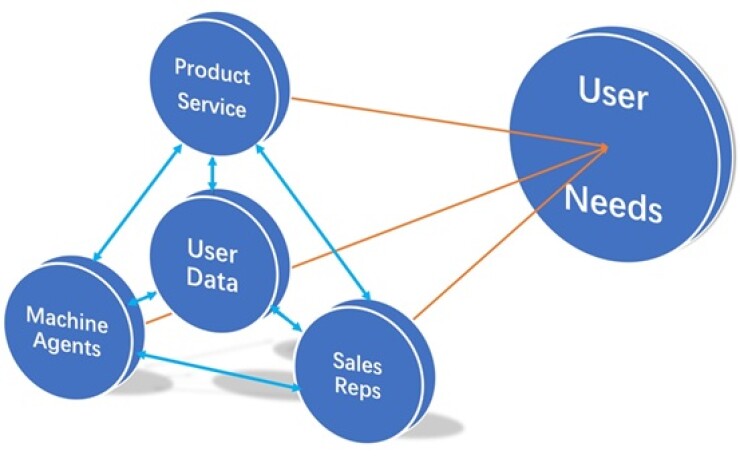

At its core, the framework brings together four elements:

- User data: behavior, preferences, feedback, and history.

- Sales representatives: human interpretation and relational insight.

- Machine agents: AI models, language agents, and recommendation engines.

- Products and services: offerings that trigger and satisfy demand.

These elements interact under five guiding principles that define how demand can be discovered in a causal and interpretable way:

- Every path must end in user demand. Demand discovery is not about optimizing clicks or transactions—it is about reaching genuine needs.

- No single element can act alone. Data, machines, people, or products by themselves cannot fully reveal demand; only interaction creates meaning.

- Products and services are essential. They are the anchors of every valid path, because demand must ultimately be connected to something tangible or experiential.

- Pathways must remain simple and bounded. Any valid route involves at most two intermediary elements, making discovery explainable and manageable.

- There is no direct route from user data to user demand. Data shows traces of past behavior, but without interpretation it cannot stand as a demand signal.

Together, these principles replace correlation with causation. They ensure that user demand is not passively inferred from data trails but actively constructed through human-machine interaction. In technical terms, this is the shift from predictive shortcuts to causal inference—a discipline that asks not only what happened but why it happened.

As the diagram illustrates, user demand arises only through the interplay of elements—not from a single shortcut.

Three key insights for insurers

From this framework, three lessons emerge for insurance leaders:

- Data is a starting point, not the destination.

Data shows what happened, not why it happened. Without causal reasoning, predictive systems risk mistaking correlation for causation. - Demand must be built through interaction.

Genuine demand is constructed dynamically when people, machines, and products engage in an iterative process. Transactions alone do not equal understanding. - Designing valid paths matters more than collecting more data.

The value lies not in the size of datasets but in the quality of human-machine interaction. Leaders should prioritize building systems that enable causal, explainable, and adaptive demand pathways.

For insurers, digital transformation is not a race to accumulate data or automate every touchpoint. It is the disciplined design of causal, explainable pathways where humans, machines, and products co-construct demand.

This shift moves AI from prediction to purpose, improves the relevance of offerings and underwriting, and strengthens trust at the point of need. Leaders who operationalize causal interaction—data as signal, machines to scale, humans to interpret, products to validate—will create compounding advantage as risks personalize and markets fragment.