In the intense quiet of an underwriting department at a major life insurer, a seasoned underwriter stares at her computer screen with a furrowed brow. On her computer monitor is the application of a 45-year-old man claiming to be a non-smoker.

Yet something doesn't add up. Experience tells the underwriter that what she is seeing in the application indicates a smoker, yet the applicant says he has never used tobacco. In an era of accelerated underwriting and without the trusty cotinine test at her disposal, how can this underwriter confirm her suspicions?

This scenario, playing out in insurance offices across the country, underscores a growing challenge in the industry. In an increasingly digital landscape, detecting undisclosed tobacco use can be more difficult. As the insurance world races towards faster, less invasive underwriting processes, it finds itself grappling with the critical question of how to effectively identify tobacco users through third-party evidence without traditional lab tests.

A combination of new digital tools offers a solution to increase the likelihood of underwriters confirming their suspicions.

The root of the challenge: Digitalization

At the heart of this dilemma is a significant shift in underwriting practices. Cotinine test results were the underwriter's go-to for detecting tobacco use dating back to the 1960s. But these tests have become increasingly unpopular as insurers embrace accelerated underwriting and "fluidless" paths that improve the customer experience but eliminate the time needed for lab tests.

This transition, while streamlining the application process, has created a significant challenge in risk assessment, prompting a search for new methods that help increase discovery of non-disclosed tobacco use.

In response, researchers at Reinsurance Group of America (RGA) embarked on two comprehensive studies to explore the effectiveness of digital underwriting evidence in uncovering the truth behind the smoke screen. These findings offer new hope for underwriters seeking innovative solutions for this growing and increasingly pressing dilemma.

The findings: A hierarchy of effectiveness

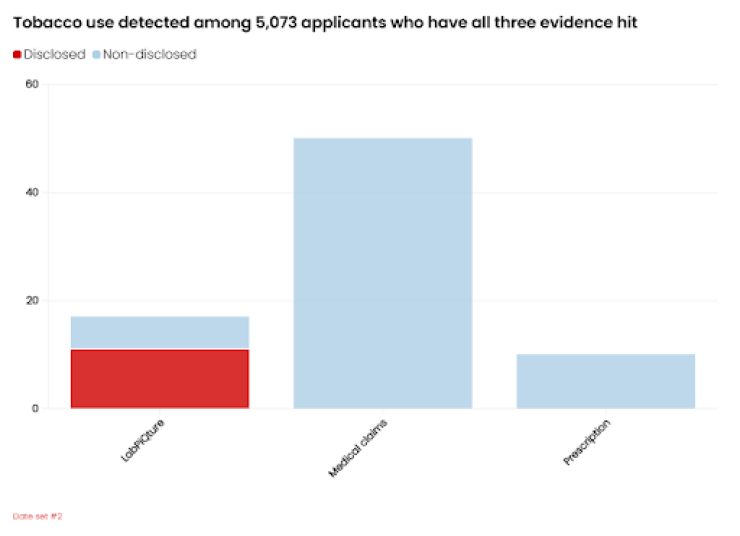

RGA's research focused on electronic health records (EHRs), medical claims (MC), pharmacy prescriptions (Rx), and LabPiQture (LP), a product from ExamOne that provides both clinical and historical insurance lab results. The results paint a clear picture of the relative value of different evidence types for detecting tobacco use:

Figure 1:

Insurance labs – Despite the industry shift, traditional insurance labs remain the most effective method for identifying tobacco users.

Electronic health records (EHRs) and attending physician statements (APSs) – Among digital evidence types, EHRs emerged as the strongest performer in detecting current tobacco use. These can include digitalized attending physician statements, which often record whether a patient is a current or former smoker, and medical codes that indicate smoking status.

Medical claims (MC) – While not as effective as EHRs, medical claims data proved to be a valuable source of information on tobacco use.

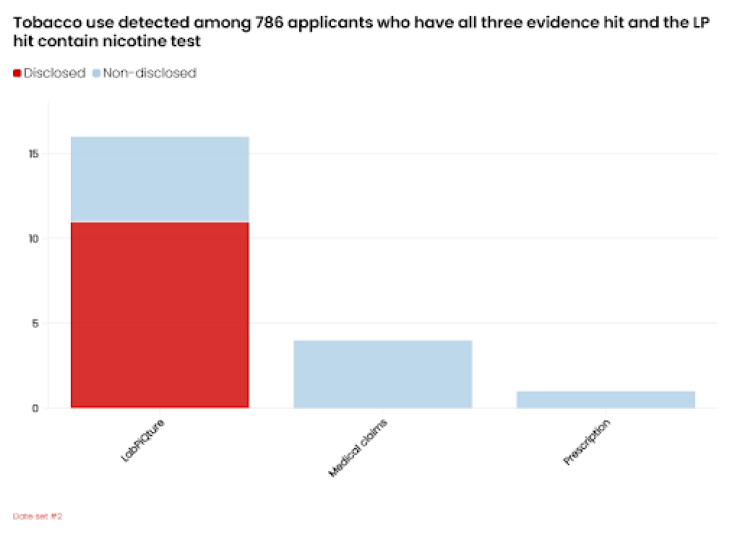

LabPiQture (LP) – The effectiveness of LP in detecting tobacco use was directly tied to the presence of historical insurance lab results within the data and was key to the second study's findings.

Prescription data (Rx) – While included in the second study (See Figures 2 and 3), prescription data showed limited effectiveness in identifying tobacco use, with very few tobacco cessation medications found.

The second study found the value insurance labs add to LabPiQture to uncover tobacco use. LabPiQture hits with prior insurance labs will include a cotinine test result, thereby matching the valuable tobacco use detection of traditional insurance labs in all but recency. One caveat is that the insurance labs housed within LP will likely not be as current as traditional insurance labs taken at the time of underwriting.

Figures 2 and 3 depict how LP smoking identification overlaps with self-disclosure, indicating that some smokers do indeed disclose tobacco use. Interestingly, we did not see the same overlap with MC or RX. This adds another layer of reliability to the LP findings.

Figure 2:

Figure 3:

Implications for insurers

The findings of these two studies have significant implications for insurers looking to enhance their risk assessment processes in an age of accelerated underwriting:

Prioritize EHR integration – Given the strong performance of EHRs in detecting current tobacco use, insurers should consider integrating this data source early in the underwriting process, if this is a priority.

Consider historical data – The value of past insurance lab results within LabPiQture data suggests that insurers should not totally disregard historical data in current risk assessments.

Maintain flexibility – As the landscape of digital evidence continues to evolve, insurers should remain adaptable to incorporating new data sources and technologies into their underwriting processes.

Adapting to a changing landscape

The shift towards accelerated underwriting presents both challenges and opportunities for the insurance industry. While the move away from traditional cotinine testing has created a gap in tobacco use detection, the emergence of digital underwriting evidence offers a promising means of narrowing this gap. By leveraging a combination of EHRs, medical claims, and historical lab data, insurers can enhance their ability to discover undisclosed tobacco use and improve overall risk assessment accuracy.

As the industry continues to evolve, staying informed about the latest research and best practices in tobacco use detection will be crucial for insurers looking to maintain a competitive edge while effectively managing risk. The findings of these studies provide a valuable roadmap for navigating this new terrain, offering insights that can help shape more effective underwriting strategies in the digital age.