Replacing legacy systems, automating underwriting, expanding distribution channels—talk to two insurance CIOs, and you’re bound to hear differing opinions of the most important technology initiatives are right now.

To this end,

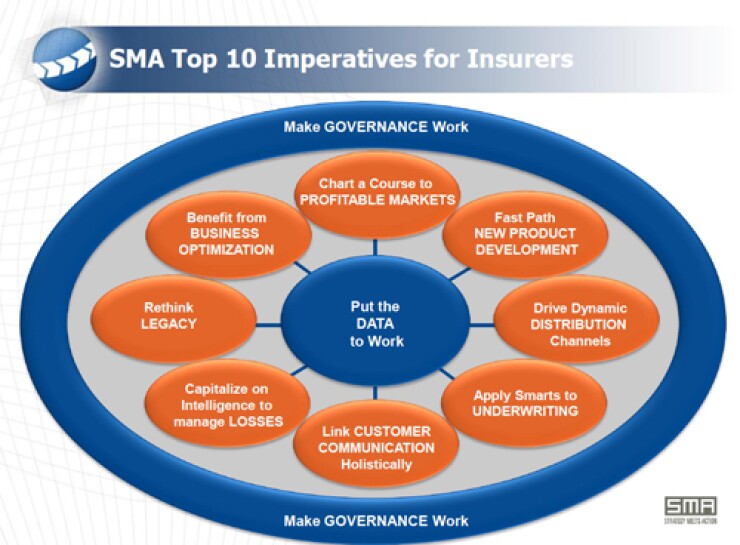

The executives consistently cited these 10 initiatives as being the most important to their business:

1. Chart a course to profitable markets

2. Put data to work

3. Rethink legacy

4. Fast path for new product development

5. Drive dynamic distribution channels

6. Apply smarts to underwriting

7. Capitalize on intelligence to manage losses

8. Holistically link customer communication

9. Benefit from business optimization

10. Make governance work

The report suggests insurance executives first put forth an IT roadmap that outlines the business priorities, and then align IT investments in a way that supports implementation of that strategy.

Perhaps the most important issue for carriers, Deb Smallwood, founder of SMA, tells INN, is data management.

“These imperatives have such a clear dependency on clean, complete and accurate data in order to leverage the various business intelligence and predictive analytics tools available,” Smallwood says. “So if an insurer wants to start with just one, it should be data quality."