Mention the term “robotic process automation,” and images of R2D2-style robots scurrying around with stacks of files may come to mind. But the reality is more about software running behind the scenes, handling repetitive computations and tasks.

Robotic process automation, or RPA, is more a realization of the next generation of office automation, moving information to where it is needed at any point within a particular process. RPA is riding the tide as artificial intelligence and machine learning gain ground in today’s enterprises. And it's coming to financial services, predicts a recent report from KPMG.

“In the next 15 years, it’s likely that 45 percent, and maybe up to 75 percent, of existing offshore jobs in the financial services sector will be performed by robots, or more precisely, robotic process automation,” predicts Cliff Justice, KPMG Advisory principal, and co-author of the study. “That should translate into enormous costs savings of up to 75 percent for firms that get on board.” Automating many repetitive and lower-level decision-making tasks will deliver “unprecedented levels of speed, accuracy, and cost efficiency beyond what a human workforce can provide.”

While the KPMG paper discusses the impact of RPA on financial services in general, there are specific applications within the insurance industry, much of which is still bogged down in manual passing and review of documents, tied to legacy systems. So what makes it different from traditiona, automation? Now, breakthroughs in enhanced AI and cognitive automation, including natural language processing, machine learning, and machine vision, together with better-designed software robots, Justice and his team observe.

As with any emerging technology wave, there are challenges to moving forward with RPA. It’s still a relatively new approach (again, in this latest incarnation associated with AI) and “many businesses simply are uncertain where and how to begin to transition to robotics and cognitive automation systems," KPMG writes.

Plus, there’s the matter of all those mainframes running operations – which is especially the case in the insurance industry. As an organization shifts to RPA, there may be a lot of time and effort required “to review and document a firm’s current procedures and processes and convert them into instructions that robots and/or AI software programs need to follow,” Justice and his team mention.

That also brings up the ultimate challenge – getting management buy-in to this glitzy new approach. It’s easy to conjure up visions of cost-savings and efficiency within a factory filled with robots, but explaining how software-based robots speed up processing work is another story. Add to that “cultural resistance to change from managers who are used to having a large number of people to supervise -- protecting one’s turf,” the KPMG team states. “Few financial services firms have a culture of innovation that lends itself to taking the dramatic steps needed to compete in the future and have to overcome an ingrained resistance to change.” That may be double for insurance organizations.

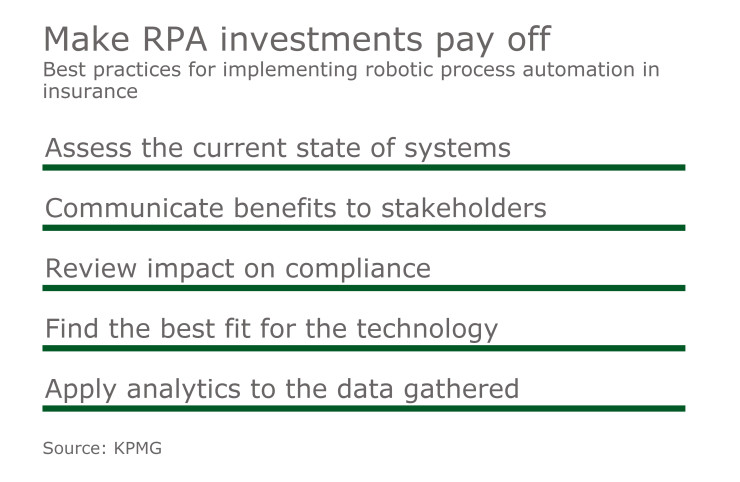

KPMG makes the following recommendations for introducing RPA into an organization:

Communicate the benefits of RPA both to senior management and the organization. “Clear communication of any innovation effort of this nature -- for example, how it will be accomplished and its goals -- is the first step on the road to a successful program,” the KPMG team states. “Assess whether an AI-driven data analytics program can help you spot trends that will inform your business strategy.”

Focus where RPA works best. “Start with the areas that are the most labor-intensive or involve repetitive, rules-driven work. This may include, for example, jobs that require a large number of relatively low-skilled employees with high turnover.”

Put customer service front and center. “Determine how customer experience can be enhanced by improved automation, including straight-through processing. By spotting trends and analyzing preferences, RPA and AI may help your firm attract and better service customers or clients. Map out any new offerings you will be able to provide to your customers as a result of enhanced robotics.”

Determine how RPA can help you harness and analyze data for better decision making and reporting. “Project the potential savings that will result from reduced errors and increased speed. Consider the potential benefits of improved data analytics guidance -- to get a profile of your most profitable customers; to determine which customers require closer risk monitoring.”

Assess the current state of your existing systems. “Calculate the technology debt you have on your balance sheet. Assess the skills/talents you have in targeted technologies. Determine whether existing products used in the front office can be applied to middle- and back-office tasks.”

Review the impact on compliance. “Consider how RPA and cognitive automation will enhance regulatory compliance in terms of speed, accuracy, and reduced head count.