-

Beazley Plc has rejected Zurich Insurance Group AG's £7.7 billion ($10.3 billion) takeover approach, the latest twist in the Swiss giant's attempt to acquire the UK specialty insurer.

January 22 -

AIG CEO Peter Zaffino to transition to executive chair and Eric Andersen named president and CEO-elect; InnSure launches climate risk incubator platform, plus more insurtech news.

January 22 -

EY financial analysis reveals insurance deals across Europe, North America, Asia and Oceania's major financial markets.

January 21 -

Legislation cites non-renewals based on "inaccurate, outdated or misleading images."

January 21 -

Insurance platform Ethos Technologies Inc. and some of its backers are seeking to raise about $211 million in an initial public offering.

January 21 -

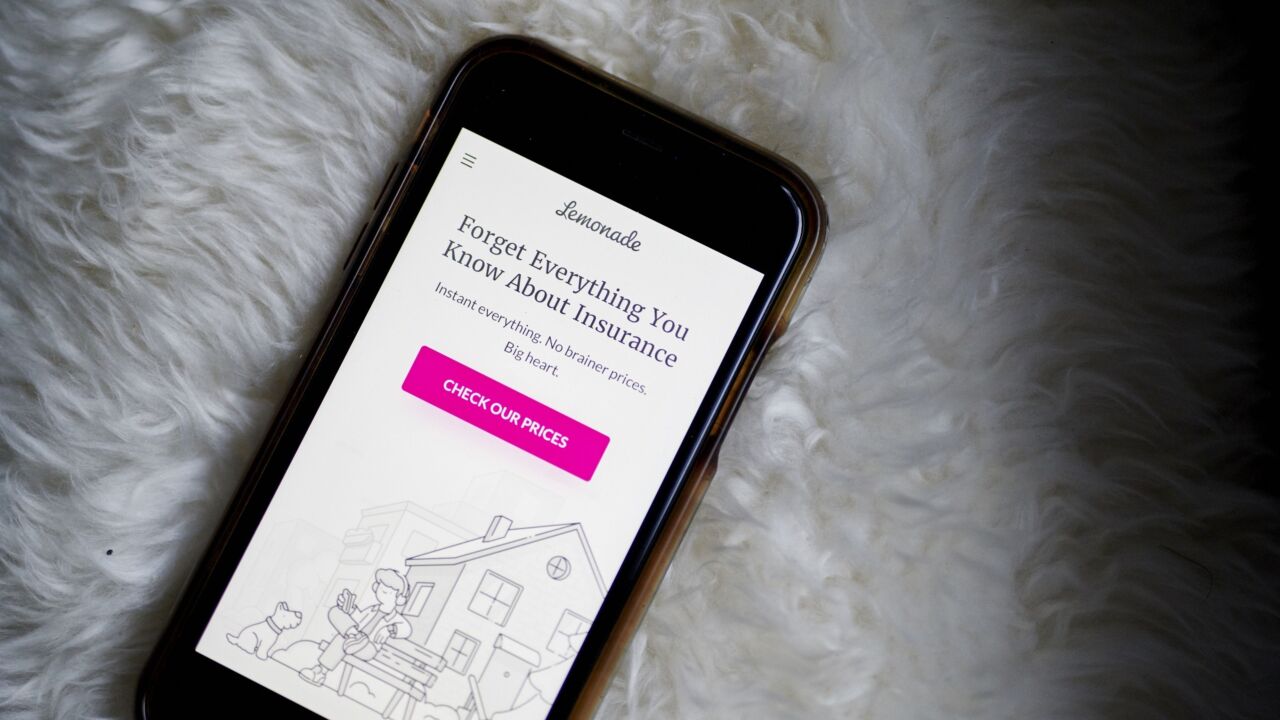

The new plans will cut per-mile rates by about 50% when customers have Tesla's Full Self-Driving system engaged, Lemonade said Wednesday in a statement.

January 21 -

Zurich Insurance Group has gone public with a £7.67 billion ($10.3 billion) bid to buy Beazley.

January 21 -

Capgemini's Samantha Chow looks at the future of life insurance and how the customer experience and coverage itself will continue to evolve.

January 21 -

Representatives of both insurers and policyholders point out multiple flaws in the new laws and additional proposed bills.

January 20 -

Digital Insurance contacted insurance professionals to comment on predictions for 2026 on various topics.

January 20