-

Rates actually declined or remained flat over a two-year period in 15 states, including Florida, with natural disasters and tariffs affecting 2026's movements.

January 27 -

A mortgage insurance premium deduction in Maine would come after the reintroduction of a similar federal policy, which took effect with the 2026 tax year.

January 27 -

The impact of extreme weather remains top of mind for many, with a majority of homeowners citing it as a factor behind purchase or relocation considerations.

January 5 -

In a world assailed by extreme weather, homeowners and purchasers need to know their property's vulnerability to wildfire or flooding. Ratings like those Zillow took down are a big improvement on often outdated federal flood maps and state wildfire maps.

December 9 -

Flood Quotes and the Flood Insurance Portal allows users to compare quotes and purchase policies directly through the platforms.

December 2 -

The average premium increase is 64% or $600 a year more, and in some states the rate would go up by more than $1,000, the comparison shopping platform found.

November 21 -

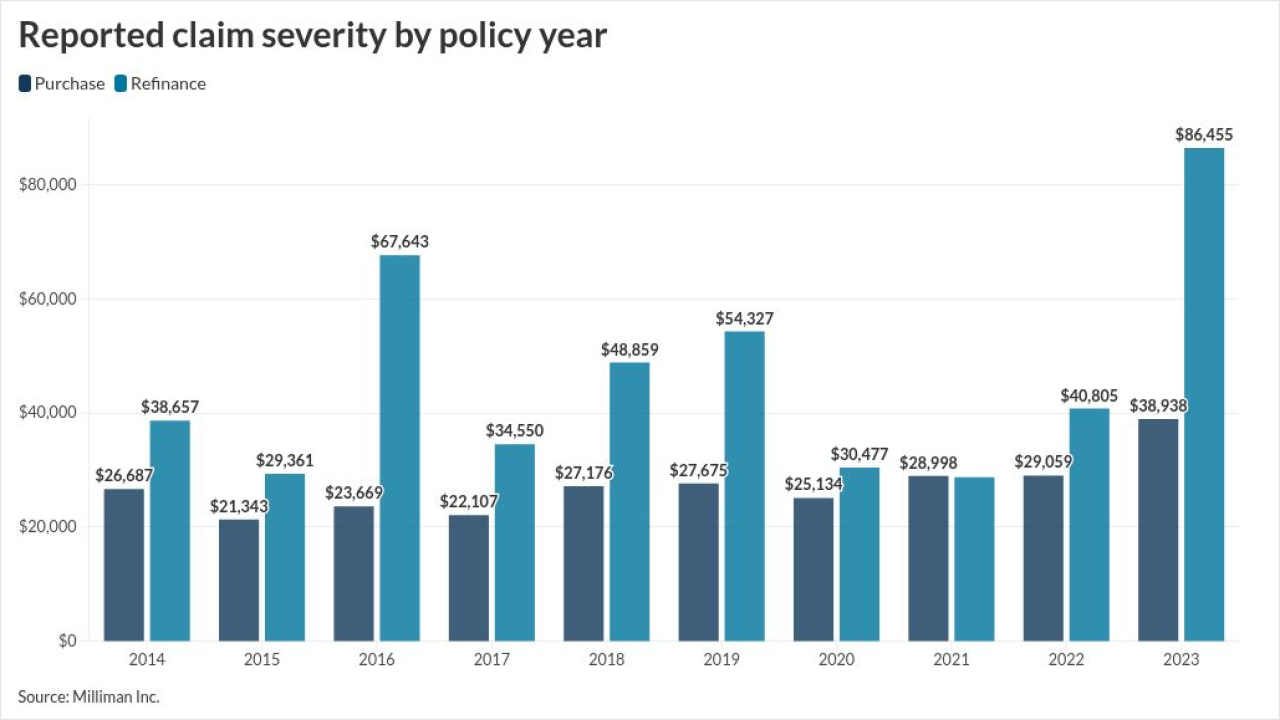

The average loss from the two categories is almost seven times higher than the mean amount for all other types, according to research from ALTA and Milliman.

November 18 -

While all six companies were profitable in the third quarter, most had earnings which were down from the prior periods, with MGIC setting a milestone.

November 11 -

Of the 15 states most affected by natural disasters, California and Florida had the highest non-renewal rates in 2024, a Weiss Ratings study found.

October 29 -

This is the second acquisition deal Old Republic has been involved in this year, after selling its title production business in January.

October 23 -

Kin, a direct-to-consumer insurance provider, has started a mortgage broker in Florida which also takes loan applications through a call center or online.

October 21 -

The title industry sustained improvement first seen last year, with second-quarter premium totals up on both a quarterly and annual basis, ALTA said.

September 24 -

Consumers are so concerned about rising costs that they often forego coverage altogether, according to two separate studies from Valuepenguin and Realtor.com.

September 15 -

Premiums for property insurance have risen over 69% since 2019, far outpacing other components of the monthly mortgage payment, ICE Mortgage Technology found.

September 8 -

The U.S. Mortgage Insurers put out a blog promising its members would be ready to accept submissions for coverage which were scored using VantageScore.

August 28 -

Between rising home costs and the end of mortgage relief programs, many homeowners are struggling to stay above water, especially in the South and West.

August 14 -

More powerful storms and pricier building costs are behind the increases in premiums, said the report's authors.

August 4 -

Numbers on use and performance point to potential for nonpublic insurers to take on a greater role but also suggest there are limits to it, Fitch Ratings found.

July 25 -

Private mortgage insurers must accept the FICO alternative as valid collateral before it can be widely adopted by the mortgage industry.

July 18 -

Lenders and other businesses active in the state also stepped up with large donations and charitable campaigns in the days following the flooding disaster.

July 8