Fraud

Fraud

-

AI impersonation fraud and attempts involving deepfakes have surged by more than 2100% over the last three years.

January 12 -

Used correctly, AI can help insurers move faster, identify risk more accurately, and reduce costs without replacing human expertise.

January 6 -

As fraudulent claims evolve, so do the defenses against them. Here are four common fraud claims and how to combat them.

December 30 -

AI may be accelerating and scaling digital crime, but the same underlying technology is poised to advance cybersecurity intelligence and strengthen defenses.

December 29 -

When embedded within a case management framework, Agentic AI can detect subtle anomalies, highlight inconsistencies, and surface patterns traditional systems miss.

December 24 -

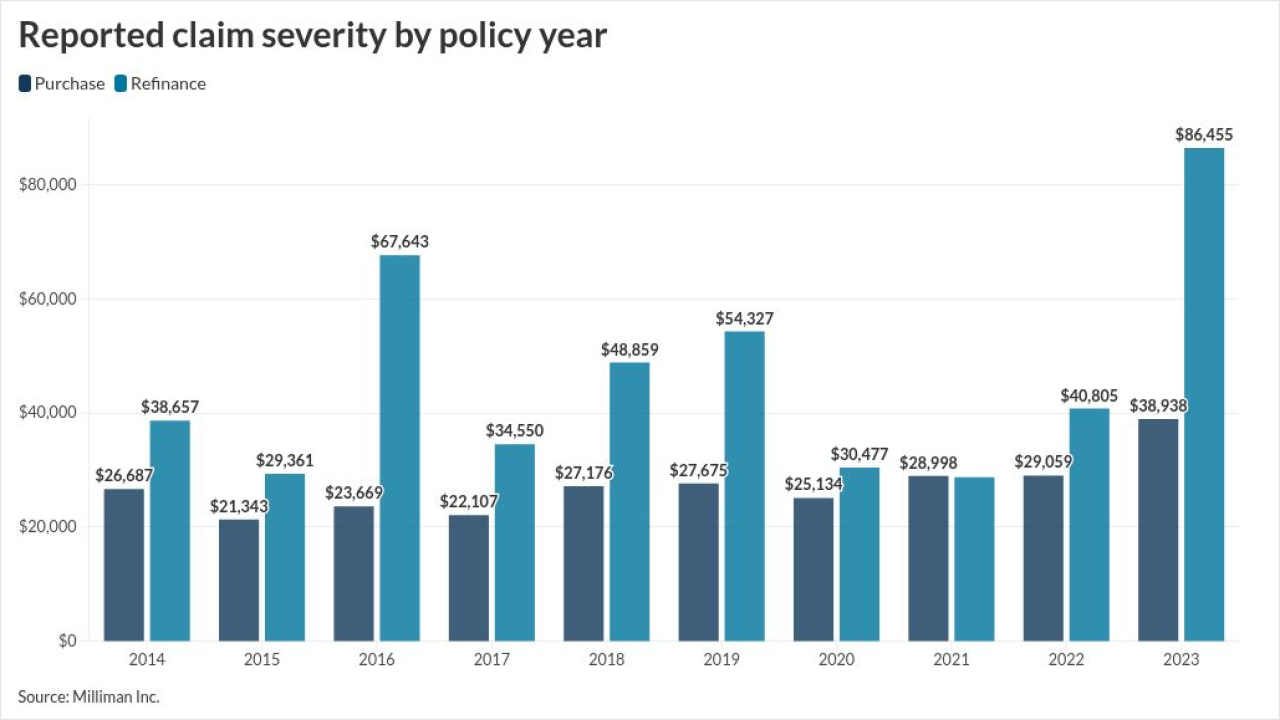

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

A new report from Nordpass identifies the most commonly used personal and corporate passwords, and they're not that hard to figure out.

November 18 -

Sarah Thompson, head of cyber, North America, for MSIG USA, discusses the evolution of cyber insurance, managing third-party risks and more.

-

The role of tech for insurers looking to level up fraud detection.

September 10 -

A new report from Resilience highlights how ransomware claims are changing, the impact AI plays in these attacks and the role of vendor vulnerabilities.

September 9 -

Fraud detection and prevention have become key reasons for carriers to implement artificial intelligence.

September 7 -

Insurers under pressure to improve digital experience while also reducing fraud.

September 4 -

Lifelike deepfakes are costing carriers money and changing how they identify fraudulent claims and policyholders.

August 25 -

When it comes to disbursements many insurers are still relying on outdated processes.

August 5 -

Catching fraudulent claims has become much more complicated than detecting doctored images. Fraud can be found in correlations of medical treatment data, legal representation and adjuster evaluations, experts said.

August 3 -

Uber sued a group of lawyers, medical providers and rideshare drivers it claims staged car accidents, manufactured damages and received unnecessary medical procedures to take advantage of insurance policies in Florida.

June 11 -

Addressing the risks from increasing cyberattacks requires more than cyber insurance.

June 5 -

The law, set to go into effect later this year, was introduced to prevent potential money laundering in all-cash purchases made by companies or trusts.

May 28 -

Pat Kinsel, CEO and founder of Proof, shares its origin story and what pain points the technology is solving.

April 10 -

Compliance professionals working to prevent financial crimes are losing their faith in AI to solve more problems than it causes.

March 18