Consumer banking

Consumer banking

-

The Jackson, Mississippi, company will use proceeds from the sale of its Fisher Brown Bottrell Insurance unit to restructure its investment portfolio, moving $1.6 billion of low-yield securities off the balance sheet.

April 24 -

Banks' sales of insurance agencies for eye-popping multiples emerged as one 2023's notable trends. Though the bandwagon shows no sign of slowing, several prominent community banks appear to be holding on to their insurance operations.

December 29 -

Integrating artificial intelligence into the world of banking and finance must be a cooperative effort between the industry and regulators. It's important that the discussions start now.

December 12 -

The Pennsylvania bank has agreed to sell its Exchange Underwriters subsidiary to World Insurance Associates for $30.5 million, saying that the deal will help pad its capital and liquidity.

December 4 -

Synchrony Financial bought Pets Best ahead of a pandemic-driven surge in the pet insurance business. Now it's selling the subsidiary for a $750 million after-tax gain.

November 29 -

Proceeds from the sale provide the bank with "flexibility to evaluate and pursue various strategic initiatives to redeploy capital in support of our core banking business," Evans CEO David Nasca said.

November 8 -

Truist Bank has agreed to pay licensing fees to USAA for the use of mobile-check-deposit technology that USAA says it invented.

October 10 -

Chubb's Banks and the Digital Wallet Race: The Embedded Insurance Strategy looks to gauge how fintechs and banks view embedded insurance.

October 5 -

The card network has agreed to pay USAA licensing fees for the use of mobile deposit capture technology. USAA says it plans to keep trying to get other banks to do the same.

August 30 -

Banks are holding their fintech partners to a higher compliance standard as regulatory scrutiny of banking-as-a-service increases.

August 22 -

Decision-making algorithms powered by machine learning are seen as the next frontier for a more nuanced approach to mortgage decisions but skeptics worry this will just be a new way to discriminate.

June 19 -

The intersection of fintech and ag banking is still ripe for innovation. Banks and fintechs are looking for specialized solutions for their ag customers, from harvesting data to managing cash flow fluctuations.

May 25 -

Regulators are bringing enforcement cases while also proposing wider changes that would alter the industry for years to come. The scrutiny covers pricing discrimination, products that make car purchases more expensive and lenders' handling of repossessions.

February 6 -

Bank regulators should heed the Treasury Department's call to embrace cutting-edge tools for credit scoring.

January 11 -

Regions and PNC are two banks that have expanded the use of their mobile branches in recent years.

November 29 -

High-net-worth clients with large policies borrow, on average, $500,000 to $800,000 to pay their premiums. Peapack-Gladstone predicts the product, which it launched this month, will be one of its top business lines within six years.

October 28 -

The layoffs appear to be focused on the company's bank subsidiary, according to the San Antonio Express-News. USAA declined to provide any details on the job cuts.

August 22 -

Digital technologies are transforming the delivery of financial services and reshaping consumer expectations. At the heart of change is the speed of money movement, which now represents the future — success for those who deliver, challenges for those who don't.

September 13 -

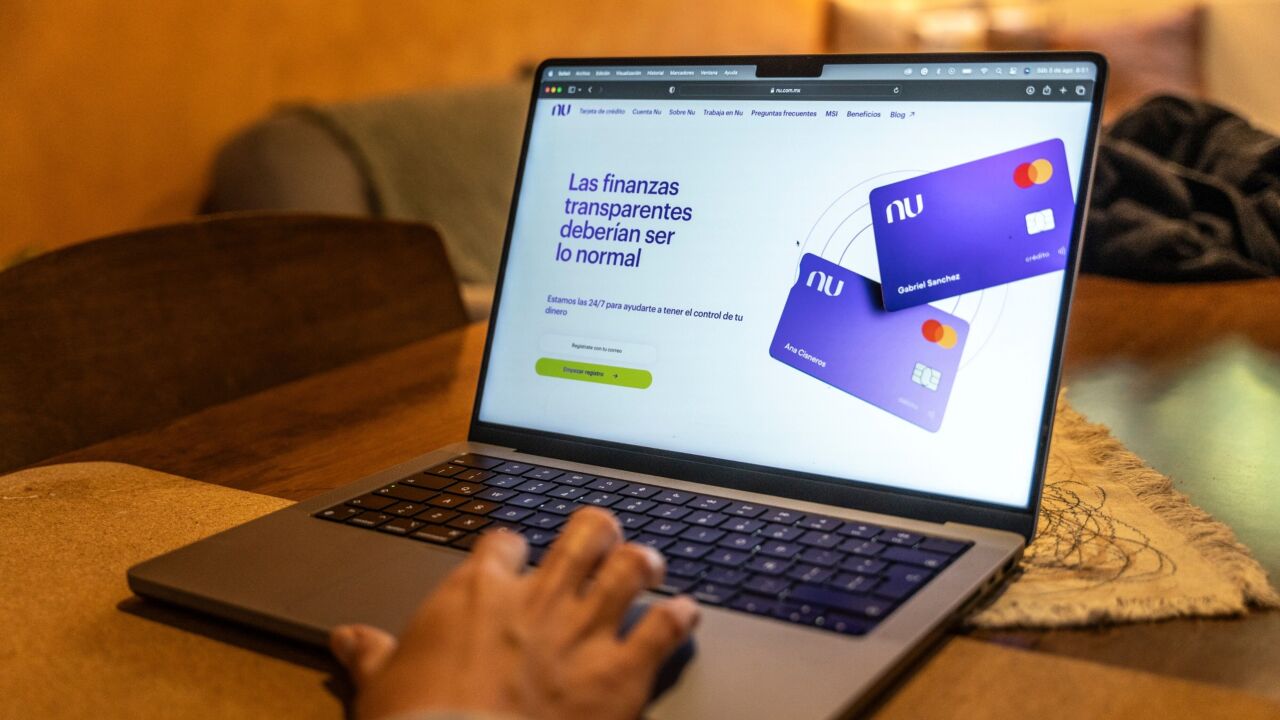

CEO hopes the simplicity of the digital bank will help attract younger customers to the 150-year-old Manulife brand.

July 3 -

The bank launched Finn in an effort to attract millennials. But there were problems with how it implemented the digital-only brand, experts said.

June 6