INN's Bill Kenealy

No group seems to deny the fact that PAYD is good for the environment and consumers. PAYD policies, which charge drivers by the mile, are viewed as environmentally friendly for reducing the number of miles motorists drive.

Consumers (e.g. paying customers) love the idea of PAYD. A

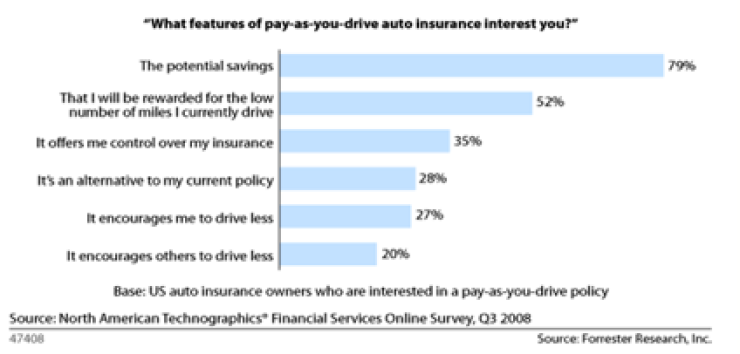

Our data goes on to show that more than three-quarters of interested drivers say that the potential savings are what interests them about a pay-as-you-drive policy—this is by far the most common motivator (see Figure 1). Half say their interest stems from the idea of being rewarded for the low mileage they currently drive. The feeling of control sparks interest for one in three U.S. drivers.

How can such an intuitive and innovative program as PAYD not be adopted by more states or backed by regulatory groups?

Detractors cite consumer privacy issues as one of the primary reasons PAYD is not implemented in more states. Yet that argument is quickly diluted when you evaluate the current technology already used in cars and consumers’ daily lives.

Additionally, more than 88% of U.S. adults now own a mobile phone. And a growing percentage of those phones offer GPS functionality. Services like

Why is privacy not an issue with these services? The insurance industry continues to hide behind risk and consumer privacy instead of approving customer and carrier friendly innovation. There is no greater risk or privacy concern that General Motors faces versus a major carrier. Yes, the customer’s driving behavior could be tracked and a hacker could find other personal information. Identify theft happens anywhere, and firms like

Customer loyalty and retention are major barriers for insurance carriers today. The constant switch and save message encourages defection.

Do you agree or disagree?

Chad Mitchell is a senior analyst with Forrester Research. He covers mobile and social media strategies in insurance, acquisition, cross-sell and retention marketing strategies, comparative raters, online guided selling tools, emerging Web and call center technologies for sales and service, agent portals for marketing and underwriting, and the best practices of leading multichannel firms. Additionally, he advises leading insurers on best practices for public and secure insurance Web sites—analyzing functionality for quoting, policy administration and claims.