Insurtech investment is likely to remain vigorous, but strategic, according to Deloitte’s newest report.

The “Insurtech Entering its Second Wave” report, which includes data from the Venture Scanner database, finds that investors will shift their focus from new startups to established innovators and more mature firms.

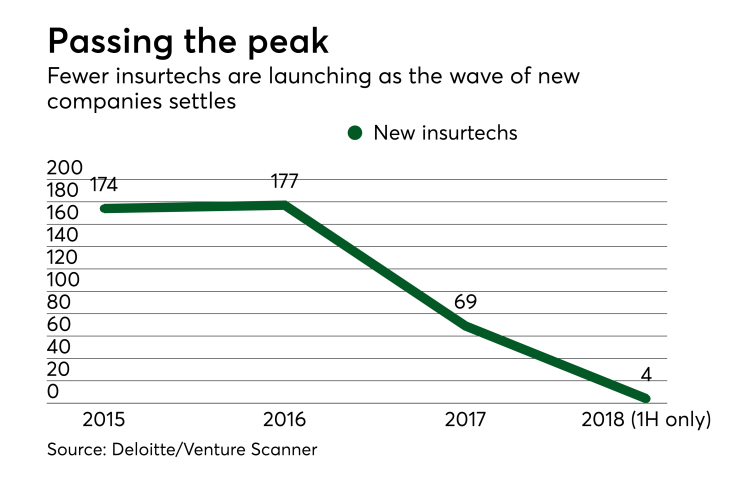

The tactical change may have appeared due to the standstill in insurtech launches in the first half of 2018. The downward trend started in 2017 when only 88 new insurtechs launched, about half as many as 2015 and 2016. The current stagnant results mirror how the peaks of other fintech sectors have worked, according to Deloitte. “The number of new insurtechs kept rising in both 2015 and 2016, at a time when startup activity in the other financial sectors had already started dropping from their high point,” the report says.

Though new companies aren’t launching, existing insurtechs are growing and gaining investment even faster. About $869 million was invested in insurtechs in the first half of the year, Deloitte reported, a pace in line with 2017's 1.82 billion. Further indicating that winners are beginning to emerge is that 64 percent more money has been invested in late-stage startups than all of 2017.

More money than ever is coming in from venture capital: The largest source of insurtech financing got even more dominant, increasing from 74 percent to 91 percent in 2018’s first half.

Personal lines P&C investment grew from 43 percent to 55 percent within a year, while commercial lines numbers deceased from 11 percent to 6 percent this year. Another decrease appeared in the operations category with the mobile applications for insurance claims. After an investment peak in 2014, which draw half the capital raised for Insurtechs, the percentage deceased by 20 percent in 2017 and remained the same for the mid-2018.

The second wave of insurtech is likely to be “more strategic,” says Sam Friedman, research leader of insurance at Deloitte. “Insurtech will become more selective on collaborations and will analyze current collaboration to see ‘what’s really working,’” he says.