-

California, rushing to halt an exodus of property insurers fleeing wildfire risk, has designated regions of the state where companies will be required to provide coverage in exchange for new industry-friendly regulations.

June 14 -

As soon as temperatures breached 43.6C in Ahmedabad, Makwana and thousands of other women were told that ICICI Lombard, an insurance company, would pay them a portion of their daily wages.

June 12 -

Casey Kempton, president of personal lines at Nationwide, addressing the Insurtech Insights conference, said carriers should work to educate policyholders about what to expect from weather claims.

June 10 -

Hurricane season has become more active due to climate change, leading to more damage — and more insurance claims. Here is how the industry is responding.

June 3 -

Experts predict a highly active Atlantic hurricane season, highlighting the widening protection gap and emphasizing the need for more affordable, accessible insurance coverage.

May 30 -

Data fraud, questionable accounting practices and intensified catastrophes are just some of the issues that have battered the voluntary carbon market.

May 28 -

With Florida being threatened by more powerful hurricanes, commercial-property insurance costs last year surged at nearly five times the national pace, according to credit rating firm AM Best Co. Inc.

May 20 -

Municipal analysts have been tracking the challenges faced by home insurers in California and other states plagued with extreme weather events as a harbinger of credit risk.

May 17 -

Consumer advocates engaged with insurance and climate change issues are asking NAIC, the association of state regulators, to share the data it will be collecting on property risk by mid-June.

May 16 -

Complexity within the insurance industry is exacerbated by climate change.

May 16 Sure

Sure -

Highlighting what technology tools insurers are using to better understand the risks associated with the climate crisis.

May 13 -

California Governor Gavin Newsom said he wants lawmakers to expedite the approval process for insurance companies seeking to hike rates, saying an overhaul of the state's market is taking too long.

May 13 -

Catastrophe bonds and other insurance-linked securities, which powered last year's highest-returning hedge fund strategy, are built on calculations that can underestimate a new breed of risk stemming from high-frequency events such as wildfires and thunderstorms, according to veteran investors.

May 13 -

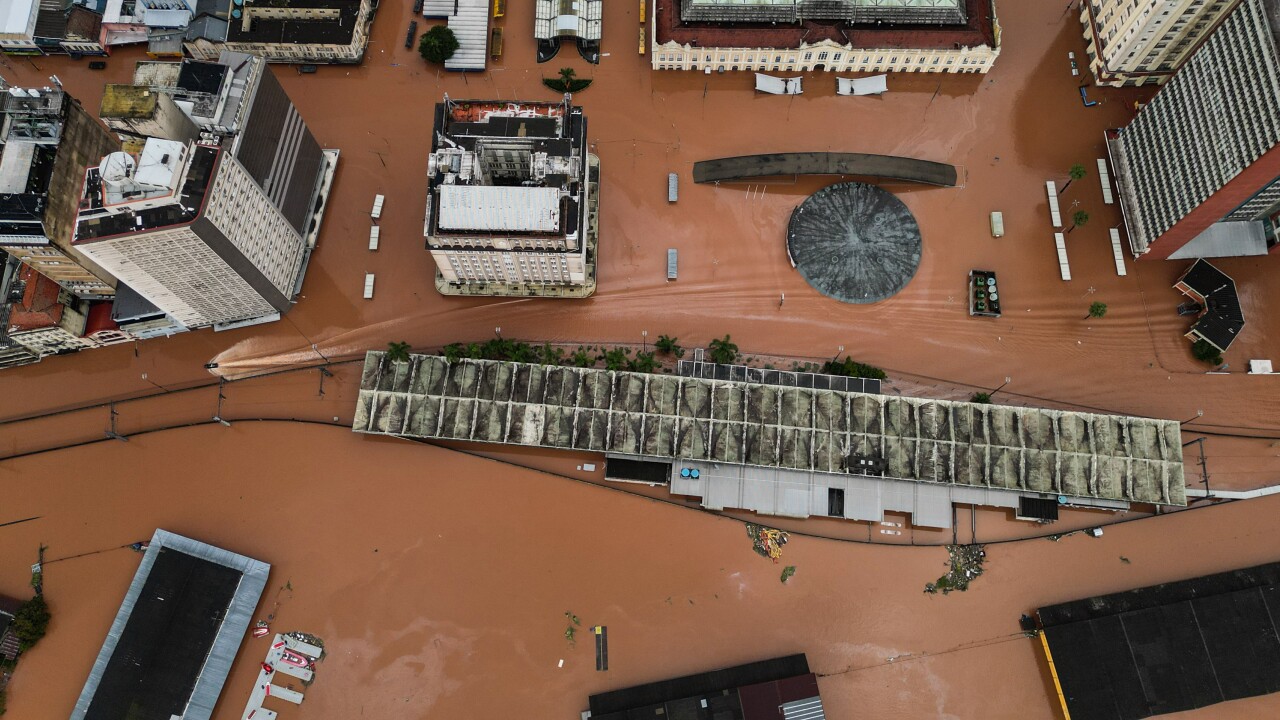

Heavy rains in Rio Grande do Sul, Brazil's southernmost state, left entire cities under water and shut down its main airport indefinitely.

May 9 -

Climate-related disasters rank as just one of the leading factors.

May 7 -

Ariel Re, Hiscox cyber consortium; Swiss Re Gen AI underwriting assistant; Liberty Mutual Reinsurance announced a partnership with Safehub and more insurtech news.

April 29 -

The Net Zero Insurance Alliance will instead be replaced by the Forum for Insurance Transition to Net Zero (FIT), convened and led by the United Nations Environment Programme, according to a statement on Thursday.

April 25 -

"Lax regulation and monitoring of property insurers makes Florida mortgage markets far more exposed to climate risk than people might think," said Parinitha Sastry, an author of a working paper by researchers at Harvard University, Columbia University and the Federal Reserve.

April 24 -

Greater exposure to climate risks is driving an increase in insurance premiums and decrease in insurance availability.

April 22 -

The two companies, units of Japan-based Tokio Marine Holdings Inc., said the decision will affect 12,556 policies with premiums of $11.3 million.

April 19