Regulation and compliance

Regulation and compliance

-

Insurers learned that 2025 was about regaining balance and 2026 will be about redefining value for customers with better data, tools and insights.

February 4 -

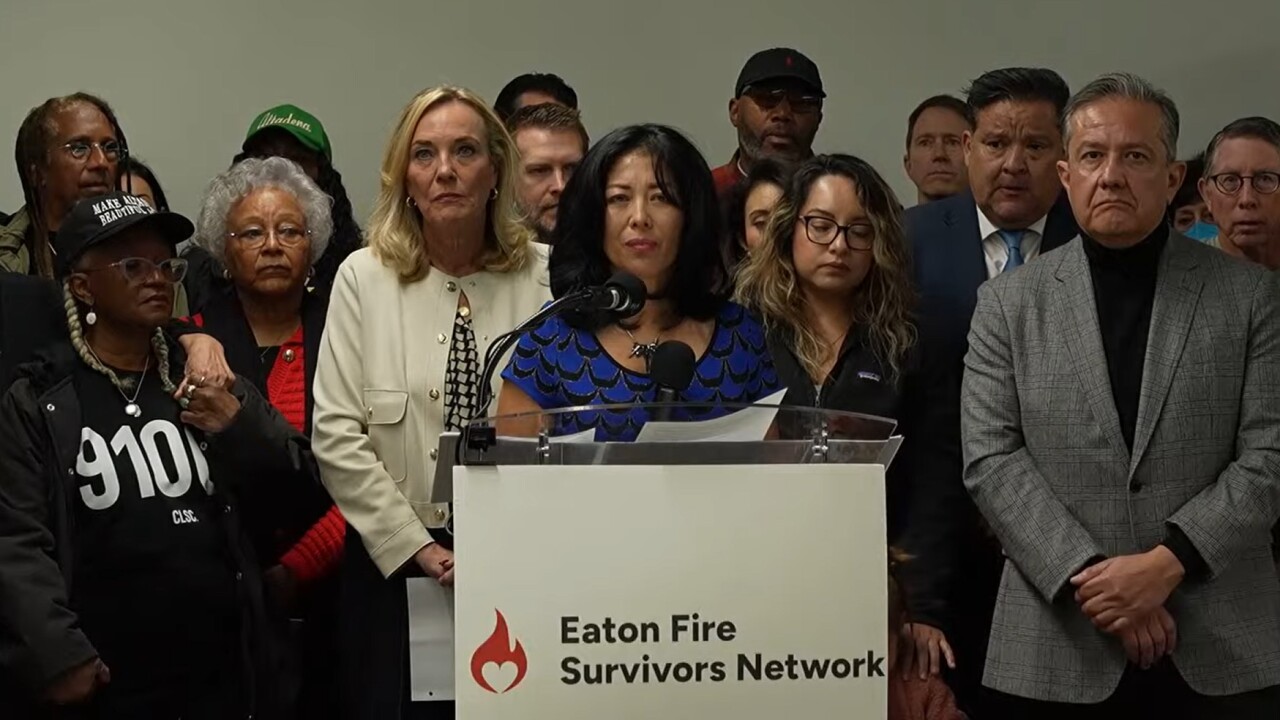

California assembly insurance committee chair and the state's insurance commissioner propose measure to improve claims handling, coverage options and transparency for wildfire survivors.

February 3 -

Insurance commissioner Ricardo Lara, responding on social media, said tariffs and ICE raids are making rebuilding more difficult. Advocates also point to federal disaster relief that has been held back.

January 28 -

Without coverage, mortgage lenders could refuse to back home sales. Also, separate wildfire coverage could fall to the public sector.

January 27 -

Legislation cites non-renewals based on "inaccurate, outdated or misleading images."

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Representatives of both insurers and policyholders point out issues with market forces and challenges to addressing coverage costs.

January 19 -

Traditional factors like artificial intelligence, cybersecurity and business interruption highlight what's on business executives' risk radar in 2026.

January 14 -

Governor Ron DeSantis and state officials attribute lower premiums for the state's home insurer of last resort, and lower home and auto premiums overall, to the state's tort reform instituted in December 2023.

January 13 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Insurers point to billions of dollars in claims paid, while wildfire survivors advocates say many haven't yet received what they are due.

January 8 -

New proposed legislation focuses on accelerating wildfire catastrophe claims payments, transparency of claims decisions, penalties for insurers delaying claims payments.

January 8 -

As Washington revisits the tax-favored status of health benefits, a longtime policy expert explains why replacing group plans could cost far more.

January 6 -

Changing communication methods like the use of emojis present a growing compliance risk in regulated industries where interactions are subject to scrutiny.

January 4 -

Increases ranging from 0.9% to 8.8% are necessary to maintain the insurer's past level of operating profit, according to its filings with state regulators.

December 29 -

Digital Insurance spoke with Nancy Clark, assistant vice president of regulatory strategy at Verisk, and a leader of the firm's Regulatory Data Exchange (RDeX) tool, about what the service offers to insurance carriers and regulators.

December 23 -

Members of the association of state insurance regulators began another revision of its proposed AI Systems Evaluation Tool, a proposal attracting skepticism from insurers and the insurtech companies who serve them.

December 21 -

Speaker Mike Johnson will block a push by moderate House Republicans for a vote on renewing expiring Obamacare subsidies.

December 17 -

Organization of state regulators, criticized for lack of disclosure of its previous collected data, promises to gather new information on losses, claims payments, policy premiums and mitigation discounts.

December 14 -

A senior advisor at NAIC, the association of state insurance regulators, told attendees of its fall meeting that the imminent FEMA Review Council report should answer questions about funding for disaster relief and flood insurance, as well as other related issues.

December 10